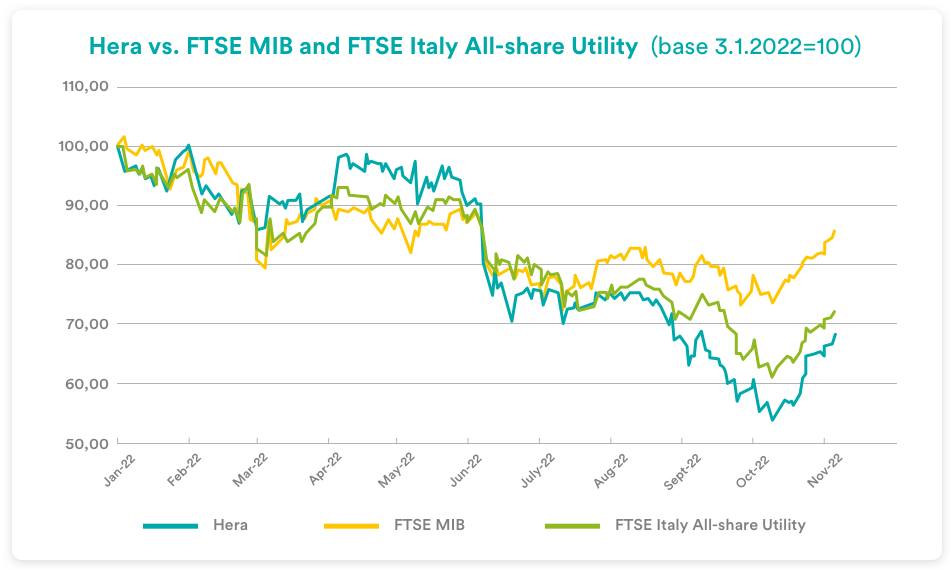

Despite the rebound that started in the second decade of October, equity markets are still currently bearish, while showing significant losses compared to their levels at the beginning of the year. The general picture remains dominated by deep geopolitical tensions, a particularly severe energy crisis in Europe – where a coordinated reaction among the various EU countries has been lacking – and restrictive monetary policies which, although aimed at slowing inflation, make the profile of economic growth uncertain.

Even though, quarter after quarter, financial results continue to indicate that Hera Group proceeds along the growth path indicated in the Plan to 2025, its shares have been penalised in this context, which was generally very unfavourable for equity investment, but which had even more negative repercussions for utilities: the peaks in gas and energy prices reached at the end of August triggered a heavy correction for the stocks in the sector, especially those in the Italian market.

The solid fundamentals shown by the third-quarter results confirm that Hera stays on track with the growth path of the Business Plan despite the challenging scenario: evidence that in a less uncertain framework can only be incorporated into investor valuations.

We explore the reasons behind what is happening in the equity market with Jens Klint Hansen, Hera’s Director of Investor Relations.

What triggered the heavy correction that led European utilities to the 2022-lows on 12 October?

The systemic factors remained the same as those that led to the bear market of 2022: i.e., the persistence of the Russian-Ukrainian conflict and China’s zero-covid policy, which caused sharp rises in commodity prices – especially food and energy – with heavy effects on inflation trends. Exacerbating the uncertain environment was also the fact that in the European Union, where there is a high dependence on Russian gas imports, there was no coordinated and timely response to the energy crisis by the various member states. Therefore, gas and electricity prices, which reached historic peaks at the end of August, had a heavy influence on inflation dynamics. The restrictive monetary policies implemented by the Central Banks to curb the acceleration of prices then worsened the uncertainty of the scenario, foreshadowing the risk of a recession.

Thus, asset managers, depending on their profile, either adopted a risk-off attitude by increasing liquidity levels in their asset allocation, or opened short positions, fuelling the fall in indices. This downward movement was particularly pronounced in the case of utilities, with a reaction that – if we look at the compressed multiples achieved – seems to have gone beyond the companies’ real risks. In addition to the negative impact of higher interest rates, the sector was particularly affected by news of coming measures to tax extra profits for companies that benefitted from the spikes in energy prices and uncertainties over how to introduce a cap on gas prices to curb speculation, as well as fears of an expansion of working capital in the face of delayed bill payments by users of gas and electricity distribution services. Meanwhile, at the end of September, the operation of the Nord Stream gas pipeline was irreparably compromised by sabotage, making the supply scenario even more critical, even in the event of a possible resolution of the Russian-Ukrainian conflict in the future. A picture of a perfect storm.

