In early 2022, the stock market’s performance has been heavily affected by a combination of negative factors, whose future evolution is difficult to predict.

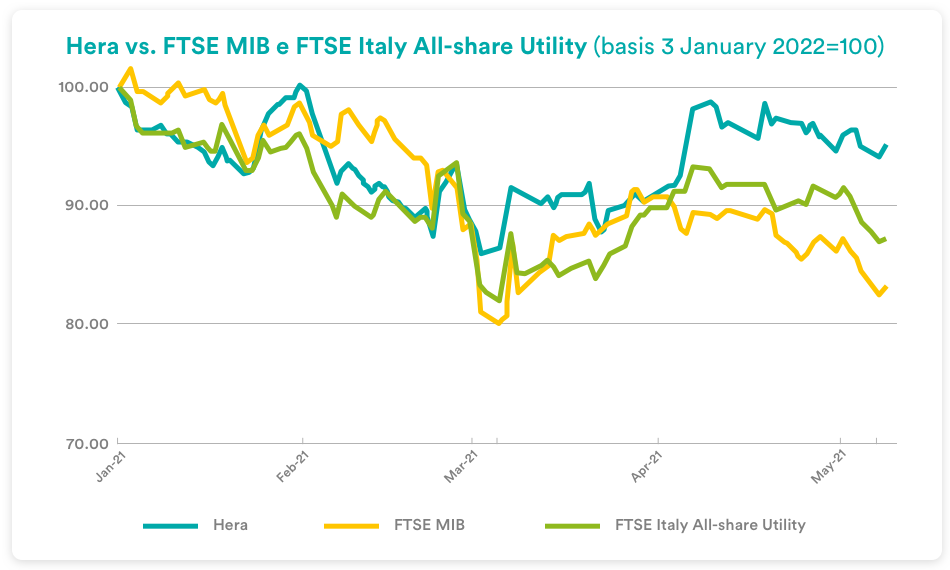

Geopolitical tensions, inflation, and rising interest rates, all weigh on the economic growth outlook. In this context, Hera stock outperformed both the FTSE MIB and the Italian utilities index. The market has recognised that the Company has a business model able to counteract the external negatives, through prudent policies and a business portfolio that is well-diversified and resilient.

Despite the recent outperformance, Hera’s share price is still far from the current average target price of 4.3 euro set by the analyst coverage.

We explore those issues through some questions we ask to Jens Klint Hansen, Head of Investor Relations at Hera Group.

What issues influenced the stock markets most in these early months of 2022?

The recent period was characterised by the serious geopolitical crisis caused by the Russian-Ukrainian conflict, which led to a further reduction in the availability of gas in Europe, as well as the difficulty in procuring certain raw materials, with unavoidable price increases. In addition to the ongoing war, the costs and continuity of supplies were also affected by the pandemic emergency, with several Asian countries back in lockdown. The impact of these events was reflected in a sharp rise in inflation, which in the Eurozone is significantly fuelled by higher energy prices. This combination of factors – prompting fears of a severe slowdown in economic growth – came at a time when central banks are reducing the pace of asset purchase, and, in the case of the Fed, when beginning a process of subsequent interest rate increases to keep inflation in check, with the first 0.5% hike announced as early as last week. In the Eurozone, inflation topped 7.5% in April, almost four times the ECB’s target. Anyhow, the European monetary authority is not generally expected to raise rates until late 2022, to avoid further weakening of the EU economies, as they have only just begun to emerge from the pandemic-induced recession.

How did investors behave at this stage?

Faced with an uncertain outlook, with some forecasts pointing to a risk of a severe recession, many asset owners opted for more liquidity, thus moving significant volumes out of open-ended investment funds and conveying them into less volatile instruments, such as private equity funds. This led to a new correction in April and then in early May, after the recovery from the 2022 lows seen in March. In addition to high volatility – including intraday volatility due to increased uncertainty about the future – recent investor behaviour has been characterised by a preference for “value” stocks, which have corrected less than “growth” stocks.

How is Hera’s share performing in this sensitive context?

Hera’s share prices continued to outperform the Italian utility index and, even more strongly, the FTSE MIB. In general, the lower fall of the FTSE Italy All-Share Utility index compared to the performance of the Italian blue chips index is due to the defensive nature generally acknowledged to our industry, although the presence of some integrated operators negatively affected the sector’s index performance. On the other hand, in absolute terms, Hera proved to have certain competitive advantages, linked to its ability to continue to increase its EBITDA even under unfavourable circumstances – a fact that the market recognised and rewarded, allowing for a lower penalisation of the share price also compared to the sector index. Moreover, the recent presentation of the new Business Plan and the release of 2021 annual results prove the Group’s good health and allow for the distribution of a 12 euro cents dividend, up 9%, which will be paid on the next 22 June.

How can Hera achieve growth even in such a difficult scenario?

Compared to other utilities, our mix of activities offers the opportunity to counteract the effects of the rising prices in energy commodities. In addition to the cautious policies that we have applied to hedge the risk of potential price changes in purchases, we can also count on the presence, in our business mix, of activities that allow us to get through this difficult scenario while still achieving growth – I mean the activities related to energy efficiency and value-added services, as well as the involvement in businesses that even benefit from higher commodity prices, such as plastic recycling. First-quarter 2022 results published today provide further evidence for this, considering that EBITDA recorded a 3.3% growth compared to first-quarter 2021. Moreover, from 1 January 2022 in our sector we have to deal with a new penalising regulatory framework, following the WACC cut set by ARERA. The fact that we have increased our EBITDA against all these unfavourable elements – almost like a “perfect storm” – is an important test, which also makes our future targets more visible.

Have you experienced any changes in the average target price of your analyst coverage in recent weeks?

Target prices remained broadly unchanged. Currently the average is 4.33 euro. Therefore, we continue to have a good 20% potential room for appreciation compared with the prices in the last few trading days. Given the size of that upside potential, five out of six analysts are maintaining a Buy/Outperform recommendation on the stock. The only broker with a Hold recommendation, however, has a target price that is more than 10% above recent price levels.

| Broker | Rating | Target Price (€) |

| Banca IMI | Buy | 4.80 |

| Equita Sim | Hold | 3.90 |

| Exane Bnp Paribas | Buy | 4.85 |

| Intermonte | Outperform | 4.00 |

| Kepler Cheuvreux | Buy | 4.10 |

| Mediobanca | Outperform | 4.30 |

| Average | 4.33 |