With the 2023-2027 Business Plan, Hera clearly defines the path to follow over the coming years. Even in the new, challenging scenario, Hera continues to leverage on a strategy that has been proven effective over time, with well-defined priorities in terms of value creation, sustainability and resiliency.

By deploying 4.4 billion euro in investments over the five-year Plan period, Hera will concentrate its resources on ensuring visible value creation while pursuing the goals of both sustainability and resilience to negative exogenous factors.

Based on preliminary results, the year 2023, the first of the Plan, shows a sharp acceleration in the EBITDA growth rate and a significant deleveraging.

The commitment to a stronger pace of development shapes the entire Plan, which preserves a resilient profile to the negative effects of climate change and the impacts of external market crises.

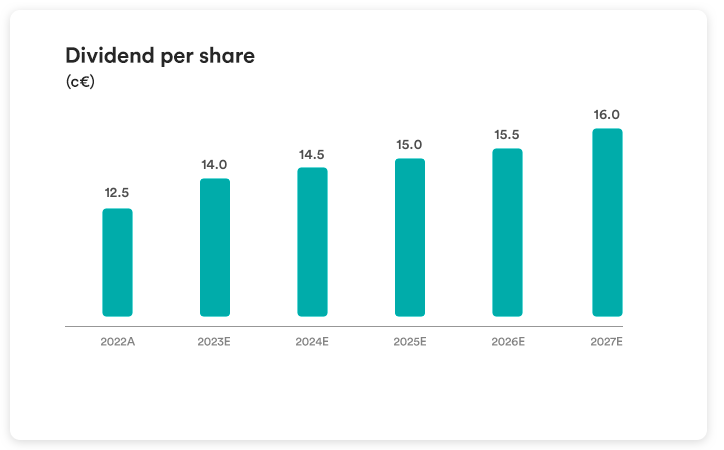

This acceleration in KPIs translates into even more attractive prospects for shareholders, who can expect an annual Total Shareholder Return of 12% over the period, with a 2023 Dividend per Share proposed at 14 eurocents, up from both the last dividend paid and the previous commitments made for the 2023 dividend.

Dear Shareholders,

the Plan that will guide our steps towards 2027 begins with a first financial year, 2023, which, according to preliminary data, shows the most significant annual growth in Hera’s history, at a rate of more than 14%.

2023 EBITDA above expectations

With a projected 2023 EBITDA of more than 1,480 million euro, Hera is actually posting the largest year-on-year increase ever, for an amount exceeding 185 million.

With a linear progress in EBITDA achieved from quarter to quarter, the year 2023 confirms the Group’s effectiveness in the development of both the Energy and the Waste market, in the execution of its investment plan, in a successful search for efficiencies to offset rising inflationary costs and, finally, in closing M&A deals that support core-business growth.

In addition, that significant growth highlights our focus on seizing growth opportunities emerging from the markets – for example, the support in promoting energy efficiency services provided by the super eco-bonuses and the tenders in the last resort markets, which have favoured a consolidation of those businesses for both the current year and 2025.

Virtuous deleveraging achieved, as Debt-to-EBITDA ratio drops below pre-crisis levels

The combination of a sharply rising EBITDA and a solid financial profile – thanks to the decrease of working capital due to the foreseen reduction in gas reserves and lower receivables in a context of commodity disinflation – brought the Debt-to-EBITDA ratio back below 2.6x, i.e., way below the level of 3.3x of the end of 2022, when gas withdrawals from storages were just beginning, but also below the 2.7x level of late 2021: therefore, at an earlier time than the onset of the energy crisis.

“Intense engagement in a

challenging two-year period led to a

faster achievement of the EBITDA

target, while investments remained

in line with the Plan”.

With an EBITDA growth above 250 million euro, Hera met the targets of the previous 2022-2026 Plan three years ahead of schedule. The investments of more than 1.8 billion euro made in the two-year period, in line with the amount that was planned for the first two years, provided an essential contribution to this dynamic.

The new Plan integrates the changing scenario, while keeping strong strategic consistency

Encouraged by the significant progress made in a critical energy scenario, we wished to design the 2023-2027 Plan according to a logic of continuity with the winning strategy of the past, while considering the needed updates for the different operational and financial scenario that we are facing.

Our purpose is very clear: we want to promote growth with the goal of creating value, also in terms of Creating Shared Value (or CSV), while keeping a resilient business profile in the face of external negative factors. This has led us to structure the actions of the Plan according to three precise strategic priorities.

“We aim to create a sustainable and

resilient value”.

The Plan to 2027 aims to offer an even higher annual return to shareholders, of approximately 12%

To create value for us, at Hera, means to maximise the gap between ROI and WACC.

