The presentation of the 2023-2027 Business Plan, held on 24 January 2024, gave further boost to the uptrend that the Hera stock started in early October 2023. At recent prices around 3.3 euro, the share price has increased by more than 30% since last autumn’s low; nonetheless, an attractive gap of around 15.5% remains against the consensus target price.

Following the release of the new Plan, the brokers in the share coverage revised their estimates upwards and consequently updated their evaluations on higher levels. Therefore, despite the significant rise achieved by the share price in the meantime, there is still a large room to be filled, given the remaining undervaluation.

With the FY2023 results released today, investors found a confirmation that Hera can actually deliver the Total Shareholder Return presented in the Plan commitments. The 17% EPS increase, together with the 14 eurocents dividend proposed, which leads to a 5% yield calculated on the price at the end of 2023, provides clear evidence of the Company’s ability to remunerate its shareholders with attractive returns.

We explore these topics in a Q&A session with Jens Klint Hansen, Head of Investor Relations of Hera Group.

How was Hera share performance following the presentation of the new Business Plan?

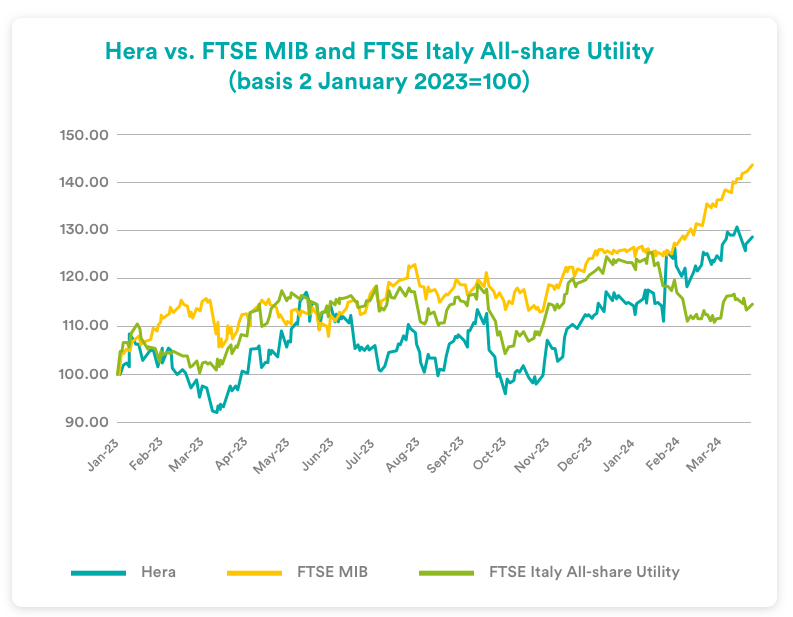

Hera share price continued the upturn that began after 3 October 2023, when it bottomed at 2.48 euro, with a clear acceleration of the trend in the sessions following the day of the Plan’s presentation, 24 January 2024. Such rally led the stock to reach the 2024 high on the last 15 March at 3.37 euro – a level around which it also currently trades.

While this uptrend in Hera’s shares has a similar pattern to that of the FTSE MIB Index, it also indicates a remarkable outperformance compared to the sector benchmark index, the FTSE Italy All-Share Utility. The outperformance compared to the industry, in short, tells us that even if the utilities stock market momentum still has to come, Hera is getting high appreciation, but for factors that I would define as purely ‘company-specific’.

What are the elements behind the strong rise in the Italian stock market?

At the beginning of the year, an intensification of geopolitical tensions had temporarily cooled investors’ appetite for risk, which nevertheless returned to risk-on mode from the end of January onwards, in view of the prospect of an imminent revert to accommodative monetary policies. A change of direction on rates is expected soon, particularly in the Eurozone, where the economy is showing signs of weakness and GDP growth estimates have been revised downwards. In addition, we are well aware that the Italian stock market sees a very high weighting of financial stocks, which take significant advantages from a high interest rate environment. Thus, the release of strong earnings growth in the banking sector has given further impetus to the rise of the FTSE MIB.

And in Hera specific case?

Our stock has strong room for appreciation compared to the fair value calculated by sell-side analysts. In an environment where investors are looking for companies with quality fundamentals, which provide a hedge against volatile market sentiment and trade at inexpensive multiples, Hera represents an excellent opportunity. The presentation of the Plan – with a clear commitment to offer a Total Shareholder Return level of 12% and the indication of an attractive 2023 dividend base, of 14 eurocents, on which to project a further 0.5 cents growth per year until 2027 – has made the investment in the stock even more attractive.

When will new prospects open up for utilities in general?

The stock market valuations of the sector remain very sensitive to interest rate levels. With real signals from the ECB, utilities are definitely set to benefit from a rerating. It is only a matter of time… In the meantime, we can continue to find drivers for the continuation of an upward trend in the solidity of the fundamentals and in the visibility of value creation that we have drawn up in the Plan. The results that the Board of Directors approved today show that in 2023 Hera has already been able to deliver on its promises in terms of Total Shareholder Return, having achieved an Earnings per Share growth of 17% and having proposed a dividend that offers a yield of 5% compared to the average price of 2023.

How did brokers’ consensus change after the Plan?

A first piece of positive evidence is that the consensus target price increased significantly, from the previous level of 3.53 euro to 3.80 euro, following the revision of estimates and, consequently, the results of their valuation models. After this increase of more than 7.5% in the target price, the recommendation picture remained very favourable, with five out of six analysts that suggest buying Hera shares, given the wide scope for revaluation compared to recent market prices. This new plan convinced all analysts: even the only broker who had – and still has – a neutral rating increased his target price from €3.4 to €3.5. The analyst with the most generous evaluation, in turn, raised his target price from €4.00 to €4.30, while the one with the most conservative evaluation moved from €3.30 to €3.60. Therefore, the range between the minimum and maximum target price has widened, being now between €3.50 and €4.30. Hence, at the recent level of €3.30, we have a potential gap to close which, depending on the broker, ranges from a minimum of 6% to a maximum of 30%.

| Broker | Rating | Target Price (€) |

| Banca Akros | Buy | 3.80 |

| Banca IMI | Buy | 3.70 |

| Equita Sim | Hold | 3.50 |

| Intermonte | Outperform | 3.60 |

| Kepler Cheuvreux | Buy | 3.90 |

| Mediobanca | Outperform | 4.30 |

| Average | 3.80 |

What do you think could be a catalyst for the share price?

After the presentation of the new Business Plan, the share price moved up, but the broker consensus moved upwards as well, so there is a lot of room for appreciation. I expect that we can continue to build on the sound fundamentals: so, the same results published today are an additional foothold point. If something should then change on the monetary policy front, we are certainly well-positioned to benefit through the lower rates at which prospective cash flows would be discounted in investors’ valuations.