What were the consequences for Hera shares?

Despite the confirmation of the health of the Group’s fundamentals provided by the distribution of a dividend of 0.12 euro per share on 22 June and the release of the half-year results on 27 July, the stock was penalised by its membership to the utilities sector, as well as by the country risk perceived by foreign investors in view of the government crisis that led to new elections on 25 September: Italian utilities are in fact those with the weakest performance within the European panorama. And perhaps also the ones that felt the most competition from the attractive yields that government bonds had reached in the meantime…

It seems, therefore, that investors have valued utility stocks quite indiscriminately…

The risks incurred by the sector are real, but the actual exposure of individual companies to those risks should be assessed more carefully on a case-by-case basis.

What triggered the price rebound movement that started in mid-October and is still ongoing?

Although with a heavy delay, since October we have started to see a more coordinated response from European policymakers to the open issues creating serious uncertainty for the sector. Looking at gas, which from peaks of over 300 euro per megawatt hour has fallen back below 130, it also became clear to investors that the most expensive bill had already been paid by users and that healthy utilities, which can count on a solid financial profile, were managing the relationship with customers by granting payment extensions. All this set in a general framework in which it seems that since October investors have turned back to a risk-on mode, believing that a resolution to the war in Ukraine is becoming more and more imminent, while there are signs that China wants to relax its strict policy of infection containment. Therefore, although the Central Banks remain committed to fighting inflation, repeating that they want to maintain a consistent restrictive policy stance, many investors in October quickly closed their short selling, buying stocks on the market to hedge their positions.

How the consensus target price on Hera changed during this period?

Although the uncertain environment and higher cost of money have a negative impact on the valuations of all listed stocks, as the risk premium increases and future cash flows are discounted at higher rates, the valuation picture on Hera’s stock remains favourable, given the solid fundamentals that the Group continues to show from quarter to quarter, even against a very complex scenario.

Indeed, analysts that cover Hera suggest either buying the stock or holding it in the equity portfolio. The average target price is 3.65 euro: a level which, compared with the latest prices traded around 2.50 euro, indicates a potential revaluation close to 50%. It should also be noted that three out of six analysts have a target price above 4.10 euro per share, thus foreshadowing even wider margins of potential appreciation.

| Broker | Rating | Target price(€) |

| Banca IMI | Buy | 4.10 |

| Equita Sim | Hold | 3.40 |

| Exane Bnp Paribas | Buy | 4.35 |

| Intermonte | Neutral | 2.85 |

| Kepler Cheuvreux | Neutral | 2.90 |

| Mediobanca | Outperform | 4.30 |

| Media | 3.65 |

Does such a significant gap from the consensus target price indicate that broker analysts see value in the stock that the market does not seem to be incorporating into the price today?

Analysts who follow Hera stock are very familiar with our 20-year track record. In fact, we have a credibility behind us that has been built by delivering results that have always met planning objectives. This has earned us the opportunity to be historically traded at a premium in terms of price-earnings. The results for the first nine months that we are publishing today also provide confirmation of the Group’s health and the value of having a valid business portfolio, managed with great control of the risk profile, an increasingly evident commitment to businesses linked to sustainability and with a long-term view, according to the guidelines outlined in the Business Plan. The financial strength that we can count on has also allowed us to pursue our planned investments, leaving room for further options, also making important purchases of gas that we will extract from storage to meet the supply demand of our customers, without price risk.

Where did this market mispricing that penalised the stock come from?

What scares investors is the uncertainty that characterises this phase. Especially passive investors, who now dominate the asset management business, are finding it difficult to distinguish us from power generation companies, many of which are currently struggling to cope with margin calls. On closer inspection, it becomes clear that Hera is not a power generator and that its business portfolio is increasingly focused on circularity and energy efficiency.

What do you do from an investor relations perspective to rectify this misreading?

We continue to talk to analysts and investors on a daily basis. We will also proactively explain the quality of this third quarter’s numbers, to make it clear to the market that fears about a fragile performance of Hera were unfounded. We will do the same in the first months of 2023, when as usual we will hold a major roadshow to illustrate to investors the new Plan to 2026, which will make the sustainability of our path even more visible in the difficult environment we are going through.