Today Hera stock trades at multiples way lower than the past. On the other hand, consensus target price is still close to 4 euro.

In light of results that confirm how the Company continues to deliver the profitable growth indicated in the Business Plan despite the risks posed by Covid-19, we are trying to understand the reasons behind market’s behaviour, which at the moment seems to remain indifferent to the huge undervaluation experienced by the share price.

We talk about such issues with Jens Hansen, Hera’s Head of Investor Relations.

At current prices, Hera’s share shows a crystal-clear undervaluation. What impact do you expect from third-quarter results released today?

Results show that Hera’s EBITDA grows as usual and in line with rate indicated in the Business Plan, despite the difficulties of the Covid-19 scenario. We are also facing a fourth quarter that has an important weight in determining full-year results, given the seasonality in certain areas of consumption, such as gas. We should also bear in mind that 80% of the customers of Est Energy are specifically in the gas area; therefore, since the Company entered Hera’s consolidation scope at the beginning of the year, it will provide an incremental contribution also in the fourth quarter. Last consideration: in the first nine months of 2020, we have also started to extract significant synergies from the deal with Ascopiave. Considering this set of perspective factors as well as the nine-month EBITDA, which amounts to €806.2 million, now the market has high visibility that solid growth is achievable in full-year 2020. Since our full-year results are visible – only the fourth and last quarter of the year being left – I would not be surprised if Hera’s solid fundamentals were increasingly discounted in the stock price.

In those months, with a Covid-dominated scenario, has the analyst coverage somehow changed its view on the stock?

At the moment, i.e. before the release of nine-month 2020 results, consensus EBITDA continues to be 1,125 million euro. Analysts have confirmed that they see in Hera’s business model characteristics of resilience and unchanged solidity. Since the beginning of the pandemic emergency in March, Hera’s target price has always remained in a range between 3.9 and 4 euro. Currently, to be precise, on average the target price is 3.91 euro.

| Broker | Rating | Target price (€) |

| Banca Akros | Buy | 3.90 |

| Banca IMI | Buy | 4.70 |

| Equita Sim | Hold | 3.50 |

| Intermonte | Outperform | 4.20 |

| Kepler Cheuvreux | Hold | 3.50 |

| Mediobanca | Outperform | 4.00 |

| Stifel | Neutral | 3.60 |

| Average | 3.91 |

Sell-side evaluations stay close to 4 euro. How do you explain that the market today is trading the stock at such a huge upside potential compared to the brokers’ average target price? What are the perceptions emerged from the most recent meetings with investors?

It must be said that some investors see uncertainty in the evolution of the regulatory framework – which anyway can only influence 50% of Hera’s EBITDA, since more than half portfolio falls under non-regulated businesses. For sure, weak first-half performances delivered by the leading players in environmental services, such as Veolia Environnement or Suez, have also contributed to worsen the market view on our Waste business, which actually proved to remain healthy in first-half results.

Noteworthy, the risk appetite that investors have showed lately reduced the attractiveness of shares that trade at compressed multiples, even when they boast an undisputed quality of profits.

Were utilities once again a safe harbour in which investors wished to secure liquidity in view of the high volatility that the US presidential elections would have brought?

This for sure. However, uncertainty has increased demand for those stocks that provide high investment marketability, due to high free-float capitalisation. In the utilities landscape, liquidity has therefore been parked on the names with the highest trading volumes, neglecting companies with smaller capitalisations in the industry.

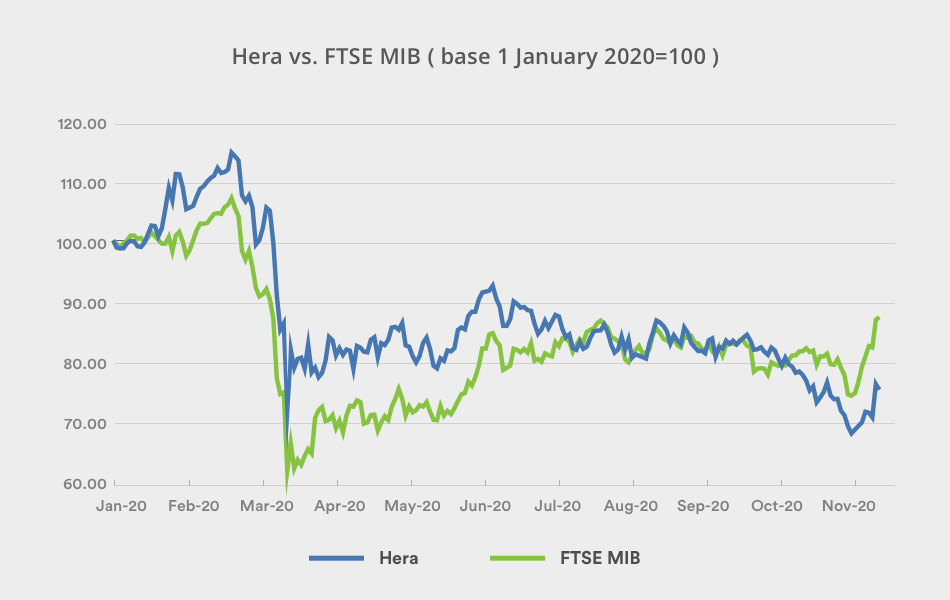

At the beginning of the year, the utilities sector had reached multiples that represented historical highs – a phenomenon from which Hera also benefited. What changed during 2020?

Certainly, in January 2020 even the Hera stock had participated in an upward rerating that brought the price up to 4.5 euro. However, during the year, increasing inflows of money were headed to “thematic” ETFs and funds, which invest in companies committed to achieving the energy transition in Europe. What makes these players particularly attractive is the fact that they will greatly benefit from the Green Deal – in fact the largest green investment stimulus program ever launched. This has resulted in a clear differentiation across the multiples at which the various segments of the utility sector are traded: the highest 2021 price earnings levels, even higher than 35x, are those of companies in the renewable energy business, while regulated companies and companies selling commodities trade at a P/E ratio below 20x. Semi-regulated plays, such as Hera, today trade at prices lower than 15 times forward earnings.

So, in this moment there is little attention on individual stories that can represent quality investments…

Our equity story has always been based on an attractive growth profile and therefore on a dividend yield that is highly visible, attractive, even though not exceeding the industry average. The track record built by achieving organic growth and M&A for 17 consecutive years has historically allowed Hera to trade at a premium. Today, we acknowledge that this premium has temporarily vanished.

However, since nothing has changed – neither the fundamentals we release, nor the future strategy – in terms of growth profile and profitability, I believe that in the medium term Hera will regain the premium multiples at which it traded in the past. This has always been the case: over time, fundamentals have always prevailed over short-term trends.