Shared Value EBITDA: from 770 million in 2023 to over 1 billion in 2027

With a win-win approach, Hera has long chosen to strategically position increasing EBITDA shares in activities that contribute to strengthening the Group’s margins while offering tangible social and environmental benefits. Following this pioneering vision, Hera dedicated 2.5 billion investments to initiatives with higher impact and visible returns.

The significant results achieved – recognised by the ESG rating agencies as proven by its inclusion in prestigious sustainability indices – have made Hera an attractive reality in which specialised funds can invest.

Over the last seven year, the choice to invest to create Shared Value

has generated significant return for Hera

and benefits for the environment and the areas in which it operates

In 2023, Hera’s Group Shared Value EBITDA reached 700 million euro, accounting for over a half – more precisely, 53% – of consolidated EBITDA.

This result is rooted in a choice made back in 2016, when Hera, taking up the challenge launched by Harvard professors Michael Porter and Mark Kramer, began to regularly measure the extent to which the results of its business performance were heading in the direction of the UN’s 2030 Sustainable Development Goals, setting itself the goal of increasing their weight over time.

Regenerating resources, pursuing carbon neutrality, innovating and increasing the resilience of territories: these are the three main pillars that Hera identified to make the path of creating shared value a reality, with the aim of strengthening its competitiveness while improving the economic and social conditions of the communities in which it operates.

The whole process – from the structure of the assessment model to the Shared-Value performance metrics in terms of shared value – is subject to validation and certification by external auditors. This makes the management’s decisions effective and structured while guaranteeing investors on the reliability and science-based nature of the process.

Shared Value, which in 2016 amounted to 300 million euro, accounting for 33% of the Group’s total EBITDA, increased at an average annual rate of 13% over the past seven years: therefore, at a pace that is almost twice the average annual rate of 7% recorded by the cumulative EBITDA growth over the 2016-2023 period.

This higher speed proves Hera’s commitment to strategically position greater shares of EBITDA on Shared-Value activities, while at the same time improving its industrial margin, through dedicated investments that over the past seven years have cumulatively reached approximately 2.5 billion euro, out of c.4 billion of total investments.

In Hera’s Plans, such dynamic is set to continue,

with Shared-Value EBITDA expected to exceed

1 billion euro in 2027 – a year in which it is expected

to be over 60 per cent of total EBITDA.

Many of the initiatives undertaken in this direction have not only already made a significant contribution to Group margins, but have also built a solid competitive advantage, from which Hera will be able to benefit over time.

Plastics, biomethane and hydrogen:

Hera is also working on all these sides,

with high-impact results

Hera’s commitment on plastic regeneration, production of biomethane and hydrogen supply chain is an effective prove of the effort undertaken in fields which have a high impact on Shared Value, with rewards already tangible today and great development prospects for the future.

On the first front, that of plastic recycling, Hera took an important step in 2017 by acquiring the leading Italian operator in the sector, Aliplast. The aim was to strengthen circular economy services provided to industrial customers to meet the growing consumer demand for environmentally friendly products. From the time of the acquisition to date, Aliplast gave great satisfaction to Hera, having recorded significant growth, with EBITDA tripling in the first five years. Expansion opportunities do not stop there: by broadening the range of materials to be recovered, through investments in new plants for recycling rigid plastics and carbon fibre, Hera estimates that plastics recycled by Aliplast could increase by 150% overall by 2030, compared to the 2017 levels.

Also on the second front, that of biomethane production, Hera followed a pioneering approach: in 2018, it inaugurated its first plant near Bologna, which can extract the energy content from the organic fraction of waste, producing both renewable gas and quality compost. As a result of that investment, the Company not only receives incentives that ensure visible returns over the years but has also developed skills that have proved very useful in the construction of its second biomethane production plant, inaugurated in 2023 in the province of Modena. In 2030, Hera therefore expects to produce twice as much renewable gas as in 2022.

Regarding hydrogen, lastly, Hera is taking actions on several fronts. On one hand, it is currently being tested whether it is possible to transport a blend of methane and hydrogen through the gas distribution network. Based on the first experiments conducted on some sections of the infrastructure, the promising results allow such investment to be considered in line with the European taxonomy. On the other hand, given its multi-utility nature, Hera has several assets that, if properly integrated, can cover the entire hydrogen chain, from production to distribution. Thanks to an investment financed by PNRR, the Italian government’s National Recovery and Resilience Plan, Hera will be able to use renewable power, coming from WTE and photovoltaics, to produce green hydrogen within a water purification plant, reinjecting the gas produced in this way back into its own network and thus cutting carbon emissions. This innovative project, which can be replicated in all the Group’s water purification plants, can provide a long-term answer to the so-called ‘hard-to-abate’ sectors, which are struggling to contain their emissions through current electrification technologies.

The set of initiatives put in place to create Shared Value has therefore really offered significant economic returns, with a parallel improvement in environmental and social performance indicators, while helping to strengthen the Group’s reputation and profile in the market.

It is a great opportunity to be a credible company in terms of sustainability

commitment and performance, considering that in the EU

almost 60 per cent of savings invested in funds present ESG characteristics

Hera has a solid competitive advantage in its ability to attract the interest of institutional investors, since it can count on a multi-year track record and a real commitment to improve its sustainability performance, as expressed in its Business Plan to 2027.

