Hera’s strategic review presents a clear path of sustainable development for the long term and a five-year Plan that allocates 3.2 bn€ investments to fuel growth.

Therefore, 2024 EBITDA is expected to reach 1.3 bn€, of which approximately 50% from Shared- Value projects.

Within the strategic framework expressed in the GROWTH acronym – Green, Resilience and Regeneration, Opportunities, Welfare, Technology, Humans – Hera has shaped a number of specific projects to achieve, in its multiutility business, the targets set in terms of circularity, carbon neutrality and technology innovation, in full compliance with the guidelines of the regulation and the objectives of international economic policies.

| 2020-2024 BUSINESS PLAN | EBITDA E 2024 m€ 1,300 |

2020-2024 CUMULATED INVESTMENTS m€ 3,200 |

EARNINGS PER SHARE c€ 22.0 |

DIVIDEND PER SHARE c€ 12.5 |

DEBT/EBITDA E 2024 2.8X |

A thorough capital allocation, involving 3.2 bn€ investments, is the basis of attractive returns that the Plan foresees.

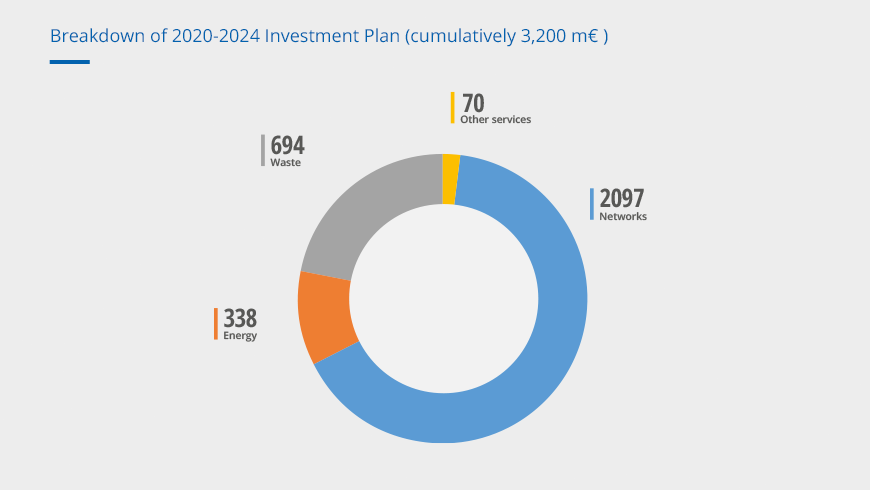

Amid the new opportunities that the new scenario provides, Hera intends to carry out a significant investment plan, which cumulatively reaches 3,200 m€ over the 2020-2024 period: an amount that indicates a 12% increase compared to the investments included in the 2019-2023 Plan and a 40% rise compared to the sum of the last five-years investments.

Investments will be for two thirds represented from maintenance capex, while for the remaining third they will be dedicated to the development. Although predominantly organic in nature (750 m€), development capex will see a non-negligible portion dedicated to M&A (150 m€) and tenders (132 m€).

Over the five-year period of the Plan, 74% of the cumulative amount of 3.2 bn€ will be allocated to regulated activities, which present high visibility of returns.

In more detail, part of the investments in the Networks area will be dedicated to implementing the process of digital transformation of the infrastructure, with the installation of new smart meters both in the electricity distribution and in that of gas. In this area, there are also plans to increase energy and environmental efficiency. A consistent effort will be focused on the integrated water cycle, where Hera intends to increase the re-use rate of water including through Artificial Intelligence. Additional capex will be destined to resilience, in the logic of fighting the climate change.

Investments in the Waste area will allow for a wider spread of punctual tariff, by placing smart waste bins in a significant portion of served territories. With a view to further improving circularity, Hera will also strengthen its waste treatment capacity, building new biomethane plants and upgrading the assets dedicated to plastic regeneration.

In Energy, a substantial share of investments will be geared to facilitate the evolution of clients’ consumption towards increasingly sustainable solutions and continue the expansion of the customer base.

1.9 bn€ of investments for the real implementation of the new EU strategies.

In the new Plan, 88% of the overall 215 m€ increase in EBITDA over the five-year period comes from projects that fall under the lines of the “Next Generation EU” programme. More specifically, 133 m€ of the EBITDA increase derive from projects under the “Green Deal” strategy and 56 m€ from projects under that of “Digital Age”.

Such a result in terms of EBITDA reflects the nature of the investments that will be carried out in the five-year period: out of a total of 3.2 bn€, over 1.3 bn€ are part of the “Green Deal” strategy, while 575 m€ refer to that of “Digital Age”.

The significant EBITDA growth is fueled by the positive performance expected in all strategic areas.

The investments of 3.2 bn€ envisaged in the five-year period are the basis of the increase of 215 m€ cumulatively expected for EBITDA over the 2020-2024 period, along a path that aims to reach 1.3 bn€ in the last year of the Plan.

Organic growth, which is expected to contribute for 145 m€, together with M&A, from which an additional 80 m€ contribution is foreseen, will allow for more than offsetting the effects of the end of some WTEs incentives, which are estimated to be around 10 m€.

