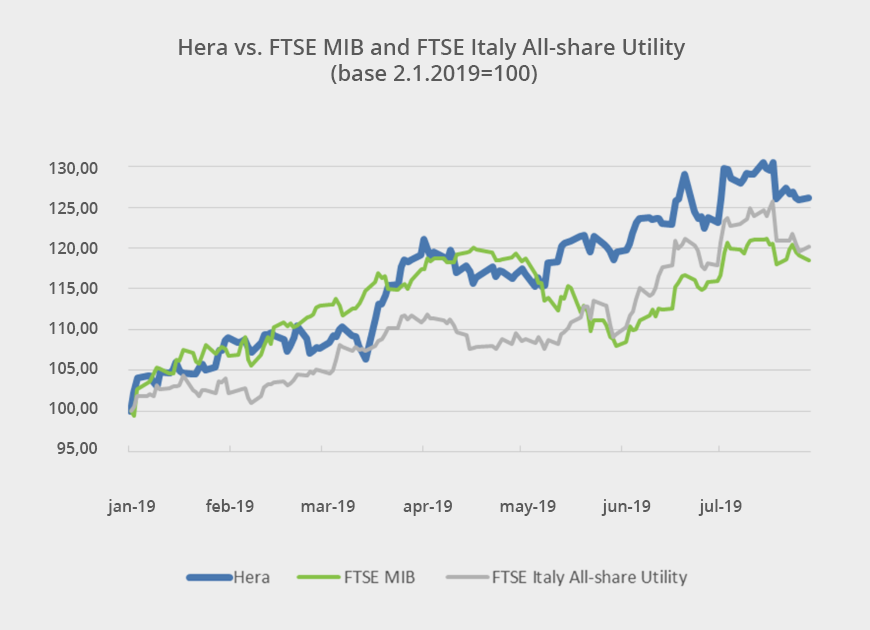

In this first part of the year, Hera’s share price rose sharply, peaking at 3.55 euro on 18 July 2019. The rally, which took place amid a bullish market outlook, also reveals some Company-specific drivers.

Starting from January, stock markets have surged, driven by the Fed’s change of stance: at the beginning of 2019, the Central Bank stopped the tightening policy followed in the last part of 2018, with the aim of preventing a global recession, given the strong trade tensions between USA and China. Results of the European elections, held in late May, removed concerns about nationalistic drifts, while a potential trade truce emerged at the G20 meeting in Osaka in late June: those new factors further fuelled stock market rally. On 18 June 2019, Mr. Draghi announcement and later, on 10 July 2019, Mr. Powell speech confirm that Central Banks will continue to make money cheaper as long as inflation recover: here is another recent factor supporting stock price performance.

Moreover, the Italian equity market benefitted from the announcement, on 3 July 2019, that Italy escaped the EU Commission sanction procedure for overrunning the ceiling of 3% in the 2020 budget deficit: the EU decision has promptly narrowed the BTP-Bund spread and re-fuelled the uptrend.

The low interest rate environment, in which high-rating bonds offer limited or even negative returns, has pushed many investors towards the utility stocks, in their quest for alternatives providing decent dividend yields.

Within this framework, Hera stock has achieved substantial price gains, also leveraging on Company-specific drivers. Sound perspectives indicated in the Business Plan to 2022, which Hera presented in January 2019, as well as the solid fundamentals, confirmed by the release of full-year 2018 and first-quarter 2019 earnings, led the stock price to close the gap versus the consensus target price over time.

The average target price of the eight brokers covering the stock is slightly higher, when compared to the last issue of the Investor News. Consensus moved from 3.51 euro on 14 May 2019, to 3.58 euro currently, as a result of the update of analyst estimates following the release of Q1 2019 results. Most brokers – five out of eight – have buying recommendations, while no broker suggests selling Hera’s shares.

| Broker | Rating | Target Price (€) |

| Banca Akros | Accumulate | 3.80 |

| Banca IMI | Buy | 3.80 |

| Equita Sim | Hold | 3.40 |

| Fidentiis | Buy | 3.30 |

| Intermonte | Outperform | 3.70 |

| Kepler Cheuvreux | Hold | 3.50 |

| MainFirst | Neutral | 3.52 |

| Mediobanca | Outperform | 3.60 |

| Average | 3.58 |

Once the Business Plan road show that took place in the first quarter of 2019 ended, in the second quarter, Hera had plenty of opportunities for further dialogue with the financial community, with a view to presenting delivered financials and the progress made in main development projects. Hera’s top management took part into the Italian Investment Conference sponsored by Unicredit in collaboration with Kepler Cheuvreux, the Mediobanca CEO Conference and the Sustainability Day of Borsa Italiana, during which they met with investors that were specifically interested in sustainability performance. Moreover, a dedicated road show preceded the Green Bond issue, aimed at presenting to bond fund managers the Group’s financial strength and the use of proceeds in funding projects that meet the UN goals, with a consequently positive environmental impact.

The inclusion of Hera’s shares in the FTSE MIB index allowed for heavy volumes, thus favouring more efficient stock pricing. While in first half-2018 daily volumes stood around 2.5 million, in first half-2019 they were above 3.8 million, a rise of more than 50%.

Over the first six months of 2019, the return for a shareholder that has bought the stock at the end of 2018, at a 2.66-euro price, would have been 30%, given a 70-cents capital gain, with the stock price at 3.36 euro on 30 June 2019, and the payment of a 2018 dividend per share of 10 cents.