The effects of such a profile are very positive for Hera, given the growth in assets under management experienced by funds with ESG characteristics. Since the European Union’s Sustainable Finance Disclosure Regulation (SFDR) took effect in March 2021, asset managers have been required to provide more and more information on the risks and sustainable impacts of their investment products sold in Europe. The total assets under management of Article 8 and Article 9 funds – identified as ‘Light Green Funds’ and ‘Dark Green Funds’ respectively – stood at 5.2 trillion euro at the end of 2023, representing 59% of the total investment funds sold in the European Union.

Hera’s Excellent ESG performance

is reflected in the ratings of specialised agencies

A way to get into the portfolios of these funds is to have good ratings from third parties conducting focused assessments. Leading ESG rating agencies over time have improved their assessments of Hera’s practices and performance, recognising it as one of the best internationally.

|

For the fourth consecutive year, Hera was included in the Dow Jones Sustainability Europe and World Indices, after an in-depth assessment by S&P Global, which covered the world’s largest 3,500 companies. Hera was recognised once again this year as a leader in its sector, ranking in the ‘Top 1%‘ of the companies examined, thanks to its environmental and social performance, making it a best practice against which other companies in the industry have to benchmark themselves. |

|

The ISS ESG agency is of the same opinion, as it placed Hera in the first scoring area, the one with the best results, for environmental and social dimensions. |

|

Also MSCI considers Hera outstanding in the field of carbon management, rating it 10/10, as well as in human capital development and waste management. |

|

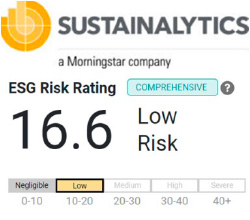

Morningstar Sustainalytics itself found value in the ESG progress achieved, which, in its view, reduces the Company’s operational risk, with the effect of improving the resilience of results and the protection of shareholders’ investment. Indeed, the rating improved to 16.6 points in the low risk class: this is the best score among multi-utilities at European level, lower only than that of fully-regulated companies. |

|

Hera was also confirmed in the FTSE for Good Index, in the Mib ESG Index of Borsa Italiana, as well as in the Bloomberg Gender & Equality Index and in the Refinitiv Diversity & Inclusion Index. In this last index, for the eighth year in a row, Hera continues to show among the Top 100 companies in the world, as the first multi-utility globally. |

|

Carbon Disclosure Project (CDP), the global non-profit environmental organisation that provides the most important platform for monitoring corporate performance in the fight against climate change, placed Hera in the Leadership Band, awarding it an overall A- rating. CDP also gave it the highest rating of A for managing risks and opportunities arising from climate change and for emissions data, including the indirect ones. This is a remarkable acknowledgement, considering that, to obtain an A rating, companies must demonstrate environmental leadership and have taken actions such as setting science-based targets, creating a climate transition plan, developing water risk assessment strategies or reporting on the impact of deforestation for all relevant operations, supply chains and raw materials. |

|

Finally, for the 15th consecutive year, Hera received the international Top Employer award for the quality of its human resources management, especially for its huge investments in welfare, training and skills development. |

|

Sustainability does not only have to do with the environment and social issues: these dimensions are supported by a Governance that guarantees the right strategic direction through accurate risk management. Therefore, it is worth mentioning that Hera has been on the podium for the last three years in the Integrated Governance Index, the ETicaNews ranking, which assesses the sustainability of the governance of the Italian listed companies, rewarding only those that demonstrate full and conscious integration of sustainability policies in their business strategies and governance structure. |

This array of ratings, awarded by the world’s leading operators,

provides an external certification of the effectiveness of the path

that Hera has undertaken some time ago and that it aims

to improve as it progresses in the creation of Shared Value

he main sustainability ratings for the year 2023 are as follows:

| Company | Rating | Notes |

| S&P Global | 82 Top 1% |

Hera achieved an overall score of 82/100, a result that places it in the top 1% globally (43/100, the industry average). Hera also achieved the best score in the environmental and social dimensions |

| Morningstar Sustainalytics | 16.6 Low Risk |

Hera obtained a score of 16.6, which places it among the companies with the lowest ESG risk (best European multi-utility). The score improved by +1.6 points compared to 2022 |

| Moody’s ESG | Advanced | Hera was ranked in the Advanced category, propaedeutic for the inclusion in the Borsa Italiana’s ‘Mib Esg’ index, which is based on evaluations conducted by Vigeo |

| MSCI | A | Hera saw its A rating confirmed by MSCI. In particular, the score shows a strong outperformance in the ‘Carbon Emissions’ category, with a score of 10/10 |

| CDP | A- | In 2023, Hera reached level A-, an improvement from the B level of 2022 |

| Integrated Governance Index | 2° position | In 2023, Hera was again on the podium for the integration of sustainability policies into business strategies |

| Diversity and Inclusion Index by Refinitiv |

Top 100 | In 2023, Hera ranked as the best multi-utility in the world in Refinitiv’s ranking on the promotion of diversity, inclusion and people development |

| Bloomberg Gender-Equality Index (GEI) | 80.1/100 | Hera obtained a score of 80.1%, in line with last year and above the average of both its sector and the Italian companies assessed |

| ISS ESG solutions | B- Prime | Hera confirmed its B- rating with Prime status, ranking among the best in the industry. In particular, it scores ‘first class’ in environmental and social aspects |

The sustainability indices in which Hera’s shares are included are the following: