The Business Plan to 2024 fully intercepts the opportunities of the new economic policies, which promote energy transition and technological development. The new Plan declines these opportunities in a way that is consistent to the specific business model of the Group, with the aim of designing the next steps of a growth path that has continued uninterruptedly since 2002.

Strong of a 2020 that testifies the ability to grow resiliently even in challenging contexts, Hera is ready to confront the priorities of the external scenario. Counting on a true vocation for sustainability and on a solid financial capacity, in the new scenario the Company does not see discontinuity, but attractive opportunities.

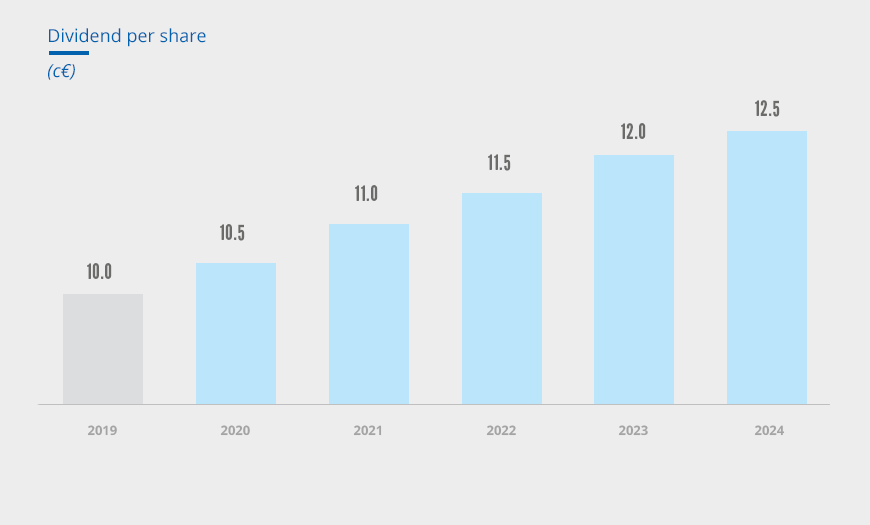

Hera puts into play a total of 3.2 billion euro investments, thoroughly allocated, which will contribute to fuel the growth of EBITDA to 1.3 billion euro in 2024. With these premises, the dividend per share is expected to grow steadily, with an annual increase of 0.5 euro cent, thus reaching 12.5 cent in 2024.

In a complex and fast-changing scenario, not all investment opportunities are foreseeable today. Hera intends to maintain a financial flexibility that would allow for prompt and effective moves, should additional organic investment or M&A opportunities arise in a logic of strengthening value creation.

Dear Shareholders,

The Business Plan that will guide Hera’s growth path to 2024 builds on the solid preliminary results of the year just ended.

2020 confirms Hera’s “resilient growth” in a very different scenario compared to that assumed in the 2019-2023 Plan.

The 2.8% increase recorded at the level of EBITDA, which reached 1,118 m€, and the lower leverage, with the Debt-to-EBITDA ratio decreasing from 3.0x to 2.9x, effectively summarise the performance of 2020, strengthening our equity story of “resilient growth”.

The cash flow generated during the year, fuelled by the sound results achieved at operating, financial and fiscal level, allowed Hera to fully cover operating and financial investments, in addition to the payment of dividends.

During 2020, Hera has therefore continued to grow while executing the strategic guidelines, despite experiencing a very different scenario from that implied in the assumptions of the Plan to 2023. The challenges imposed by Covid-19 and the mild temperatures of the winter months have subtracted 43 m€ from the EBITDA; on the other hand, organic growth and M&A provided a contribution of 77 m€, generating a net positive change in EBITDA of 33 m€.

In 2020, we have built a solid platform for future growth

While the integration of EstEnergy has brought significant synergies, in 2020 we also continued to expand our activities, participating in numerous tenders in the different business areas in which we have a solid track record. Leveraging on this serious skill profile, in the past year we could also sign partnerships with leading operators such as Eni and Maire Tecnimont; partnerships that open up new spaces to us in the waste treatment market, particularly in the plastics segment.

The results achieved in 2020, as the first year of the Business Plan to 2024, are therefore an encouraging starting point, which allows us to look forward to the next four years of the Plan’s period with confidence, as we can rely on a solid platform on which to leverage future growth.

Ahead of us, a scenario that presents attractive opportunities to invest and grow

In addition to this solid premise created by the 2020 results, also the attractive features of the external environment play a significant role.

The scenario offers attractive prospects for an operator with a business model that is genuinely committed to sustainability and has the financial flexibility to promptly seize investment opportunities.

The new orientations that have recently emerged in economic policies, especially in the environment field as well as the sustainable development objectives indicated by international bodies do not represent a discontinuity from our point of view, as these policies have been an essential component of our operating philosophy for years.

