The results of the first nine months of 2021 show that Hera is pursuing the targets indicated in its long-term strategy. Results delivered quarter after quarter prove consistency with these commitments and flexibility in their achievement even against changing contexts.

The strong EBITDA growth of 77.1 m€ that the Group achieved mainly derives from the improvement of the Energy area, whose EBITDA increases by 37.1 m€, driven by the recovery of operating conditions that were more ‘normal’ than in the past year, given the more favourable weather conditions and the reduced restrictions to control the spread of the virus. In this area Hera has played its role as an agent of the energy transition, successfully proposing value-added services and solutions that significantly increase the energy efficiency of buildings, while using the “ecobonus” incentives.

The Waste area also played a key role at EBITDA level, with an increase of 35.1 m€. The benefits of exiting the phase of anti-Covid restrictions have been fully captured, as shown by the expanding volumes, even in special waste, while the acquisitions in the materials regeneration business prove to be strategic not only for the actual execution of environmental policies but also for the margins that they express.

The regulated businesses, which represented a stabilising factor in times of GDP contraction, improved in terms of EBITDA even during the economic upturn, leveraging on a careful selection of the segments in which Hera has chosen to focus.

Winning the tender for Rimini’s water management, with more than 160 thousand users in portfolio for the next 18 years, marks a substantial confirmation in this direction.

In mid-October Hera also issued its first sustainability-linked bond, for an amount of 500 m€, with a maturity of 12 and a half years. This issue demonstrates how Hera’s commitment to carbon neutrality and circular economy also involves a consistent financial strategy.

| 9M 2021 (data in m€) |

EBITDA 883.3 (+9.6%) |

NET PROFIT 308.4 (+32.3%) |

NET OPERATING INVESTMENTS 361.0 (+13.3%) |

NET FINANCIAL DEBT 3,303.8 (+2.4% vs. 31 Dec. 2020) |

In the first nine months of 2021 Hera reached 6,424.3 m€ in Revenues, scoring a 1,518.4 m€ (+31.0%) increase compared to the same period of the previous year. The Energy area contributed for 1,150 m€, as a result of the strong expansion in trading, higher volumes of gas sold and rising electricity prices. A significant contribution (183 m€) came from the heat district business, due to the substantial development of the activities related to the bonus for the restructuring of facades and energy efficiency works, together with a 10.0 m€ growth in value-added services provided to customers.

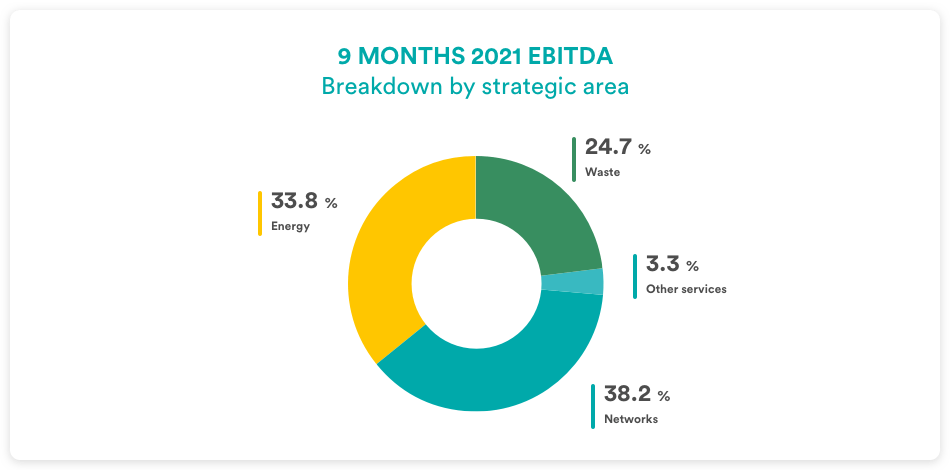

The nine-month 2021 Group EBITDA stands at 883.3 m€, a 77.1 m€ (+9.6%) increase compared to the same period of 2020.

The Energy area provided the higher contribution in absolute terms to the increase in Group EBITDA, for 37.1 m€ (+14.2%). As this area was the most severely impacted by the pandemic restrictions in the previous year, it is understandable that the removal of these impacts has brought significant benefits (+24.5 m€) to the numbers for the first nine months of 2021.

The most significant input came from the value-added energy services segment (+34.2 m€). These results mainly reflect the appreciation for the solutions that Hera offers in the “ecobonus” activities, which have the advantage of a tax credit immediately transferable to the bank on the cost of works dedicated to improving the energy efficiency of buildings.

