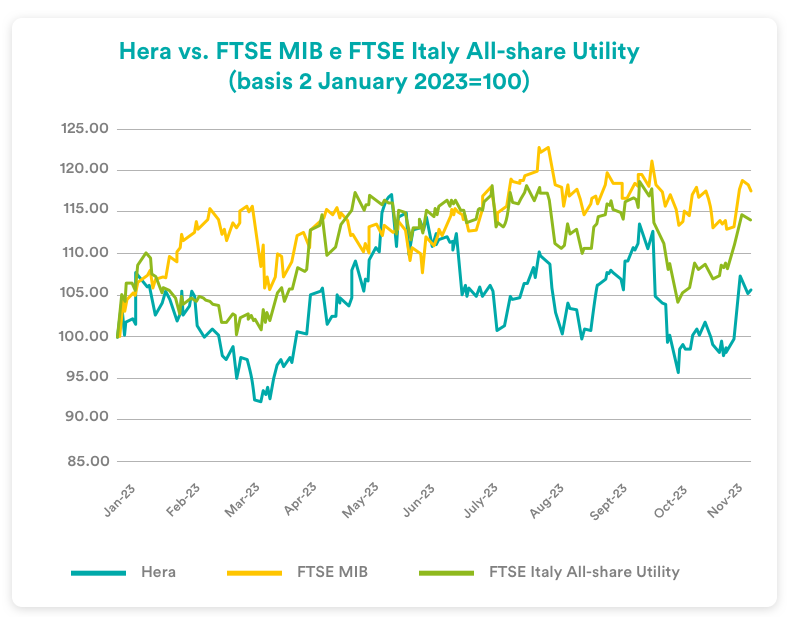

The last three months have seen an unfavourable scenario for equity investment: interest rates rising steadily, reaching 20-year peaks; the Chinese economy afflicted by persistent weakness; and, on 7 October, the outbreak of war in the Middle East, which exacerbated geopolitical tensions. The indices thus showed a volatile trend. The performance of Hera’s shares reflected this market sentiment: multiples have therefore not yet discounted the brokers’ upward revisions to estimates after half-year results.

As the end of the Central Banks’ aggressive cycle of interest rate rises approaches, the general market sentiment is starting to become less uncertain, especially looking ahead to 2024; this is driving investors to look for quality stories with solid fundamentals, which can also protect them from the risk of further short-term volatility. From this perspective, Hera represents an ideal investment opportunity, as it boasts a proven resilience and visibility of growth profile.

Activities to meet with investors are intensifying and will culminate in an articulated roadshow at the beginning of the year, following the publication of the new Business Plan, exactly with the aim of highlighting the potential value implicit in investing in Hera’s stock, which is not yet expressed in the stock market prices.

What has driven the equity market movements in recent months?

In the last three months, following the half-year earnings season, we experienced a very volatile trend in the world’s major stock markets, with most indices fluctuating widely, but not yet recovering the highs of the end of July. While the cycle of aggressive interest rate hikes persisted, taken by the Central Banks up to peaks we have not seen in over 20 years, we repeatedly witnessed signs that confirmed the weakness of the economy in China. On 7 October, the outbreak of the war between Israel and Palestine also heightened geopolitical tensions. The recent start of the quarterly reporting season also provided a mixed picture on the health of listed companies so far.

How did Hera shares perform in this context?

From 26 July, date of release of half-year results, to date, Hera’s share price also followed a volatile trend, influenced much more by the general market sentiment than by the solid fundamentals proven by the half-year results, with figures that exceeded expectations. Since the end of July, therefore, the stock has returned around the 3-euro level, recording a high of 2.94 euro on 14 September 2023, and then retraced, hitting a period low at 2.48 euro on 3rd October. From then on, especially from 26 October, the share price posted a series of upward movements that brought it back around 2.8 euro.

How do the brokers covering the stock evaluate Hera?

Following the release of half-year results, consensus estimates improved – a fact that was also reflected in the ratings. The consensus target price increased from 3.37 euro to 3.51 euro, after five analysts out of the seven in coverage raised their target price. Considering the wide difference compared to recent price levels, with a discount over 25%, six analysts out of seven recommend buying Hera shares. Only one broker has a neutral rating, despite indicating a 3.3 target price, about 20% higher than the prices recorded in recent sessions. No analysts suggest selling.

| Broker | Rating | Target price (€) |

| Banca Akros | Buy | 3.60 |

| Banca IMI | Buy | 3.50 |

| Bnp Paribas Exane | Buy | 3.30 |

| Equita Sim | Hold | 3.30 |

| Intermonte | Outperform | 3.40 |

| Kepler Cheuvreux | Buy | 3.50 |

| Mediobanca | Outperform | 4.00 |

| Average | 3.51 |

The sell-side provided a boost to Hera’s share price trend, particularly in the last few days, following the previews that analysts prepared ahead of the release of nine-month results.

Do you believe that this recent recovery movement still has room for extension?

Certainly, the results published today confirm the quality and continuity of Hera’s growth path, endorsing the framework of the estimates that analysts updated after the half-year report. Compared with those estimates, and thus with the resulting target prices, a clear gap remains open at current share prices. In very volatile market conditions, investors know that it is essential to focus on the quality of the fundamentals of the stocks that they include in their portfolios. I believe that Hera is an ideal stock for this “flight to quality,” having largely demonstrated, even in the most recent period, that it has a business model that offers protection from the risks of pandemics, economic slowdowns, and geopolitical crises.

During the long season of continuous rises in interest rates by Central Banks, utilities have been penalised, as they have been perceived as bond-proxy.

Hera suffered less compared to other stocks in the industry that are very exposed on RES, as it can leverage on a strong earnings component that comes from regulated or semi-regulated businesses, as in the case of markets of last resort. This protection against changes in macroeconomic variables will be an even more valuable feature now that the fear of further tightening of monetary policies appears to be lower, with several economists beginning to predict declines in interest rate levels for the second half of 2024. Indeed, in recent sessions, as real rates on 10-year maturities have begun to stabilise, there is a consensus that the process of raising nominal rates is coming to an end. Confronted with this new scenario, the stock’s reaction was immediate, but it still has ample room to continue.

What will you do, in terms of Investor Relations activities, to highlight this further appreciation potential?

In the last months, after the appointment of the new Executive Chairman, Hera’s senior management intensified the meetings with investors. We will certainly continue in this direction with the upcoming events that we have on our agenda. In a few days, on November 14, we will be in Paris for the BNP Paribas Exane MidCap Conference, while on November 29 and 30 we will participate in the sixth Mediobanca Infrastructure Conference held in Australia, in Sydney. As soon as we have released the new Business Plan, in early 2024, we also plan to run an extensive roadshow, during which we will meet with investors in major financial centres in Europe and the United States.