The multi-business model is synergic and functional also for solutions that safeguard the environment…

Hera has always been a multiutility that offers environmentally sustainable solutions in a synergic way. Since inception, in 2002, we received a precise mission from our historical shareholders: to operate while carefully considering the needs of the environment, the served communities and all the stakeholders who interact with us. Over time, we have interpreted our mission in an increasingly conscious way, adopting virtuous behaviors, first within our activities; at the same time, we have stimulated behaviors oriented towards greater sustainability from our customers and suppliers.

…as proven by an almost sixfold increase in EBITDA over the past 18 years and number of external sustainability awards

All this is tangibly reflected in the results achieved in recent years, with an EBITDA that has grown 5.8 times compared to 2002, while Hera investments contributed to making the reference market more efficient and consolidated, including through several acquisitions, from the integration of which significant synergies emerged.

In terms of ESG – Environment, Social and Governance – Hera has achieved important results, such as its recent inclusion in the Dow Jones Sustainability indices, with Standard&Poor’s recognising it as a “Leading practice” in its sector worldwide. Its commitment to reducing CO2 emissions, reflected in its over ten-year participation in the Carbon Disclosure Project, is witnessed by the class A – which CDP analysts have attributed to Hera. Not least, back in 2017, the Ellen MacArthur Foundation included the Company among the 100 best examples of Circularity globally, based on its management models.

Dynamic EBITDA growth and a vocation for sustainability are our strategic pillars, together with financial solidity and shareholder remuneration

The sustained growth rate at operational level and the serious commitment to sustainability go along with two other essential pillars in our strategic development path: financial solidity and shareholder remuneration. As a matter of fact, over the last eight years, we have achieved a continuous reduction in our leverage, while Earnings per Share have shown an average annual improvement of around 10% from 2002 to 2019. Such an evolution of the fundamentals has been the premise, through an attractive dividend policy and the appreciation of the stock on the market, to offer an average annual Total Shareholder Return of 9% from the IPO to the end of 2019.

The new context therefore does not present risks of discontinuity for us, but new and diversified opportunities for growth, given the strategic pillars on which we can count in facing the coming years.

A scenario that presents diversified and remunerative investment opportunities

Many businesses in which we operate see a competitive structure that is still very fragmented and further undermined by Covid-19: this creates a favourable context for M&A. On the other hand, in the next few years, several tenders for the assignment of services managed under concession will take place, not only in gas, but also in water and waste; the liberalisation of the “Maggior Tutela” electricity market – i.e., the standard offer regime – will also be managed through tenders, as of July 2021. The rapid evolution of technology creates further investment opportunities, in some cases even in incentivised form, such as in biomethane, and stimulates continuous efficiency improvements. Finally, it is not negligible that the regulatory framework, through the tariff systems set by ARERA, promotes and incentivises environmental sustainability as well as the fight against climate change in the management of regulated services.

At the core of the Business Plan to 2024, cumulative investments for 3.2 billion euro, of which two thirds dedicated to maintenance

The Plan to 2024 is focused on 3.2 billion euro investments: an amount that shows a 339 m€ increase compared to the previous Plan and a 40% increase compared to the cumulative investments of the last five years, although it is limited to those projects on which we currently have full visibility. Two-thirds consist of maintenance investments, which will allow us to guarantee the full functionality of our plants even in face of the new scenarios, maintaining the RAB at current levels. One third of the investments, around 1 billion euro, will be dedicated to development, especially organic development, which will absorb 750 m€, against 150 m€ dedicated to M&A and 132 m€ to tenders.

Under the business profile, 2.1 out of 3.2 billion euro will be destined to Networks, while the remaining part will be allocated to Waste for 694 m€ and to Energy for 338 m€.

We target a 2024 EBITDA of 1.3 billion euro, through an accurate capital allocation

We expect attractive returns from these investments, as proven by the 50 m€ increase that we have forecast in our EBITDA target at the end of the Plan’s period, having lifted it to 1.3 bn€, while expecting a total increase of 215 m€.

The drivers of this growth are visible and aligned with the growth profile of past years, considering that 135 m€ are expected from organic development and 80 m€ from M&A. All the supply chains in which we operate will make an important contribution to the Group’s EBITDA performance: we will therefore leverage the benefits of a diversified portfolio.

Shareholders’ remuneration remains solid and transparent, with a dividend reaching 12.5 cent by the end of the Plan.

Based on a framework of solid fundamentals, Hera aims to increasing the Dividend per Share by 0.5 euro cent every year, to reach 12.5 euro cent in 2024, with a cumulative 25% rise over the Plan period. Therefore, the average payout ratio is 57%.

A financial buffer to be ready to take advantage of opportunities not included in the Plan

In the Plan that we have designed, we have also envisaged a strengthening of financial flexibility, with a Debt-to-EBITDA ratio set to reach the level of 2.8x in 2024. We did so to be able to promptly take advantage of any further investment opportunities that may arise in addition to those already included in the Plan. This additional allocation of capital would take place in compliance with a strict rationale of value creation, within the stated strategic lines and against expected returns that exceed the cost of capital.