Once again, in the first quarter of 2022 Hera proved the resilience of its business model, by posting a 3.3% EBITDA growth compared to first-quarter 2021, despite the penalising context.

EBITDA achieved growth by leveraging on the contribution of all businesses, with Waste showing the strongest performance (+11.4%), driven by waste treatment activities. The 3.6% progress achieved in Networks EBITDA is even more valuable when considering the 70-bps cut in WACC set by the Regulator. Finally, the 1.2% increase in the Energy area reflects the sound performance of activities dedicated to improving the energy efficiency of buildings, which continue to be led by the “Ecobonus” incentives.

Net Financial Debt increased by 193.9 m€ (+5.9%) during first quarter of 2022, mainly due to the expansion of Net Working Capital (+304.5 m€), because of the rise in energy commodity prices and the payment in instalments of customer bills. The Debt-to-EBITDA ratio remains at the physiological level of 2.8x, well below the threshold of 3.0x that Hera has set itself as a “golden rule”.

| Q1 2022 (data in m€) |

REVENUES 5,312.0 (+133.8%) |

EBITDA 374.0 (+3.3%) |

NET PROFIT 126.5 (-4.3%) |

NET OPERATING INVESTMENTS 124.4 (+10.4%) |

NET FINANCIAL DEBT 3,455.2 (+5.9% vs. 31 Dec. 2021) |

In first-quarter 2022, Hera Group’s Revenues amounted to 5,312.0 m€, up 133.8% compared to the same period of the previous year. Energy area provided the most significant contribution, of 2,852 m€, mainly leveraging on higher revenues from trading and higher commodity prices (for 2.9 bn€). Weather conditions also played a positive role (+86 m€) by driving gas sales volumes. Energy efficiency services, which benefit from tax incentives, together with value-added services also contributed to a 75 m€ increase in revenues.

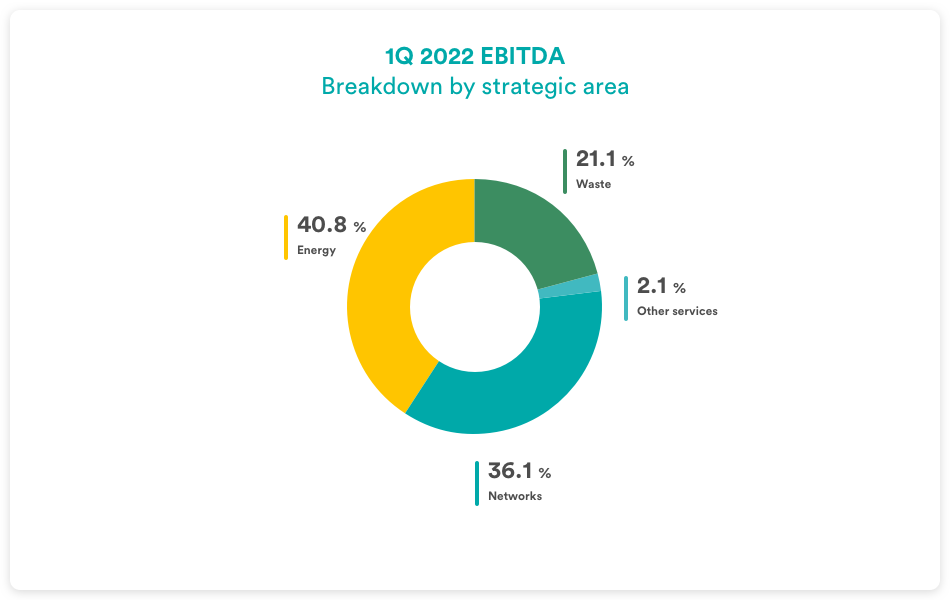

In the first three months of 2022, Group’s EBITDA reached 374.0 m€, showing a 3.3% progress compared to Q1 2021. EBITDA performance was supported by both organic growth drivers and the contribution of M&A deals closed after the first quarter of 2021.

