Hera’s EBITDA growth path continued uninterrupted in 2022, with progress of 75.6 million euro that allowed the Group to reach a record level of 1,295 million euro, despite a much more challenging external scenario than was foreseeable at the beginning of the year.

The portfolio maintained a well-balanced structure, with the liberalised activities reaching 59% of the Group’s EBITDA.

All businesses performed well, as a result of continuous investments and wise management policies, although the extra-returns recognised in regulated activities were not able to fully offset the WACC cut of 22 million euro set by ARERA.

In 2022, the Environment area led the growth in consolidated EBITDA, with an increase of nearly 16%, owing to the high margins achieved in plastics regeneration and energy production by WTEs. The contribution of the Energy areas, growing by 7.4%, was also decisive, mainly due to the expansion of sales activities and those dedicated to improving the energy efficiency of buildings, incentivised by the Ecobonus.

| FY 2022 (data in m€) |

REVENUES 20,082.0 (+90.3%) |

EBITDA ADJUSTED 1,295.0 (+6.2%) |

NET PROFIT ADJUSTED 322.2 (+1.4%) |

TOTAL NET INVESTMENTS 688.7 (+20.8%) |

NET FINANCIAL DEBT 4,249.8 (+30.3% vs. 31 Dec. 2021) |

To ensure a better comparability of its performance over time, Hera has chosen to present the results for the fiscal year 2022 according to a management criterion, instead of the accounting criterion, which provides for the valuation of commodity inventories using the weighted average cost criterion. To ensure a consistent comparison, the figures for the fiscal year 2021 have also been presented according to the management approach.

Due to the sharp increase in gas prices, in fact, the intense storage activity that has taken place since April 2022 with the aim of guaranteeing the supply service to customers has taken place at costs per cubic metre that were up to five times higher than in the previous year. However, the higher value of gas purchases made for storage, determined on a management basis, is fully recovered over time, as withdrawals are made to deliver gas to customers, according to contracts with defined prices.

In FY2022, Group Revenues increased by 90.3% compared to FY2021, reaching 20,082.0 m€: the strong increase is mainly a reflection of the hike in commodity prices.

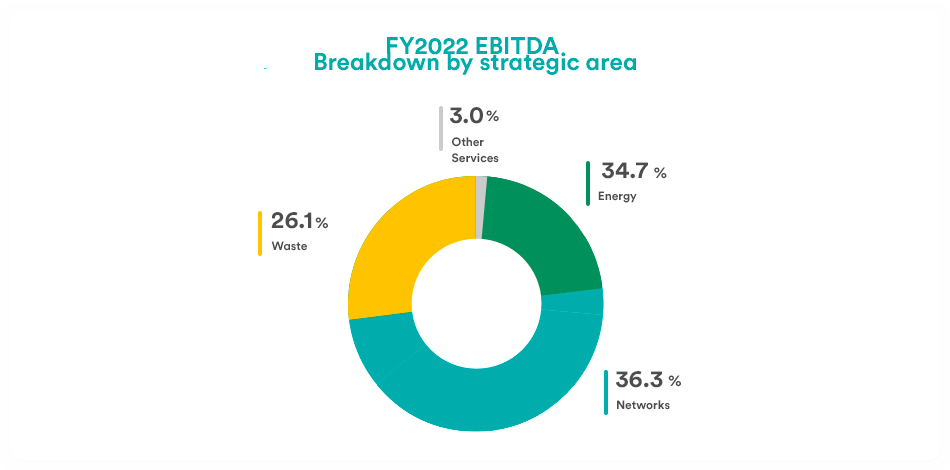

In 2022, Group’s adjusted EBITDA amounted to 1,295.0 m€, up 75.6 m€ (+6.2%) compared to 2021. Drivers of such performance were organic growth (+45 m€), improved results from circular economy activities (+44 m€), as well as the contribution of recent M&A deals (+8 m€). These positive factors more than offset the negative impact of the WACC cut made by ARERA in regulated businesses (-22 m€).

