Despite an external context that proved to be extremely challenging due to the Covid-19 pandemic, in the first nine months of 2020 Hera managed to post higher results both at EBITDA level and at the P&L bottom line.

With a careful and responsible approach towards all stakeholders, Hera successfully faced and managed the risks related to the virus outbreak, thus neutralizing the impacts of the restrictions introduced to contain the health emergency.

On the one hand, organically, EBITDA grows by leveraging on the successful efforts made to optimise costs and achieve new efficiencies; on the other hand, EBITDA benefits from a significant and fundamental support from the integration of the companies acquired in 2019.

| NINE MONTHS 2020 (data in m€) |

EBITDA 806.2 (+2.6%) |

EBIT 414.7 (+2.3%) |

NET INVESTMENTS 366.0 (+10.6%) |

NET FINANCIAL DEBT 3,284.5 (+0.3% vs. 2019YE) |

In the first nine months of 2020 Hera achieved a 2.6% EBITDA increase, which offset 40.2 m€ of negative impacts due to:

- mild winter temperatures,

- lower demand during the lockdown period last spring,

- end of incentives at the Ferrara WTE plant.

EBITDA increase was made possible by the following positives:

- organic growth, which offered a 25.1 m€ contribution by leveraging on the reduction of certain costs and the achievement of new efficiencies allowed by new technologies – such growth also counterbalanced the regulatory changes in the gas distribution business,

- the expansion of the perimeter, for a total of 35.5 m€, as consequence of the consolidation of EstEnergy (+30.7 m€ of net contribution), from 1st January 2020, and Pistoia Ambiente (+4.8 m€), from 1st July 2019.

In the first nine months of 2020, Group Revenues amounted to 4,905.9 m€, a contraction of 157.3 m€ (-3.1%) compared to the same period of 2019. Such performance mainly reflects the negative impact of the 370 m€ decrease in revenues from trading, production, and sale of electricity, caused by the lower volumes sold and the lower prices of commodities. Among the factors with a positive impact on consolidated revenues, the most significant is the one resulting from the expansion of the consolidation scope following recent acquisitions, which contributed for about 376 m€.

Consolidated EBITDA, equal to 806.2 m€, shows an increase of 20.4 m€ (+2.6%) compared to same level of 2019.

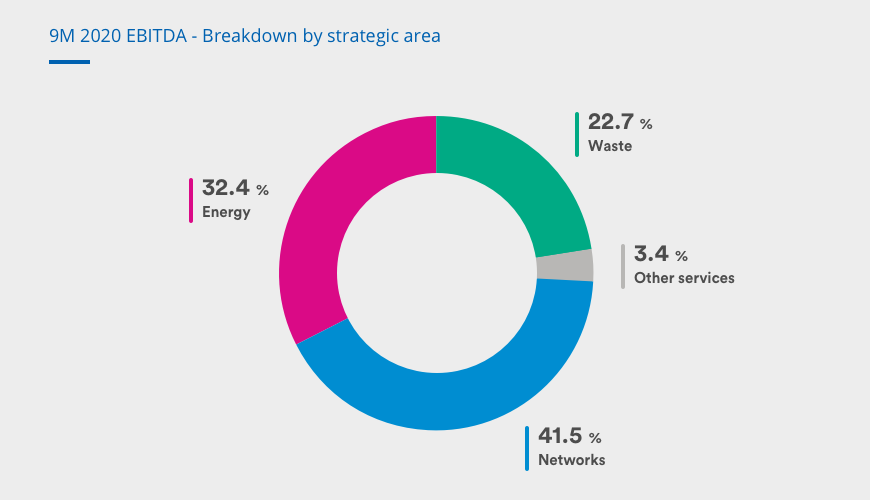

Energy area drove the performance of consolidated EBITDA, recording a 15.5% growth rate. The incremental contribution of EstEnergy (+42.3 m€), included in the consolidation scope from 1st January 2020, has more than compensated the negative effects of both lockdown (-17 m€) and mild winter temperatures (-7.5 m€).

In the consolidated financial statements, Networks show a decrease in EBITDA of 2.4%. Actually, on a like-for-like basis, Networks achieved a progress of 1.0% (+3.4 m€), although the tariff revision in gas distribution had a negative impact of 7 m€, since in the remaining businesses the regulation has recognised the quality of assets and service. The 2.4% EBITDA reduction in this area is therefore a reflection of the spin-off of Hera’s gas distribution networks in Padua and Udine, as envisaged by the Ascopiave deal (-€11.6 m€ impact on the first nine months of 2020).

The Waste area – despite a 4.5% decrease in EBITDA due to the sharp drop in energy prices – has overall shown solid fundamentals, with the prices of special waste treatment steadily increasing and total waste volumes slightly declining (-4%).

The EBITDA growth in Other Services was strong (+8.8%), with an improvement in the margins of telecommunication services and public lighting that offset the negative effects of the Covid-19 emergency, equal to 0.5 m€.

| EBITDA (m€) | 9M 2020 | 9M 2019 | Change |

| Waste | 183.3 | 192.0 | -4.5% |

| Networks | 334.7 | 342.9 | -2.4% |

| Energy | 261.1 | 226.1 | +15.5% |

| Other services | 27.1 | 24.9 | +8.8% |

| TOTAL | 806.2 | 785.9 | +2.6% |

Changes in the scope of consolidation drove the €11.2 million (+2.9%) increase in Depreciation and Amortisation, which amounted to €391.5 million. EBIT thus improves by 2.3% compared to the first nine months of 2019, reaching € 414.7 million.

The result of the area of financial management is €79.5 m, an increase of €12.4 m (+18.5%) compared to the first nine months of 2019. The change is essentially attributable to the notional charges of € 16.9 m€ that derive from the put option envisaged by the Ascopiave agreement.

Tax rate shows a sharp improvement. It decreases from 28.5% in the first nine months of 2019 to 27%, as a result of the tax optimisation allowed by the investments focused on technology and environment. Nine-month 2020 Group Net Profit is therefore €233.1 million, up by 1.0%, despite it has to discount the notional charges relating to the EstEnergy acquisition.

Net Financial Debt, which stood at € 3,284.5 m€, remained basically unchanged compared to € 3,274.2 m€ at the end of 2019. A strong cash generation made it possible to fully cover investments, as well as the disbursements for dividend payment and M&A transactions. The Net Debt-to-EBITDA ratio shows a further reduction, as it stands at 2.50x, excluding the notional debt related to the Ascopiave transaction. Hera’s financial structure continues to be rock solid, with an average debt maturity exceeding six years and more than 56.6% of the debt stock expiring over five years.