Hera’s share continues to benefit from the high quality of its fundamentals and the visible growth perspectives, given the presence in the Group portfolio of businesses that are regulated or enabling the circularity and the energy transition. As a result of these unique features and benefitting from proactive investor-engagement initiatives, Hera has strongly outperformed the sector index.

Hera’s equity story represents a safe harbour for investors. It represents a 20-year uninterrupted growth story, with strong protection against the risks of today’s scenario, which is characterised by many uncertainties: inflation, unstable energy prices, interest rates expected to rise, geo-political conflicts and ongoing pandemic.

Hera stands out in this context, with its FY2021 results approved today by the BoD, which strengthen the equity story, lead to propose a 12 euro cents dividend and make even clearer the current undervaluation compared to the average consensus target price of 4.34 euro.

We explore those topics through some questions we asked to Jens Klint Hansen, Head of Investor Relations of Hera Group.

How did Hera share perform in the last few months?

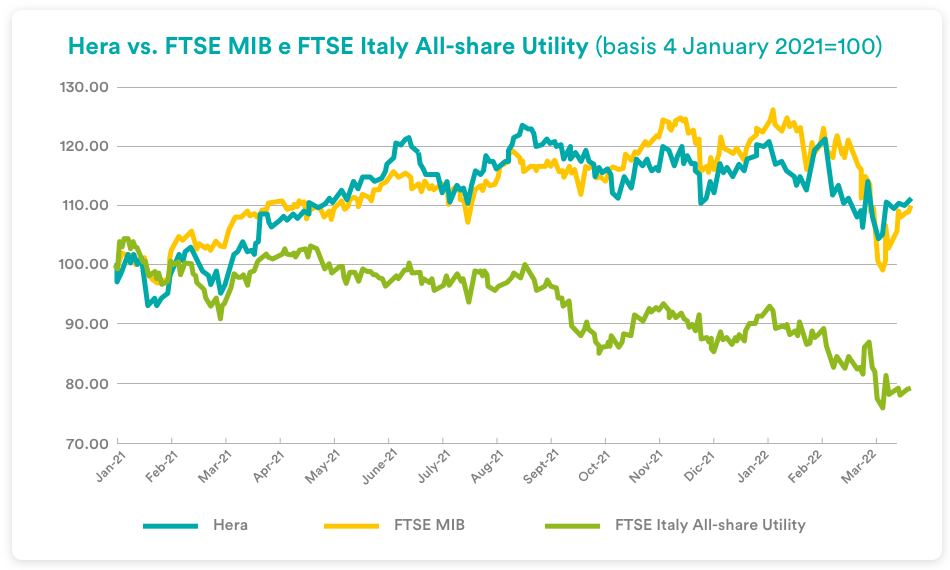

The price of Hera’s shares continues to show a significant outperformance compared to the index of the Italian utilities. The gap of more than 30 percentage points since the beginning of 2021 reflects a further divergence, which took place in the most recent sessions. While Hera shares are trading around 10% above their price at the beginning of 2021, in line with the performance of the Italian blue chip index, the FTSE Italy All-share Utility index is around 20% below its 4 January 2021 level.

What is the reason for this even more pronounced divergence with the performance of the Italian utility index, which dropped considerably lately?

I believe that the increase in the outperformance can also be attributed to the intense roadshow activity that we conducted during the last few weeks, following the presentation of the new Business Plan in January. Meeting with investors in this delicate phase, in a context of great uncertainty due to the Russian-Ukrainian conflict, gave us the opportunity to better explain the solid drivers that support the targets set in the Plan. At the same time, we were also able to explain how our results are only marginally impacted by strong fluctuations in the price of energy commodities, as Hera applies careful hedging policies. We could also highlight how high oil prices have increased the competitiveness of the prices of plastics recycled by Aliplast. Not to mention the services related to energy efficiency, where Hera already proved to have attractive returns, which we expect will continue to be incentivised in a scenario that will require reducing dependence on Russian gas, including minimising heat loss from buildings.

What do investor appreciate most of Hera’s equity story at the moment?

I believe that currently portfolio managers find in Hera that quality of earnings they are trying to stick to, when they have to decide to invest or stay invested, if they are already our shareholders. We undoubtedly represent an equity story of growth, but at the same time we have a conservative risk profile, given our relevant presence in regulated activities and our exposure to businesses that contribute to the achievement of European environmental sustainability goals. This also provides great visibility to the dividend policy that we presented in the Business Plan. Buyers at the end of 2021 would receive a yield of 3.3% based on the dividend proposed by the Board today.

What are the main trends in the stock market presently?

Certainly, the latest period saw a paradigm shift, as we moved from long years of virtually zero inflation and cheap money to the prospect of rising interest rates to keep inflation under control. Central Banks do not consider any more such perspective as a temporary effect of supply chain disruptions due to the pandemic – albeit with due differences between the timing of Fed and ECB interventions, against a much weaker economic context in Europe. In the new scenario of rising borrowing costs, investors are using higher rates to discount the future cash flows of companies, with the effect of reducing stock valuations. In recent weeks, financial markets are also incorporating a less robust growth outlook for 2022 compared to the prevailing expectations at the beginning of the year, as high commodity prices result in a tax on the global economy. This weakness in Europe is exacerbated by the energy crisis triggered by the ongoing war. As a result, growth stocks and cyclical stocks in general have seen a cut in their expected earnings growth, which has had a downsizing effect on valuations and led to sharp price corrections. However, with the first signs of dialogue in the Russian-Ukrainian conflict, we have seen a less volatile market that quickly returned to a risk-on mode, despite the Fed’s rate increase on 16 March, the weaker growth outlook in China and the outbreak of a new pandemic wave. Asset managers therefore seem ready to keep their exposure to the equity market, but with a much more selective approach. Hera, due to the nature of its business portfolio, has all the characteristics to take advantage of the new situation.

Where does Hera’s share price stand compared to the consensus target price?

The price has fluctuated remaining just below 3.5 euro in recent trading sessions, therefore indicating that there is significant upside potential considering the average target price of 4.34 euro. Analyst coverage has recently broadened while increasing its quality profile, with Exane BNP Paribas issuing the initiation of coverage research on Hera.

Also because of the approximately 28% gap between recent prices and the average consensus target price, five out of six analysts have Buy/Outperform recommendations for the stock. Despite the considerable difference between the high (4.85 euro) and low target price (3.90 euro), even at the most conservative valuation, at current prices the room for appreciation is well above 10%.

| Broker | Rating | Target price (€) |

| Banca IMI | Buy | 4.80 |

| Equita Sim | Hold | 3.90 |

| Exane Bnp Paribas | Buy | 4.85 |

| Intermonte | Outperform | 4.30 |

| Kepler Cheuvreux | Buy | 4.10 |

| Mediobanca | Outperform | 4.30 |

| Stifel | Buy | 4.10 |

| Average | 4.34 |