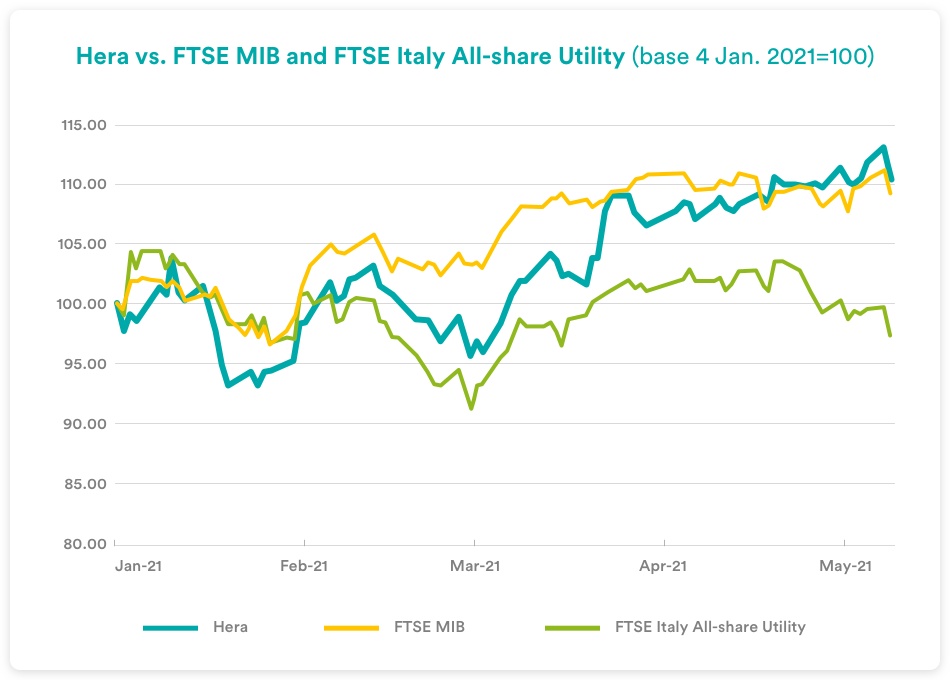

In these early months of 2021, Hera’s share price has gained strength. And not only in absolute terms, with a rise of over 10%, but also because it has outperformed the index of the utility sector. In the last few trading sessions, the stock has even outperformed the FTSE MIB, which is heavily weighted towards stocks that allow the theme of future recovery to play out in a catch-up trade.

Equity markets remain well set. EpS estimates continue to improve, while investors are ready to incorporate into stock prices the perspective of a recovery that is expected to be increasingly visible in the second half of the year, as vaccination campaigns progress and restrictions aimed at fighting the pandemic are lifted.

Hera can also count on the contribution of some Company-specific factors, linked to its healthy fundamentals, as proven by the annual results and the quarterly report released today. The increase of 0.5 cents in the dividend, compared to what was indicated in January 2021 when the Business Plan was presented, has added further appeal to the stock.

We explore these issues, which favour a better understanding of Hera shares’ potential, with Jens Hansen, who is the Head of the Group Investor Relations.

How can we read the performance of Hera’s shares since the beginning of the year?

Undeniably, during the first part of the year Hera’s share price has risen by more than 10% in absolute terms, while gaining strength against benchmark indices. Hera significantly outperformed its industry index, the FTSE Italy All-share Utility, which remained substantially at the levels of the beginning of the year. Since the last few sessions in April, the stock has also outperformed the FTSE MIB, the blue chips index of the Italian market, of which Hera itself is a component. This is a noteworthy achievement, as the FTSE MIB’s performance could benefit from the rally of financials, which have considerable weight in the Italian market, and from that of stocks whose sectors are highly exposed to the future recovery of the economic cycle.

In general, what has driven the markets upwards in this first part of 2021?

On the one hand, analysts have been gradually improving their EpS estimates for listed companies. Factset, for example, indicates that the upward revisions experienced in early 2021 are the largest in 10 years. Investors, on the other hand, have shown confidence in the opportunities for the economy to enter a robust recovery phase starting from the second half of 2021, as progress in vaccination campaigns allows for the removal of restrictions aimed at limiting infections. The focus on vaccination success is understandable, as robust fiscal policy programmes need a return to unrestricted mobility and social conditions if they want to take full effect. In the meantime, Central Banks have also repeatedly given indications that they intend to maintain accommodative monetary policies for a long time to support the recovery. The overall picture is more than favourable for equity markets…

What happened in February that penalised so much the utilities performance?

In early February, we saw a sudden rise in bond yields in response to fears of an overheating economy. Financial markets feared that rising commodity prices could lead to a highly inflationary scenario. The Fed’s has then ruled out any intention of raising interest rates or initiating ‘tapering’ policies until it has had evidence that growth is firmly on track and the labour market had returned to full-employment levels; these statements brought rates back to the levels of early February, even in the Eurozone. Utilities, which had reacted negatively to fears of higher interest rates, were able to recover their early-February levels following a looser monetary policy attitude. However, from March onwards, the market was more selective, even in the utilities sector, while favouring stocks with lower multiples and able to show good resilience in terms of margins even in a context of higher inflation.

And what about Hera-specific factors?

At Company-specific level, in the last few months Hera could count on the support offered by the Business Plan, presented on 13 January, and the 2020 annual results, released on the last 24 March. The solid performance of the fundamentals gave visibility to perspective growth. Investors also appreciated the decision of Hera’s BoD to raise the dividend of 0.5 euro cents, compared to what announced at the Plan’s presentation, with effects that are not limited to the 2021 financial year, but which are carried consistently forward into the following years covered by the Plan.

Therefore, is the dividend yield confirmed as a component of shareholder return?

For sure, given the shareholders’ approval at the Annual General Meeting held on 28 April 2021. The ex-dividend date is scheduled for 5 July 2021, with payment on 7 July. If we take into account the 2020 closing price, the dividend per share of 11 cents translates into a yield of 3.7%. Given the increase in the share price since the beginning of the year, Hera shareholders are gaining an attractive total return…

What is the consensus target price at this time?

The consensus target price of the seven analysts covering Hera’s stock is close to 4 euro: 3.96 euro to be precise. It is worth considering that target prices range between a minimum of 3.50 euro and a maximum of 4.70. Even the evaluation of the most cautious broker is then above recent price levels. The majority of analysts – four out of seven – has a target ranging from 4.00 and 4.7 euro. Considering the wide room for potential appreciation, six out of seven analysts present a positive recommendation, as they expect the share to outperform the index or they suggest buying it.

| Broker | Rating | Target price (€) |

| Banca Akros | Buy | 4.00 |

| Banca IMI | Buy | 4.70 |

| Equita Sim | Hold | 3.50 |

| Intermonte | Outperform | 4.20 |

| Kepler Cheuvreux | Buy | 3.60 |

| Mediobanca | Outperform | 4.00 |

| Stifel | Buy | 3.70 |

| Average | 3.96 |