First-half 2021 results confirm that Hera is following the path indicated in the Business Plan, while consistently implementing a circular economy model and pursuing its commitment – attested by STBi – to reducing greenhouse gas emissions.

The strong growth that the Group achieved in 1H 2021 EBITDA derives more than 54% from the contribution of the Energy area, which sees a return to more normal operating conditions compared to the first half of 2020, as a result of less severe anti-Covid restrictions and more favourable weather conditions. In this area, Hera achieved significant progress, while making concrete its commitment to the reduction of Scope 3 emissions produced by customers through the offer of value-added services and solutions that improve the energy efficiency of buildings, by leveraging the incentive aspects of the “ecobonus” tool.

The crucial role of the Waste business, which contributes almost 35% to the growth of consolidated EBITDA, was also confirmed in 1H2021. In this strategic area, Hera could benefit both from the expanding volumes – also in special waste, following the gradual recovery of activities compared to the shutdown of 2020 – and from a shrewd acquisition policy that now allows it to play a major role in plastic recycling, a business that is profitable for the Company and increasingly central to the implementation of environmental policies for the regeneration of materials.

Moreover, in regulated businesses, Hera continued to expand its customer base, focusing on segments consistent with its own risk/return profile.

The strong cash flow generated in the first half of the year led to an 8.4% reduction in Net Financial Debt and brought the Debt-to-EBITDA ratio down to 2.5x: after 18 months, Hera has therefore returned to the leverage levels prior to the acquisition of EstEnergy.

| First-half 2021 (data in m€) |

EBITDA 617.9 (+10.4%) |

NET PROFIT 216,1 (+30.0%) |

NET OPERATING INVESTMENTS 237.4 (+21.7%) |

NET FINANCIAL DEBT 2,956.7 (-8.4% vs. 31 Dec. 2020) |

In first-half 2021, Hera Group Revenues reached 4,179.7 m€, while posting an increase of 777.4 m€ (+22.8%). Some 600 m€ out of the overall increase come from the Energy area, mainly due to higher revenues from trading, higher volumes of gas sold and rising electricity prices; even the heat management business provided a strong contribution, of 72 m€, as a result of the substantial development of the activities related to the bonus for the renovation of facades and energy efficiency works.

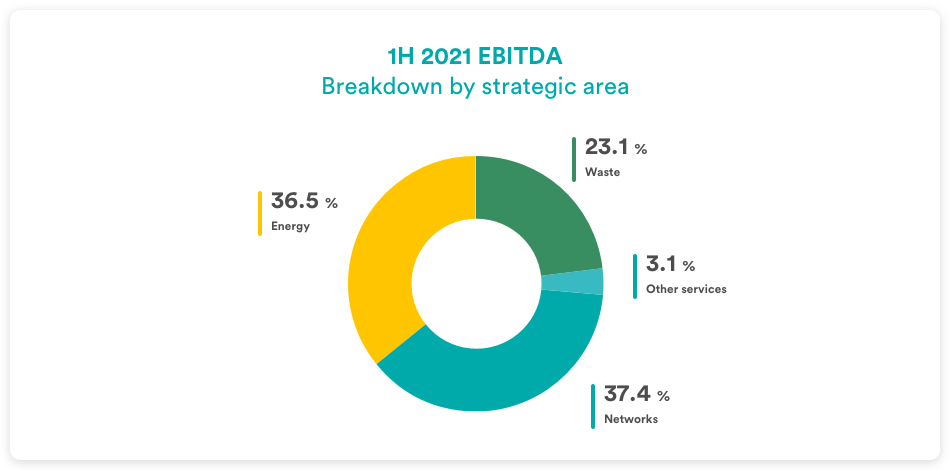

In first-half 2021, consolidated EBITDA reached 617.9 m€, posting an increase of 58.2 m€ (+10.4%) vs. the same period of 2020.

The Energy areas provided the largest contribution (+31.7 m€) to consolidated growth, achieving a 16.4% EBITDA increase. In the first half of 2020, this area resulted in being the most penalised by Covid-19.

