In the first nine months of the current fiscal year, Hera achieved an EBITDA growth of 15.1%, despite a 22.3% decrease in Total Revenues, due to falling energy commodity prices.

Energy areas, which explain 112.4 m€ of the total EBITDA progress of 132.0 m€, recorded a significant increase (+43.8%), leveraging on a fast growth of the customer basis (+310 thousand) and a wide range of services provided, including those successfully addressing the Decarbonisation issue.

In the Waste area (+4.8%), where one of the two Waste-to-Energy plants in revamping has not returned into operation yet, Hera leveraged higher treated volumes and prices, as well as the broader scope gained with the acquisition of ACR Reggiani.

In the Networks (+0.9%), new efficiencies and development investments have more than counterbalanced the impact of cost inflation, while waiting for the next WACC adjustment due to the rising interest rates.

In the first nine months of 2023, despite higher investments and dividends paid, Hera generated a free cash flow of 100.9 m€, which has brought the leverage (Debt-to-EBITDA ratio) back beneath the 3.0x threshold.

| 9M 2023 (data in m€) |

REVENUES 11,396.4 (-22.3%) |

ADJ. EBITDA 1,006.8 (+15.1%) |

ADJ. EBIT 504.6 (+15.5%) |

TOTAL NET INVESTMENTS AND M&A 593.0 (+18.7%) |

NET FINANCIAL DEBT 4,148.9 (-100.9 m€ vs. 4,249.8 as at 31 Dec. 2022) |

As illustrated in detail in the Annual Financial Report at 31 December 2022, starting from last year, Hera’s management decided to present the results by valuing the natural gas inventories according to a managerial criterion, in order to provide a representation consistent with a market context that shows significant and sudden changes in price compared to historical trends. At the end of the first quarter of 2023, once the winter season was over, and due to materialisation of the expected flows, the previous valuation mismatch was fully reversed. The following injection campaign, launched starting from the second half of March, was also subjected to a double valuation process, consistent with the approach used in the previous fiscal year.

In the first nine months of 2023, Group Revenues amounted to 11,396.4 m€, posting a 3,269 m€ (-22.3%) decrease compared to the same period of 2022.

The difference is mainly attributable to the Energy area (-3,631 m€), whose revenues reflected the drop in energy commodity prices and lower volumes of gas traded and sold – in this case due to the mild temperatures of the first months of 2023. This negative impact was partially offset by higher volumes on electricity (+16.8%), as a result of the effective commercial effort in the liberalised market, and to the awarding of tenders in last resort segments – as well as by activities of energy efficiency in residential buildings (SuperEcobonus) and Value-Added Services, with a positive contribution that reached a total of 276 m€.

Revenues from the Waste business also provided a positive contribution (+73 m€), mainly due to the benefits of the 2022 M&A in this business, with the acquisition of ACR Reggiani.

The Group’s adjusted EBITDA of the first nine months of 2023 amounted at 1,006.8 m€, up by 132.0 m€ (+15.1%) compared to the same period of 2022. Such a significant expansion had three main drivers: organic growth (+74 m€), Decarbonisation activities and Value-Added Services for individuals (+44 m€), as well as recent M&A deals (+14 m€) – mostly, ACR Reggiani.

