Uncertainty and volatility are the key words that have dominated the equity markets in these times of Covid-19 pandemic. Long term sustainability and “green” agenda are the key words that have shaped the new monetary and fiscal policies in Europe.

Hera’s solid fundamentals, confirmed by half-year results, its authentic commitment to 2030 ESG goals, and the room for potential capital gain considering the mean target price of c.4 euro form the pillars of a robust investment case, which looks appealing, especially in the new scenario.

How do you interpret the equity market performance in this first half of the year?

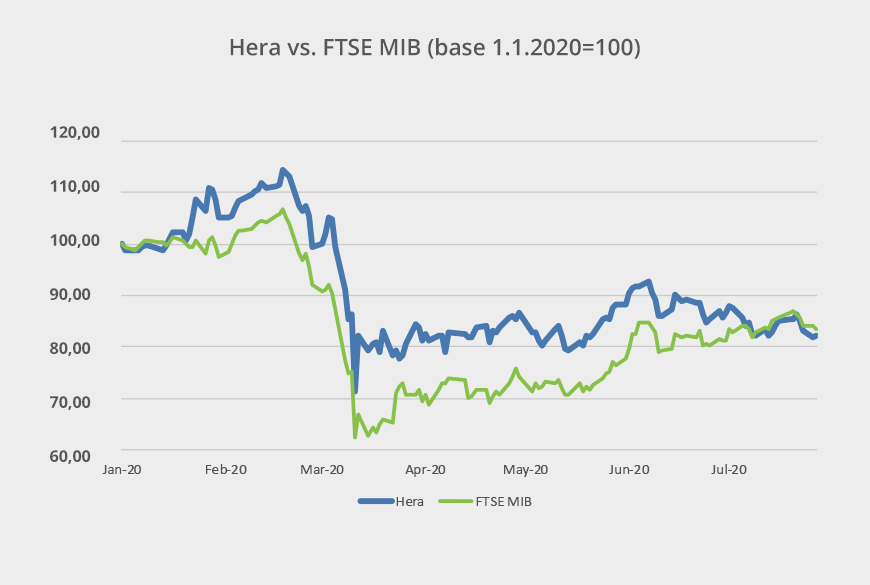

The equity market has proven to be heavily affected by the climate of uncertainty generated by the Covid-19 pandemic. After the sharp correction in stock prices experienced between the end of February and mid-March, a phase of gradual recovery has followed, along with the gradual resumption of activities when the lockdown imposed to avoid contagion was over. However, high volatility has characterised the rebound from lows.

How did this context affect Hera’s stock performance?

At the time of the pandemic outbreak, on 19 February 2020, Hera reached its all-time high, following the roadshow for the new Business Plan presentation. Investors had shown themselves willing to incorporate into the stock price the increasingly ambitious perspectives of the 2023 financial targets as well as the commitments in terms of sustainability performances that have been presented for the first time with 2030 horizon.

Hera’s stock has then been involved in the generalised equity sell-off, even though its correction resulted in being more limited compared to that of the FTSE MIB index, as a consequence of the “essential” nature of its own core business, represented by public utility services.

Despite the volatility of the Hera shares proved far lower than that of the market, over the last few months the stock price followed a non-linear path, with some significant fluctuations amid relatively modest volumes. Once the recovery phase started, Hera’s shares continued to outperform the blue chips’ index of the Italian market through early July, while its performance converged to that of the FTSE MIB index latter days. It should be considered that on 6 July 2020 Hera has distributed a dividend of 10 euro cent per share, resulting in a one-off gap that the price is gradually closing.

How do you see your equity story prospectively?

The initiatives taken in terms of monetary and fiscal policies in Europe have created very credible conditions for an economic recovery. Moreover, many of the planned investments fit into the logic of increasing attention to sustainability issues; that represents another promising element.

Even in the hardest times of the Covid-19 emergency, Hera has always kept the ESG growth engine running. In view of the new priorities, it can only benefit from its strong position as a truly responsible company in charge of circularity projects.

Over the last few months, what has changed for Hera on the sustainability side?

The efforts made over the years, in late June 2020 allowed for Hera inclusion in the FTSE4Good Index Series, a series of indices made up of the leading companies at global level that actively promote sustainable development. Moreover, for the third year in a row our Group ranked first in the Integrated Governance Index 2020 in the area of sustainable finance; Hera also resulted in being sixth in the general ranking, which assesses the level of integration of ESG factors in corporate strategies. The interest from the investors that apply ESG criteria when building their portfolios has also been confirmed by the number of meetings that we had in the last Digital Italian Sustainability Week – with 36 individuals met in one-to-one or group meetings, most of which pension funds, resulting in a 20% increase in comparison with the number of investors met in the 2019 edition of the same event.

What impacts do you expect on the stock from the interim results that you release today?

Solid fundamentals confirmed by half-year results make the current analyst consensus estimate for 2020 EBITDA, currently around 1,120 million euro, even more visible. Based on the estimates prior to the release of the Interim Report, the average brokers’ target price stands at 3.99 euro, materially unchanged vs. that of 3.96 euro of last May, i.e. pre-publication of first-quarter figures.

Recent Hera’s stock prices are around 3.3 euro. Large revaluation potential seems clear, as currently the stock trades at a 20% discount to the average target price.

| Broker | Rating | Target price (€) |

| Banca Akros | Buy | 3.90 |

| Banca IMI | Buy | 4.70 |

| Equita Sim | Buy | 3.80 |

| Fidentiis | Hold | 4.20 |

| Intermonte | Outperform | 4.20 |

| Kepler Cheuvreux | Hold | 3.50 |

| MainFirst | Neutral | 3.60 |

| Mediobanca | Outperform | 4.00 |

| Average | 3.99 |