The gas business provided a contribution that exceeded 24 m€, while recording a net increase of 16.6 thousand customers. The new lots awarded through tenders, resulting in 52,000 new clients served, offset the reduction in the number of safeguarded users. Moreover, during the first half of the year Hera won three of the nine tenders on the “maggior tutela”, ie, greatest protection segment, with 70,000 new clients served starting from 1st July 2021.

Even the segment of energy services provided a significant contribution (+15.6 m€). The “ecobonus” activities, with a tax credit of 110% – immediately bankable – on the cost of works aimed to improve the energy efficiency of buildings, have represented an area of intervention in which Hera managed to quickly become involved, through the offer of very effective solutions, while leveraging an instrument that presents certain fiscal complexities.

A significant contribution to the 20.2 m growth of consolidated EBITDA also came from the Waste area, which shows a 16.5% increase. The EBITDA of this area reflects higher revenues from power generation and higher volumes treated, in addition to the positive contribution coming from Aliplast. This subsidiary benefited from double-digit growth in volumes, combined with an improvement in plastics recovery margins due to the higher price of the original polymer. The special waste segment saw volume expansion of more than 100,000 tons, with good resilience in pricing. Lastly, the performance of the Waste area also benefits from a 3.5 m€ contribution deriving from the EBITDA of Recycla, a company acquired at the end of June 2021, but consolidated retroactively as of 1st January 2021.

In the Networks, the EBITDA progress amounted to 4.2 m€ (+1.9%). Despite the slight decrease in electricity distribution (-0.1 m€) and in the water business (-0.4 m€), mainly due to energy and sludge treatment costs, the sound results achieved in district heating (+1.6 m€) due to colder temperatures than those experienced in 2020, combined with the solid results in gas distribution (+3.3 m€) – as a result of new efficiencies and continuous investing – allowed regulated businesses to make a decent progress as a whole. In this area, Hera is waiting for the official results of the tenders for the gas distribution concession in Udine and that for the management of the water cycle in Rimini.

| EBITDA (m€) | 1H 2021 | 1H 2020 | Change |

| Waste | 142.6 | 122.4 | +16.5% |

| Networks | 231.1 | 226.9 | +1.9% |

| Energy | 225.3 | 193.6 | +16.4% |

| Other services | 18.9 | 16.9 | +11.9% |

| TOTAL | 617.9 | 559.7 | +10.4% |

Depreciation & Amortisation rose by 3.9%, mainly due to the new capex, reaching 274.3 m€. This allowed EBIT to post a 16.2% increase – hence higher than that of EBITDA – amounting to 343,6 m€.

The result of the area of financial management is 55.1 m€, a decrease of 1.1 m€ (-2.0%) compared to first-half 2020. On the one hand such performance reflects higher income both from associates and for late payment indemnities on credits in the “last resort” segment, while, on the other hand, it reflects the increase in financial expenses for the sale of tax credits related to the “ecobonus” activities. All in all, the cost of debt in first-half 2021 is 2.8%, a substantial decrease vs. 3.5% in first-half 2020

In first-half 2021 the tax rate is 26.7%, 0,3 percentage points lower compared to 27.0% in first-half 2020, mainly due to the tax relief allowed on investments in innovation.

Net Profit post minorities therefore reaches 216.1 m€, achieving a significant increase of 30.0%, also leveraging on the advantages allowed by tax benefits for approx. 24 m€.

Net Financial Debt stands at 2,956.7 m€, compared to 3,227.0 m€ as at 2020 year-end. Strong cash flow generation in first-half 2021, equal to 443 m€, on top of a 161 m€ decrease of Net Working Capital, which benefits from the decrease in the number of customers under safeguards, allowed for a full funding of capex expenditure (247 m€), use of funds of 20 m€ and disbursement for the buyback and the M&A for a cumulated amount of 67 m€, thus generating a Free Cash Flow of 270.3 m€.

As a reflection of the improvement in Net Financial Position, the Net Debt-to-EBITDA ratio as of 30 June 2021 decreases to 2.50x, compared to the 2.81x ratio at 2020 year-end.