In first-quarter 2021, Energy areas drove the EBITDA of Hera Group. Overall, EBITDA grew by 3.7%, against a scenario that proved to be less penalizing than that of the same period of 2020, in terms of both weather conditions and severity of anti-Covid restrictions.

Quarterly results provide a clear picture. On the one hand, Hera is constantly looking for new efficiencies, especially through innovation; on the other hand, it continues to expand its customer base in a selective way, by leveraging also on value-added services and high-impact activities for the implementation of circular economy. With such a model, Hera achieves healthy returns.

In these early months of 2021, Hera’s share price has gained strength. And not only in absolute terms, with a rise of over 10%, but also because it has outperformed the index of the utility sector. In the last few trading sessions, the stock has even outperformed the FTSE MIB, which is heavily weighted towards stocks that allow the theme of future recovery to play out in a catch-up trade.

One of the typical features of companies that are leaders in their industry is the ability to consolidate their leadership over time through innovation.

Hera nurtures that intangible asset, the innovation, through continuous investment, by leveraging some specific strengths.

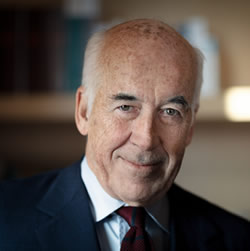

While we take a closer look at some of the new projects Hera is working on, we try to understand what are the specific factors that drive the Group’ s success in innovation, through some questions that we put to Mr. Salvatore Molè, Central Innovation Director of Hera Group.