The breakdown of EBITDA by sector shows that the largest contribution came from the Environment area, which recorded an increase of 15.9% in 2022 (+46.3 m€). While there was a slight decrease in the regulated part of collection (-8.6 m€), the liberalised part benefitted from the high energy prices, recording an increase of 55.0 m€. Although the shutdown for revamping of the two WTE plants in Trieste and Ravenna partly conditioned the performance (-7 m€), energy production from other WTEs provided a significant contribution (+30 m€, net of higher production costs), also in terms of profits, as energy production from WTEs is not included in the taxation of extra-profits that applies to energy-producing companies. Aliplast (+17 m€) also played a relevant role, as it benefitted from a strong demand for regenerated plastics, favoured by the high prices reached in virgin plastics. The role of organic growth was also fundamental, with a contribution of 9.0 m€, as was that of M&A (+6.0 m€), mainly due to the consolidation of Macero Maceratese. The agreement for the acquisition of 60% of the share capital of ACR Reggiani, a leading company in the remediation of industrial sites, was finalised at the beginning of 2023. Therefore, Hera has visible opportunities of continuing to benefit from the expansion of the Group’s perimeter in this area, given the important complementarities with the business of the newly-acquired company, which boasts some of the largest Italian listed groups in its client portfolio.

The Energy areas, as well, provided a key driver of consolidated EBITDA growth, with an increase of 31 m€ (+7.4%) compared to 2021. Energy commodity sales activities saw an EBITDA increase of 20 m€; energy efficiency activities for residential buildings, incentivised by the Ecobonus, made an incremental contribution of 18 m€, while Value Added Services of 8 m€. These positive components more than offset the reduction (-16 m€) in dispatching services provided to Terna compared to 2021, as a result of the normalisation of demand from the grid operator.

Lastly, the EBITDA of Networks recorded a marginal decrease of 2.7 m€ (-0.6%). The 70-basis point cut in the WACC of the regulated activities of distribution and the 40-basis point cut in the WACC of the water cycle had a total negative impact of 22 m€. The organic growth (+19 m€) almost completely counterbalanced the effects of the regulatory review, given the extra-returns recognised for service quality. It should also be considered that the increase in interest rates recorded in 2022 did not reach, by a difference of 4 basis points, the threshold set for an immediate adjustment of the WACC, which will instead be aligned with the new interest rate level from 2024.

| EBITDA (m€) | FY 2022 | FY 2021 | Change |

| Waste | 338.0 | 291.7 | +15.9% |

| Networks | 469.5 | 472.2 | -0.6% |

| Energy | 449.1 | 418.1 | +7.4% |

| Other Services | 38.4 | 37.4 | +2.7% |

| TOTAL | 1,295.0 | 1,219.4 | +6.2% |

Consolidated EBIT also posted progress, amounting to 627.9 m€ (+3.4%), despite the weight of Depreciation and Amortisation and Provisions being up by 55 m€ compared to 2021, as a result of new investments and business expansion, respectively, which required higher provisions for risks, although the credit profile, however, remained very good and without any significant deterioration.

The result from the area of financial management was negative by 125.0 m€, compared to a negative balance of 119.8 m€ in FY2021. The change reflects the higher average Net Financial Debt, which is mainly the result of the expansion of Net Working Capital due to energy commodity inflation. Hera’s average cost of debt remains at a very low level, standing at 2.6% in 2022.

The tax rate calculated on adjusted pre-tax profit reached 26.0%, down from 26.8% in 2021. Therefore, in 2022, adjusted Net Profit after Minorities is 322.2 m€, up 1.4% year-on-year. The adjustments considered relate to non-recurring items that had made a positive contribution in 2021 and temporary accounting differences in the valuation of gas storages.

ROE, which represents a benchmark from the point of view of shareholder return, when calculated as the ratio of adjusted Net Profit to Equity, continues to provide reassuring indications, having remained at a double-digit level (10.0%).

Net Financial Debt as of 31 December 2022 amounted to 4,249.8 m€. The change of 988.5 m€ compared to the level of 3,261.3 m€ at 2021 year-end is mainly attributable to the extraordinary gas storage that Hera decided to accumulate to cover demand in the winter season.

The Debt-to-EBITDA ratio, which in accounting terms is 3.28x, actually remains below the level of 3.0x that Hera has set as the maximum threshold: in fact, by subtracting the amount of gas storage, the leverage returns below the prudential threshold of 3x.