The utilities sector is certainly not one of the sectors that investors have favoured during 2021; nevertheless, Hera shares have performed well since the beginning of the year, leveraging the generally positive tone of the stock markets and a number of Company-specific factors that have boosted the share price.

While the stock markets continue to rise, supported by expectations of a post-pandemic economic recovery and still accommodating monetary policies, there is great volatility, mostly due to the sharp increase in the prices of energy commodities and their inflationary effects.

The results that Hera released, quarter after quarter, confirmed the growth features of its equity story, with a risk profile that remains very low even in the face of turbulent external scenarios.

Nine-month 2021 results that the Board of Directors approved today will help cement this equity story. Moreover, they will increase the visibility of further appreciation potential that the stock presents at current price levels, also considering the gap with the average broker target price of 4.2 euro.

We explore these issues in an interview with Jens Hansen, Head of the Group’s Investor Relations.

How has Hera’s stock performed in the last period?

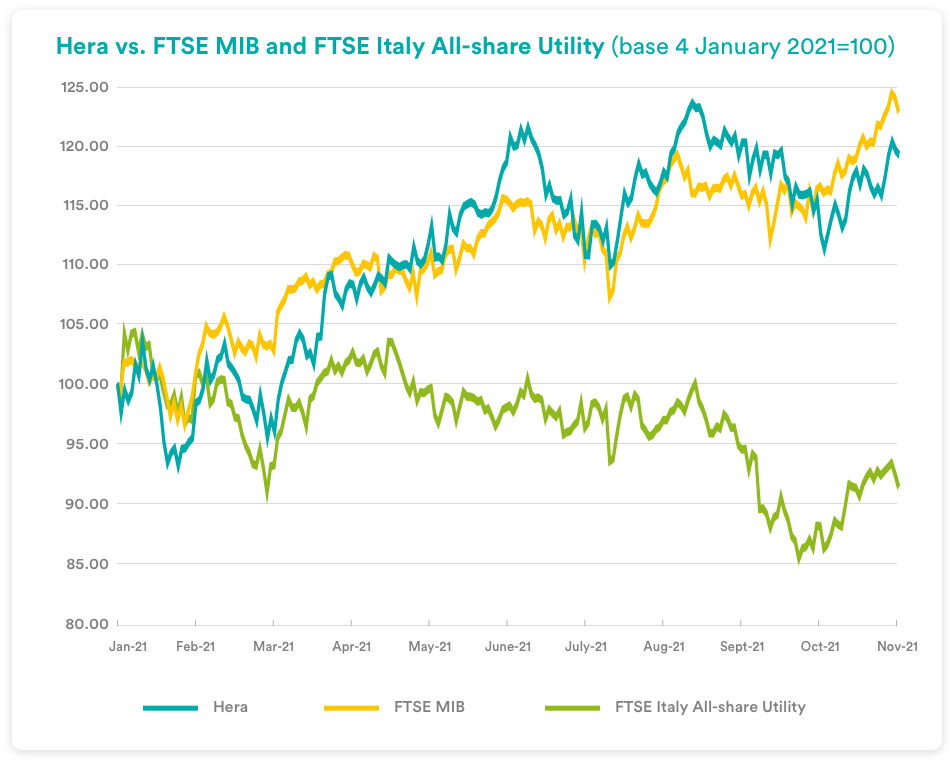

In a lacklustre year for utilities, Hera’s performance exceeded 20%, following a path very similar to that of the FTSE MIB, which benefited from the drive of cyclical and financial stocks, in a context of an economy gradually recovering from the effects of the pandemic. The Italian utilities index is now more than 5% below its early 2021 levels, having showed a marked underperformance in the period between mid-August and the end of September. Therefore, the 25% outperformance of our stock compared to the sector benchmark confirms that an important part of the investment community has appreciated the peculiarities of our business model: a model that, on the one hand, presents a well-balanced approach and, on the other, has proved capable of fully exploiting short-term opportunities, such as the tax incentives linked to the ecobonus aimed at the improvement of the energy efficiency of apartment buildings.

What continues to drive global equity markets upside?

The main stock market indices continued to set new record highs fuelled by positive sentiment about the outlook for economic recovery amid progressive post-pandemic reopening. News outlets, such as the one about an experimental antivirus pill that would reduce the risk of developing serious complications from COVID by around 90%, are a catalyst for buying on stock markets. The quarterly earnings season is delivering a convincing set of growing earnings for the third quarter of the year as well, even though disruptions in supply chains and logistical difficulties are driving up the prices of raw materials and semi-finished goods. The emergence of solid fundamentals from nine-month results also translates into continued upward revisions of analysts’ estimates for the coming fiscal years. Meanwhile, central banks – especially the Fed, ECB and BoE – continue to interpret inflation as a temporary phenomenon and maintain a very “patient” attitude, seeing no need to raise interest rates in the short term. Even the Fed’s recent announcement of a reduction in securities purchases, the so-called tapering, has not in fact led to concerns about an imminent increase in real interest rates. With ample liquidity available, investor appetite for equities therefore remains very high.

Why do utilities continue to be overlooked by investors in 2021?

Generally speaking, prices of utility stocks have suffered whenever there were upward movements in bond yields during 2021 due to fears of inflationary flare-ups, since the utility equities are considered as bond-proxies. Then there is the actual impact that higher energy prices have on the accounts of companies in this sector. Firstly, it is not so easy for investors to identify what the actual risk-opportunity is for the individual company. At the European level, among the large utilities, it has in fact emerged that most operators have already hedged against commodity volatility throughout 2022 and for much of 2023. Even in Hera’s case, exposure is actually very low. Secondly, utilities are seen by investors as vulnerable to the risk of new and unforeseen tax impositions, or cuts and postponements in tariff adjustments: measures that governments might decide to impose to avoid the impact of higher energy commodity costs being heavily passed on to the end consumer, i.e., their voters.

What Company-specific factors reflect the performance of Hera shares?

The stock – which once again proved to be a growth play – also benefited from a twofold upward revision of its dividend, on account of an increase in earnings that exceeded the expectations of the Plan presented in January: in July, our shareholders could benefit from a dividend yield of 3.7% based on the 2020 year-end price. The extent to which these solid quarterly results are sustainable, given an approach aimed at controlling risk along the growth path, is probably something that the stock market has not yet fully understood and incorporated into the share price. We went through a scenario dominated by the effects of the pandemic, only to be confronted with an equally challenging environment, characterised by strong fluctuations in commodity prices: yet we continued to produce results that put us ahead of the completion of the path outlined in the Business Plan to 2024.

What is the consensus target price at the moment?

The consensus target price currently stands at 4.18 euro, more than 5% higher than that preceding the publication of the half-year results. Analysts from Equita, Intermonte, Kepler Cheuvreux and Stifel have increased their target price following the upward revision of earnings estimates, in light of the strong increases that Hera has achieved in half-year data. Target prices are currently highly dispersed, ranging from a low of 3.90 euro to a high of 4.70 euro. Even taking as a reference the lower end of the range, at current prices there is still an attractive potential appreciation area for the stock, which the results for the first nine months published today will only confirm.

| Broker | Rating | Target Price (€) |

| Banca IMI | Buy | 4,70 |

| Equita Sim | Hold | 3,90 |

| Intermonte | Outperform | 4,30 |

| Kepler Cheuvreux | Buy | 4,10 |

| Mediobanca | Outperform | 4,00 |

| Stifel | Buy | 4,10 |

| Average | 4,18 |