The 3.3% progress achieved in the quarter at EBITDA level is evidence of Hera’s sound and visionary business-model approach, which was also able to leverage internal and external growth drivers, creating value and offsetting both the negative impacts of the macroeconomic scenario and the WACC cut set by the Regulator.

Despite the increase in net working capital due to the rise in energy prices and the pursuit of an intensive investment programme, Hera managed to maintain a solid financial structure, capable of supporting both customers in need, with bill payment in instalments, and the forthcoming distribution of dividend of 12-euro cent per share, confirming its growing shareholder remuneration policy.

Even in a challenging context, Hera is firmly on the strategic path traced in the Plan to 2025.

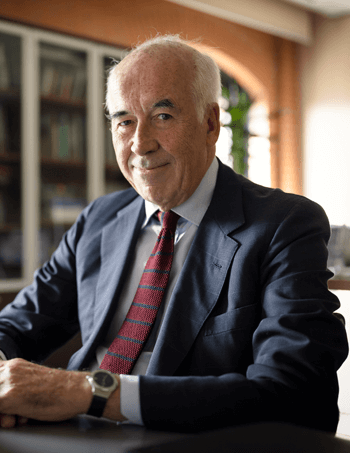

Dear Shareholders,

In the first quarter of 2022, Hera achieved results that we consider satisfactory considering the context in which we reached them. The 3.3% growth in EBITDA demonstrates the ability of our well-balanced business portfolio to more than compensate for the negative impacts that the external scenario can have on the individual business areas.

The multi-utility model and the careful hedging policies acted as a shield against the challenges of the scenario

The pandemic, with the Omicron variant causing a new wave of infections, has combined with the Russian-Ukrainian conflict. Therefore, we had to deal with skyrocketing inflation, which reached 6.7% in Italy in March, driven by the sharp rise in energy commodity prices. Both gas and electricity prices reached levels four times higher than those of the last two years, with a marked volatility. This has had an impact on Hera’s P&L, but also on the energy costs of households and enterprises that are our customers, while it generated disruptions in the supply chains.

A further aspect to be taken into account when assessing the Group’s performance in this quarter, with respect to the scenario variables, is the cut in the WACC that the Authority decided to make at the end of 2021, with effect from 1 January 2022: at consolidated EBITDA level, we can quantify the negative impact of the new regulatory framework at around 5.5 million euro on a quarterly basis.

Anyhow, the multi-utility model and a cautious policy of hedging the risk of changes in commodity prices have allowed Hera to contain the penalising effects of this scenario, with rates of return on invested capital and equity, in terms of ROI and ROE, clearly above their respective cost and in line with the levels of the same period of the previous year. This confirms the usual creation of value while maintaining a conservative risk-exposure profile.

The Income Statement remains in line with past performance, while investments continue

Revenues showed a 133.8% growth compared with the first quarter 2021, with the impact of higher prices amplified by the seasonality of gas consumption for heating purposes. Despite the peak in energy commodities prices, we reached an EBITDA of 374.0 million euro, up by 3.3% compared to the same period of 2021.

Against these hikes in energy prices, we chose to adopt a prudent policy of provisioning for credit losses, despite Hera’s customer insolvency rate remains at minimal levels, also benefitting from the selective policy in granting extensions in payments.

Although some critical issues related to the scenario also had an impact on our suppliers, during this quarter we succeeded in executing all the investments envisaged in the Business Plan. Therefore, Capex amounted to 125 million euro vs. 113 million euro in the first quarter of 2021. Among the most relevant initiatives, we have upgraded the Waste-to-Energy plants in Trieste and Ravenna.

EBITDA growth driven by a plurality of factors

In this quarter, as always, Hera activated all available options to continue its growth path. Effective evidence of this can be found when examining the factors that drove the 3.3% progress at EBITDA level, which allowed the Group to offset the negative impact of the WACC review, which was of 5.5 million euro.

The largest contribution came from activities in the field of circularity and environmental sustainability – i.e., those related to energy efficiency in buildings, plastics recycling and value-added services in the Energy area – which together contributed to the increase in Group EBITDA with 9.1 million euro.

An additional amount of 4.2 million came from the increased market share gained in the Energy area and from the tenders we won in the “Maggior Tutela” segment, which brought Hera a total of more than 100 thousand new customers, together with the 3% increase in waste treatment and new efficiencies in regulated businesses.

We also benefitted from the incremental contribution related to the acquisitions of Vallortigara, Recycla and Ecogas, since these transactions were closed after 31 March 2021.

Dividend of 12 eurocents to be paid on 22 June

During this first quarter of the year, we also maintained a solid financial structure. Therefore, we can sustainably afford the upcoming dividend distribution of 12 eurocents per share, approved by the Shareholders’ Meeting on 28 April, thus continuing to translate the progress of the shared value created by Hera also into an increasing remuneration for shareholders.

With the EBITDA of 374.0 million euro achieved in the first quarter of 2022, we have already achieved more than 40% of the growth envisaged in the five-year plan, even though we have only covered a quarter of the time. Hence, we are well ahead of schedule.

We are committed to executing the Plan to 2025, with a new CEO who is taking office today

So, we face the next few months, which are still challenging in terms of external variables, confident in our proven business model and the initiatives we have put into play to continue creating value.

Sharing with me the responsibility for the execution of the Plan to 2025, now we also have Mr. Orazio Iacono, the Chief Executive Officer that the Board of Directors has appointed today, whom I am pleased to warmly welcome.