Through strict capital allocation discipline, riding on the development of the market and gaining new efficiencies, we expect the spread between ROI and WACC to widen, with a targeted ROI increasing from 7.9% in 2022 to 9.5% in 2027, while WACC would move only marginally over the five-year period, from 5.7% to 5.8%. With such dynamics, we could achieve an overall improvement of more than 150 basis points over the period covered by the Plan.

This effort to maximise value creation translates, from the perspective of annual shareholder return over the 2023-2027 period, into a dividend yield of around 5% and growth in Earnings per Share of more than 7%, for a total return of more than 12%.

A targeted investment plan will enable us to be increasingly sustainable, while reaching a CSV weight of 70% in 2030

The second priority of our strategy sees us committed to being a genuinely sustainable company that shares the value created over time with stakeholders.

This translates, in terms of the Plan, into focusing on operational investments, in a well-calibrated manner, on three precise fronts. In the 2023-2027 five-year period, 31% of capex will be dedicated to projects that, according to SBTi’s validation, will enable us to reduce CO2 emissions by 29% in 2027 compared to 2019. A further 39% of the total capex will then be allocated to projects to improve circularity, e.g., increasing Aliplast’s recycled plastic volumes by 122%. Finally, 40% of the investment plan will be aimed at Resilience of our assets and Innovation, with significant benefits expected especially in the reduction of water network losses and the continued strengthening of our assets so that they can respond adequately to the threats posed by events, even those extreme, due to climate change.

Considering the planned investments, we expect that the CSV EBITDA will rise by 379 million euro over the Plan’s five years, reaching 1,049 million euro in 2027. At the same time, its weight on the total EBITDA is expected to grow significantly, from 52% in 2022 to 64% in 2027: a target which makes it legitimate to project the ratio to 70% in 2030.

The resilience of our business model and portfolio underpins uninterrupted structural growth over time

Our third strategic priority focuses on developing businesses in a way that minimises the negative impacts of external turbulence: this objective inspires our well-diversified multi-utility business model, our policies to mitigate potential threats that may arise from the macroeconomic scenario, and, last but not least, our desire to prudently keep the leverage below the 3x threshold.

Given this rigorous risk management approach, Hera has demonstrated over the years its ability to navigate through very challenging operating environments while continuing to achieve profitable growth.

The EBITDA growth of 375 million euro is highly visible and has a strong “structural” component

Together, these projects lead us to forecast an EBITDA growing from 1,295 million euro in 2022 to 1,650 million euro in 2027, with an overall change of 355 million euro.

That increase reflects a “structural” component, consisting of 375 million euro of organic growth and 100 million euro of growth from M&A deals, net of approximately 120 million euro of EBITDA achieved in 2022 as a contribution from “non-structural” opportunities – the latter deriving, for approximately 70 million, from the 110% Ecobonus that ended in 2023 and, for approximately 50 million, to the last resort markets , which we conservatively estimate may bring lower contributions in 2027.

Moreover, we expect all businesses in the portfolio to contribute almost equally to the growth of the Group result, reflecting the benefits of a 4.4 billion investment plan, of which 2.1 billion in development projects.

While in the liberalised activities we expect a strengthening of Hera’s market shares, in the Networks business we will increase the managed RAB also considering the new regulatory framework, which increases the allowed return by additional 100 basis points.

Hera maintains a distinct cash generator profile, which creates room for investment opportunities beyond those planned

The strong cash generation, with around 5.2 billion euro of cumulated Operating Cash Flow in the five years of the Plan, will allow Hera to fund all investments in capex, dividend distribution and almost all M&A payouts, with the result of a very small increase in debt, amounting to approximately 300 million of euro, over the period of the Plan.

Therefore, with a targeted leverage of less than 2.7 times in 2027, Hera will have the financial flexibility to take advantage of further investment opportunities that may arise over time, in addition to those already included in the Plan.

“Because we monitor risks very

carefully, we also know how to

make a correct assessment of the

opportunities to be seized”.

Shareholders will benefit from positive operating performance through a more dynamic earnings growth and an even more attractive dividend distribution profile than in the past

With a targeted EBIT of 855 million euro in 2027, and counting on the contribution of a careful financial and fiscal management, we aim at achieving an EpS of 31 eurocents in 2027, with a CAGR exceeding 7% over the Plan period.

“The expected development of

earnings allows us to strengthen the

shareholder remuneration profile

through the dividend”.

For 2023 we will propose the distribution of a dividend of 14 eurocents per share, compared to the 13 eurocents of the previous Plan.

With 16 eurocents of DpS floor in 2027, we therefore expect a 5-year CAGR of 5.1%.

Through the features indicated, this Plan confirms that, while maintaining the conservative attitude typical of Hera’s risk aversion, we have ‘raised the bar’, setting more ambitious growth targets than in the past.

This will require an unsaved commitment from all Hera’s people, starting with the management team. Anyhow, we are convinced that this will also lead to the creation of more value to share with stakeholders and to greater satisfaction in terms of returns for our shareholders.