The new Plan to 2024 clearly indicates both the extent and quality of the value that Hera Group can create.

- the targets set in the past, exceeded for the fifth time in a row

- the new objectives to 2024 and 2030, more ambitious than the previous ones and even more closely linked to the new priorities of a Europe that is moving towards “zero emissions” and wants to make the economy even more circular

- the prospect of steady growth in dividend per share

are all elements that will help enhance investors’ perceptions of Hera’s strengths and prospects.

We talk about this with Jens Hansen, who is Head of Investor Relations at Hera.

How do you expect investors are going to take the presentation of the new Plan to 2024?

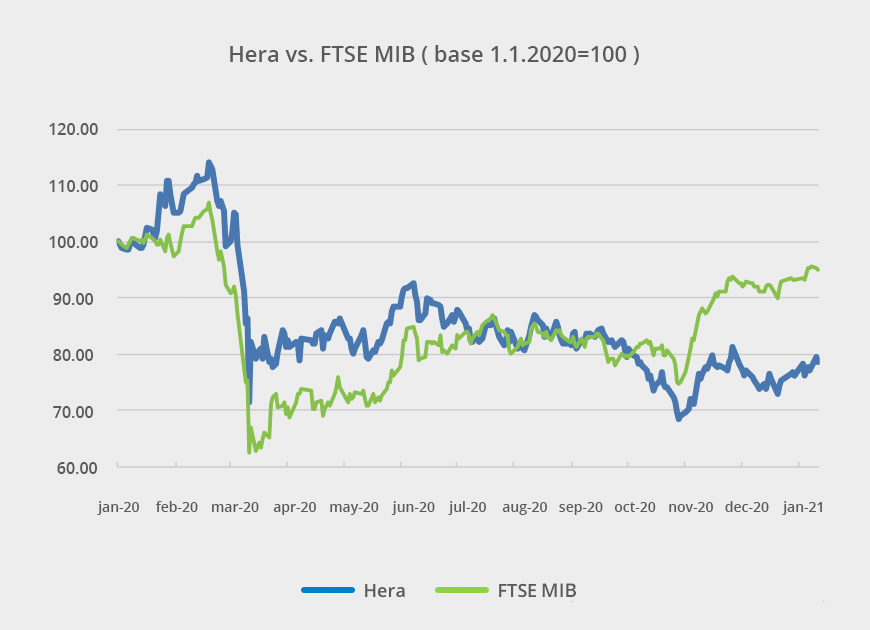

Considering the current levels of Hera’s share price, I believe that the release of the new Plan to 2024, which also includes some preliminary results for the year 2020, can shed light on the real value of our Group.

For the fifth consecutive time, we are presenting results that exceed the objectives of the Plan for both EBITDA and financial leverage. By leveraging the investment opportunities, we have been able to seize – which led to attractive returns on invested capital – we could offset the challenges of the outside environment, including those coming from the regulatory review that has reduced the WACC of distribution and metering activities starting from 2020.

The long-term strategic profile is also very clear: on one hand, it is consistent with the sustainable development approach that we have embraced already 18 years ago, when Hera was established; on the other hand, it is perfectly fitting with the new objectives that we are called to achieve as a multi-utility, in the framework of the policies of the Next Generation EU program.

And from a shorter-term perspective, what does Hera offer to investors?

The Plan, for the way it has been designed and specifically for the investments that have been selected, envisages a strong cash flow generation, which underpins the earnings distribution policy. Hera is committed to paying its shareholders a dividend per share that increases by 0.5 euro cents every year of the Plan’s period, thus moving up to 12.5 cents in 2024.

The brilliant performance expected in terms of economic-financial results will therefore translate into a steady growth of shareholders’ remuneration through dividends.

Hera can boast several external acknowledgments for its commitment to sustainability issues. Which aspects of this plan could change or strengthen the perceptions of investors who embrace ESG criteria?

Hera can leverage the recent inclusion in the Dow Jones Sustainability indices, the A- rating from the CDP, the Carbon Disclosure Project, in addition to a position of excellence in terms of circularity awarded by the Ellen MacArthur Foundation. These recognitions are a starting point, however, not an arrival point. The Plan to 2024, as well as the sustainability targets that we have presented to 2030, add a lot of value from an investor’s point of view, because they provide a concrete idea of the impacts that an ESG champion like Hera can have in terms of carbon neutrality or circularity, while pursuing ambitious economic and financial objectives.

Therefore, through the details of this Plan, investors will see the potential of the virtuous ESG profile of the Company translated into practice.

What additional changes do you expect in investor perceptions?

I also expect investors to appreciate our commitment to maximum transparency. We have decided to promptly apply the new sustainability measurement and disclosure standards in our reporting. Our Financial Statements, both the Financial and the Non-Financial Reports, have long been prepared in accordance with GRI criteria; starting this year, they will be drafted in line with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). Through the rigorous adoption of these new standards, we want to enable financial market operators to compare our performance with that of our peers, while maintaining consistency with the historical series of Hera’s results.

And what about long term objectives?

Here again, we aimed to be as transparent and intelligible as possible. The proposed key in terms of Creation of Shared Value, which we have embraced since 2016, is very concrete. When defining sustainability targets to 2030 this year, we also began to adopt the rigorous standards set out in the methodology of the “Science Based Target initiative”.

How is the analyst consensus on Hera stock currently structured?

Analysts that cover the stock are largely issuing Buying recommendations, after the recent upgrades by Kepler Cheuvreux and Stifel (formerly MainFirst). Their target prices are included in a range that goes from a low of 3.50 euro to a high of 4.70 euro, with an average of 4 euro. Therefore, even at the lows, target prices identified by brokers indicate significant potential headroom for share price increase compared to recent levels.

| Broker | Rating | Target price (€) |

| Banca Akros | Buy | 3.90 |

| Banca IMI | Buy | 4.70 |

| Equita Sim | Hold | 3.50 |

| Intermonte | Outperform | 4.20 |

| Kepler Cheuvreux | Buy | 3.60 |

| Mediobanca | Outperform | 4.00 |

| Stifel | Buy | 3.60 |

| Average | 3.93 |

The publication of the preliminary results for 2020 and the clear and visible

growth path indicated in the new Plan to 2024 can only increase market confidence in Hera, creating the conditions to reconsider the investment opportunity that the stock offers.