Considering that Hera hedges most of the commodity risk, the price spikes experienced in 2021 had only modest effects on EBITDA, despite the high volatility.

The EBITDA in the Energy area, on the other hand, was affected by the reduction in safeguard contracts in the electricity supply. Such reduction has only partly been offset by increases in the default segment and FUI gas; therefore, in the Markets of “Last Resort” the net balance is negative for 3.9 m€.

Lastly, ancillary services linked to the dispatching market are back to more normal levels compared to 2020, with a reduction of 18.9 m€.

In the first nine months of 2021, a significant contribution of 35.1 m€ to the increase in consolidated EBITDA, also came from the Waste area, which posted a 19.1% progress. The EBITDA of this area reflects higher revenues from power generation and increasing volumes treated (+3.1%), in addition to the positive contribution coming from Aliplast (+11,9 m€), as a result of growing volumes and margins in plastics recovery also due to the higher price of the original polymer.

The performance of the Waste area also benefits from the contribution of Sea, Recycla and Gruppo Vallortigara, companies acquired during the year. With 3% of waste sent to landfill, Recycla is showing an excellent operational performance, exceeding EU targets.

In the Networks, the EBITDA progress amounted to 2.5 m€ (+0.7%). Despite the slight decrease in the water business (-2.6 m€) and electricity distribution (-1.5 m€), the sound results achieved in district heating (+2.6 m€) also due to colder temperatures than those experienced in 2020, combined with the good performance in gas distribution (+4.0 m€) – that benefits from new efficiencies and continuous investing – overall have produced positive dynamics in regulated businesses. The result of the Networks area reflects the issue of 5.4 m€ of White Certificates linked to energy efficiency activities, as well as the contribution of 2.4 m€ of new connections, due to the recovery in the building of new houses.

In this area, Hera has recently won the tender for the management, for the next 18 years, of the water cycle in 24 municipalities in the province of Rimini, including the city itself, with over 160,000 users, as well as the tender for the gas distribution concession in Udine, for the next 12 years.

| EBITDA (m€) | 9M 2021 | 9M 2020 | Change |

| Waste | 218.4 | 183.3 | +19.1% |

| Networks | 337.3 | 334.7 | +0.7% |

| Energy | 298.1 | 261.1 | +14.2% |

| Other services | 29.4 | 27.1 | +8.5% |

| TOTAL | 883.3 | 806.2 | +9.6% |

Depreciation & Amortisation rose by 5.4%, mainly due to the new capex, reaching 412.5 m€. This allowed EBIT to achieve a 13.5% increase – hence higher than that of EBITDA – that amounts to 470.8 m€.

The result of the area of financial management is 85.4 m€, a decrease of 5.9 m€ (7.4%) compared to the first nine months of 2020. On the one hand, such performance reflects lower income for late payment indemnities on credits in the “last resort” segment, for 7.3 m€, and higher financial expenses, for 5.5 m€, for the sale of tax credits related to the “ecobonus” activities. On the other hand, these factors are partially compensated by the benefits of liability management operations and higher profits from associates.

All in all, the cost of debt in the first nine months of 2021 is 2.8%, a substantial decrease vs. 3.3% in the first nine months 2020.

Nine-month 2021 tax rate, which is equal to 26.2%, shows a 0.8 percentage points decrease compared to 27.0% for the same period of 2020, mainly due to the tax relief allowed on investments in technological, digital and environmental innovation.

Net Profit post minorities therefore reaches 308.4 m€, an increase of 75.3 m€ (+32.3%) that also benefits from a 56.2 m€ special item related to the tax redemption of goodwill. Such item will be absorbed by the end of the year with the recall of bonds for 350 m€, financed by the new sustainability-linked issue of 500 m€ placed in October.

Net Financial Debt stands at 3,303.8 m€, compared to 3,227.0 m€ as at 2020 year-end. Strong cash flow generation in the first nine months of 2021, equal to 643 m€, allowed for a full funding of capex expenditure (377 m€), 65 m€ of provisions and the disbursement, for a total amount of 147 m€, related to the M&A operations and the partial buyback of the bond with maturity at 2028, on top of financing the majority of the 161 m€ of dividend distributed to shareholders.

The Net Debt-to-EBITDA ratio as of 30 September 2021 is further improved, decreasing to 2.75x, compared to the 2.87x ratio at 2020 year-end and the 2.97x as at 30 September 2020.