Looking at the breakdown of EBITDA by business, the Energy areas account for approximately 41% of consolidated EBITDA, with a growth of 1.8 m€ (+1.2%) vs. Q1 2021, reaching 152.5 m€. The main contributors to the progress in this area were the energy efficiency activities dedicated to improving the residential buildings, incentivised by the “Ecobonus”, together with value-added services. This growth was partially offset by a contraction in ancillary services (-5.6 m€), which returned to normal levels after performing exceptionally well in first-quarter 2021. Even the expansion of the customer base contributed to these results: the increase of customers in all segments of the market of Last Resort added to those won in Consip tenders as well as in tenders in the segment of Higher Protection (3 out of 9 lots put out to tender by the Single Buyer).

The Waste area shows the strongest growth (+11.4%), having increased its result by 8.1 m€ compared to Q1 2021. Waste treatment activities were one of the main driving factors, with a contribution of 4 m€ from companies acquired after the first quarter of 2021 and an increase in the contribution from WTE energy production (+5 m€). This higher contribution from the WTE was achieved despite the revamping shutdown of the Trieste and Ravenna plants, which had a negative impact of 1.5 m€. Another positive factor was represented by market expansion (+1.9 m€), while Aliplast continues to benefit from sustained demand for regenerated plastics (+1.1 m€).

Networks offered an incremental contribution of 4.7 m€ to Group EBITDA by posting a 3.6% growth, thus fully compensating the contraction due to ARERA’s WACC review, which weighed for to 5.5 m€ and -70 bps. The overall increase benefitted from new connections and bonuses, particularly in the gas and water cycle businesses (+2.1 m€), from organic growth, driven by the colder weather that led to an increase in district heating (+3.2 m€) and new efficiencies achieved through cost containment.

| EBITDA (m€) | 1Q 2022 | 1Q 2021 | Change |

| Waste | 78.9 | 70.8 | 11.4% |

| Networks | 134.8 | 130.1 | 3.6% |

| Energy | 152.4 | 150.6 | 1.2% |

| Other services | 7.8 | 10.4 | -25.0% |

| TOTAL | 374.0 | 362.0 | 3.3% |

The growth achieved at EBITDA level could not fully cover the 10.8% increase in Depreciation and Amortisation, mainly due to new operating investments, changes in the scope of consolidation, higher commissions of the Sales Companies, as well as prudential higher provisions and write-downs on receivables, in line with the effect on working capital of the increase in commodity prices. Therefore, EBIT reaches 220.1 m€, slightly down (-1.3%) compared to the first quarter of 2021.

The result of the area of financial management, which amounts to 29.5 m€, shows a slight increase (+2.4% vs. Q1 2021). Such performance reflects a reduction of 5.7 million euro due to lower income from late-payment indemnities as well as an increase of 3.8 million euro due to lower financial charges on long-term debt, as a result of the liability management carried out and the positive contribution of 1 million euro due to lower charges for extraordinary transactions.

The tax rate is 27.7%, basically stable compared to that of 27.8% in Q1 2021, mainly due to fiscal incentives related to investments in technological, digital, and environmental transformation.

In the first quarter of 2022 Net Profit post minorities reaches 126.5 m€, therefore declining by 4.3% compared to the same period of 2021.

Net Financial Debt, which as of 31 March 2022 is 3,455.2 m€, shows a 193.9 m€ increase compared to the 3,261.3 m€ at the end of 2021. This increase mainly reflects the higher net working capital (304.5 m€) due to the changed energy scenario and the impact of the instalments requested by 140 thousand users, in addition to cash absorption related to the progress of operating investments (129.1 m€). The Debt-to-EBITDA ratio, of 2.8x, remains at a level that is below 3.0x – the threshold that Hera has set itself as a “golden rule”.

Profitability ratios remain high, with ROI at 8.6% and ROE at 9.7%.