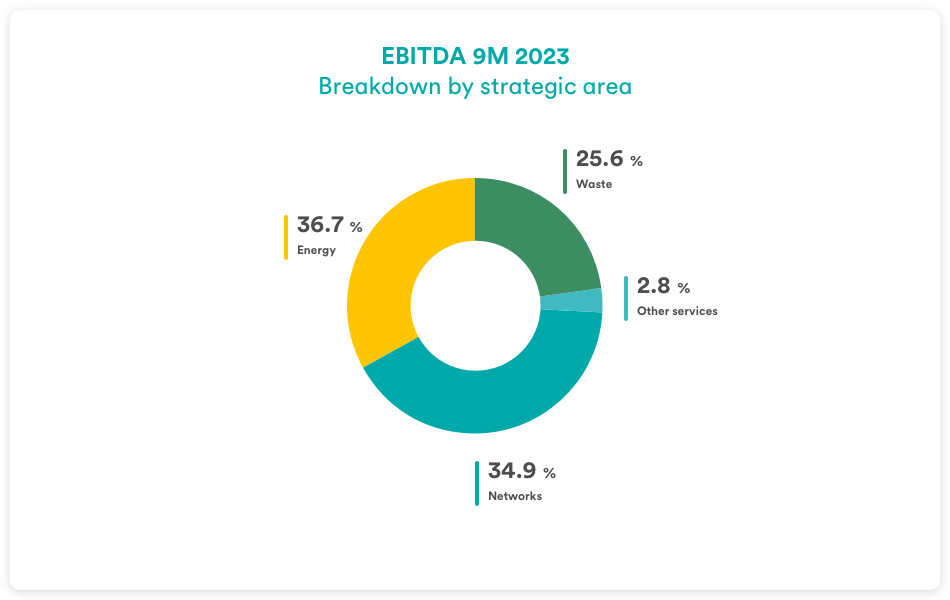

| EBITDA (m€) | 9M 2023 | 9M 2022 | Change |

| Waste | 258.0 | 246.2 | +4.8% |

| Networks | 350.9 | 347.9 | +0.9% |

| Energy | 369.3 | 256.9 | +43.8% |

| Other Services | 28.6 | 23.8 | +22.7% |

| TOTAL | 1,006.8 | 874.8 | +15.1% |

The Group’s 15.1% EBITDA increase was driven by the brilliant performance of the Energy areas, which posted a 43.8% progress compared with the first nine months of 2022.

Sales and trading activities increased by 69 m€, mainly due to a greater customer base (+310,000), which more than offset the lower gas volumes, due to both mild winter temperatures and energy efficiency improvements. Decarbonisation services continued their expansion (+44 m€), despite the depletion of tax incentives. In this area, an accounting change in stored gas should be noted, with a positive balance of 93 m€, compared to the negative figure of 93 m€ recorded at the end of 2022. Therefore, the accounting difference of gas injected into storage in 2022 was completely reabsorbed.

Moreover, also the Waste area offered a positive contribution at Group level, as it improved its EBITDA by 4.8% (+11.8 m€), even though it only had part of the installed plant capacity available, considering that the Trieste WTE was back in operation last quarter, but the Ravenna WTE under revamping will only be operational again at the end of 2023. The total progress of 11.8 m€ in the Waste area is a combination of a decline of 3 m€ in the regulated activities of waste collection, against a growth of 15 m€ in the liberalised market component. Basically, the c.9% increase in waste treated, combined with a further increase in prices, more than offset the negative impact of cost inflation.

Lastly, the Networks EBITDA recorded a slight improvement of 3.0 m€ (+0.9%). The result derived from positive EBITDA performance in Water (+4 m€) and District Heating (+2 m€), which more than compensated for the negative performance in Energy distribution (-3 m€).

In Networks, Hera benefitted from the inflation adjustment on Regulated Revenues starting in the second quarter of 2023, while still awaiting the next adjustment of WACC to the new level of interest rates. Therefore, the progress in EBITDA in Networks compared to the first nine months of 2022 for the time being only reflects the positive impact of development investments, especially in the water network, and newly gained cost efficiencies.

Group’s adjusted EBIT amounted to 504.6 m€ (+15.5%) in the first nine months of 2023, growing at a slightly faster pace than EBITDA (+15.1%), mainly due to a weaker pace in the increase of the item Depreciation, Amortisation and Provisions (+14.7%).

The result from financial operations shows an increase of 50.2 m€, recording a negative balance of 139.7 m€ in the first half of 2023. Such result reflects the more expensive cost of money, due to continued increases in interest rates, as well as the higher average debt of the period. Through careful liability management, today Hera can boast a solid financial structure, with a competitive average cost of debt of around 2.8%.

Mainly due to the tax credits for the purchase of electricity and gas, the tax rate calculated on adjusted pre-tax income reaches 26.8%, showing a significant reduction compared to 28.5% in the first nine months of 2022 – a level that moreover benefitted from the extraordinary contribution of 2.3 m€ to tackle the “high utility bills”.

In the first nine months of 2023, adjusted Net Profit after minority interests was then 235.5 m€, up 10.0% compared to the same period in 2022.

The Net Financial Debt at the end of September 2023 is up 2.4%, as it moved from the 4,249.8 m€ at the end of 2022 to 4,148.9 m€ as at 30 September 2023. The operating cash flow, which reached 664 m€, combined with the release of cash from working capital management (+277 m€) as a result of the planned depletion of gas storage, fully covered operating investments (490 m€), financial investments for M&A and share buy-back (82 m€), as well as the distribution of dividends (240 m€), then generating a surplus of 100.9 m€.

The Debt-to-EBITDA ratio as at 30 September 2023 stood at 2.91x, thus remaining within the maximum threshold that Hera had prudently set for itself to maintain a controlled risk profile in a high interest rate environment.