All the portfolio’s strategic areas will provide the Group EBITDA with a positive contribution, with Energy that gains higher weight compared to the past, given the contribution from EstEnergy.

Leveraging on a strong cash generation, Hera can invest to grow and remunerate shareholders, in the meantime strengthening its financial flexibility.

In the new Plan, the cumulated cash flows for the 2020-2024 period will fully fund higher working capital, investments and dividends. Therefore, Hera will be able to further improve its leverage, with a Debt-to-EBITDA ratio declining to 2.8x in 2024.

In addition to the EBITDA improvement, the Plan provides for a decrease in the cost of debt, which is expected to drop from 3.5% in 2019 to 2.6% in 2024, also following the successful liability management operations that have been carried out recently. Moreover, the Plan foresees a decrease in tax rate, from 28.3% in 2019 to 27.0% in 2024, as a result of careful fiscal management, aimed at reaping the benefits provided by the laws in force.

The Earning per Share summarises the expected improvements in operational, financial, and fiscal performance. Thus, the Plan foresees an EpS increase from 20.4 €cent in 2019 to 22.0 €cent in 2024.

A clear strategic direction to face the challenges of the scenario, while generating concrete results in terms of sustainability projects.

The “growth” equity story presented in the Plan is perfectly fitting with the new priorities emerging in the international context in the fields of carbon neutrality and circular economy. Hera has structured its strategic framework focusing on concrete directions and sustainability actions, embedded in the GROWTH acronym: Green, Resilience and Regeneration, Opportunities, Welfare, Technology, Humans.

Counting on this approach, Hera can better define its contribution as a multiutility in achieving a sustainable future for the Planet.

Approximately 50% of EBITDA to 2024 is consistent with the sustainable development goals of the United Nations.

Moreover, in 2024, 50% of the overall EBITDA of 1.3 bn€ will be consistent with the SDGs, i.e., with the sustainable development goals, set by the UN 2030 Agenda, along three main directions:

- 402 m€ from initiatives to regenerate resources and close the loop

- 169 m€ from projects that pursue carbon neutrality, especially through bioenergies and energy efficiency

- 78 m€ from actions aimed at strengthening the resilience of infrastructures and spread innovation to improve both efficiency and quality of services.

Hera targets a Shared Value EBITDA of 648 m€ in 2024, with a weigh that reaches 50% of total EBITDA, compared to the 36% weight recorded in 2019.

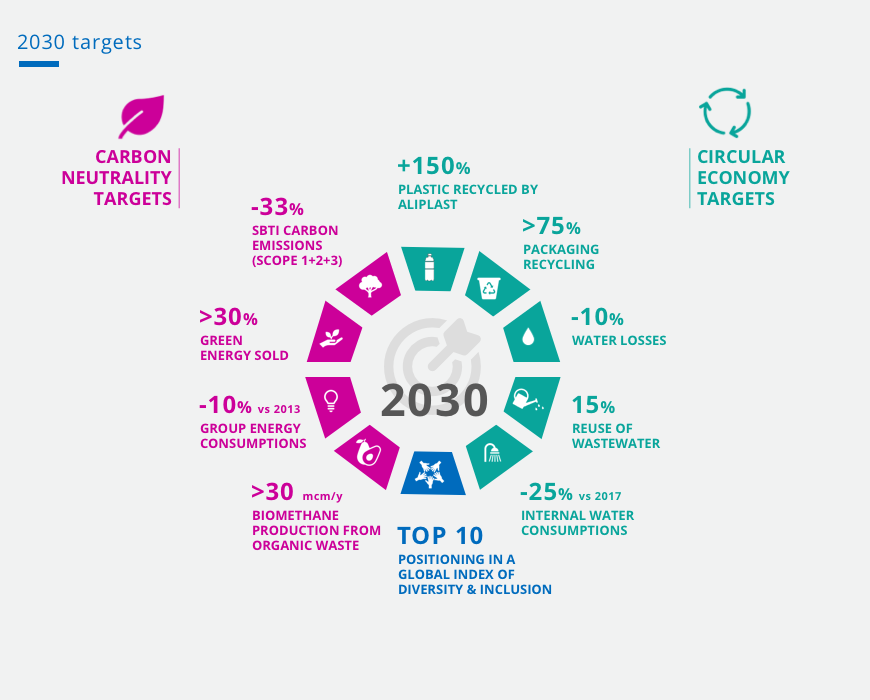

The commitment to ten sustainability targets has a ten-year horizon.

Starting from last year’s strategic review, Hera’s planning also includes a long-term commitment, with the clear identification of ten sustainability targets to 2030: five of them aim to achieving a strategy of circular economy, other four targets focus on the field of carbon neutrality and one last target has social nature. Among those targets, a commitment stands out: to reach in 2024 a 33% reduction of Group climate-changing emissions, calculated in terms of scope 1, 2 and 3, versus the data of 2019.

Looking at 2030, we have also set the goal of pragmatically addressing the future potential of clean hydrogen generation, exploring the possible synergies with our multiutility portfolio.

With the new planning exercise, Hera has further improved the visibility of its contribution to the ecosystem in which it operates, while demonstrating how it is possible to combine profitable growth and positive impact in terms of strategies supported by international economic policies.

Ambitious contribution to EU and UN strategies