Despite the recovery from last October’s lows, the price level at which the Hera stock is trading indicates that there is still a considerable gap to fill compared to the FTSE MIB performance and the average share target price of the analyst coverage, today at 3.6 euro.

The release of the preliminary 2022 results will provide evidence on the profitability recovery in the Energy area in Q4, together with a declining leverage. Thus, the market will have new elements to update the valuation of Hera stock. Investors will also be able to draw reassuring elements on the solid profile of the future growth from the targets of the new Plan to 2026, set in continuity with past strategy.

Therefore, shareholders see the Hera’s consistent commitment to foster the energy transition and circularity through its operations and can count on an investment plan that involves highly visible cash generation and a controlled degree of risk. The confirmation of a dividend policy that will lead the dividend per share to reach 15 cents in 2026 reinforces the aspects for which an investment in the stock offers attractive returns.

These are the considerations that emerge through some questions asked to Jens Klint Hansen, Head of Investor Relations at Hera.

How can we read Hera share price trend over the last period?

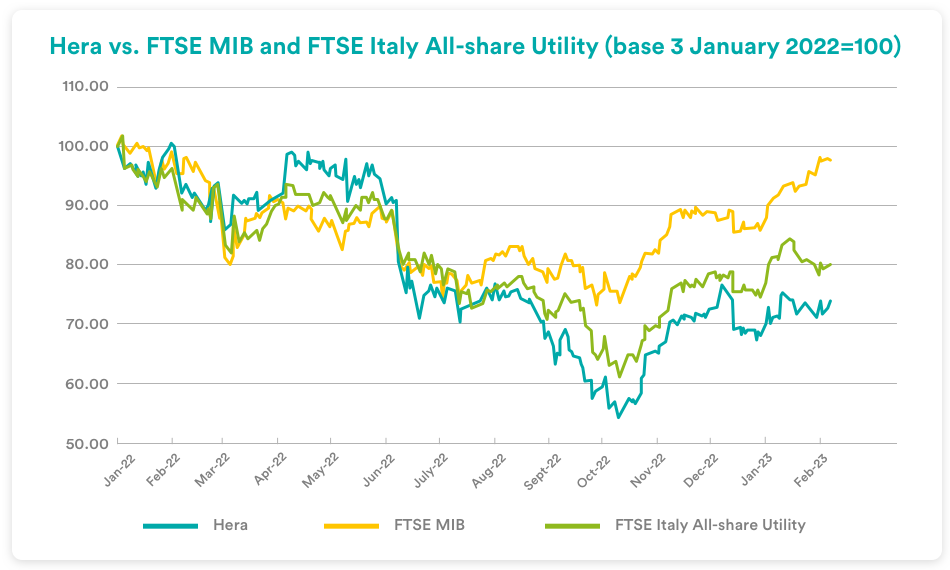

In 2022, the share price was heavily penalised, particularly in the second half of the year. The negative stock market performance coincided with the most acute phase of fluctuations in energy commodity prices, which caused great concern among some investors. After hitting the year’s low in October, Hera stock started a recovery movement, which, however, did not allow it to close the gap with the Italian blue-chip index so far.

What is the reason for Hera’s weaker performance compared to the FTSE MIB since the second half of last year?

On one hand, it should be considered that the significant rebound of the FTSE MIB index was driven by the high weight per capitalisation that some energy and banking stocks have within it: these are in fact typical beneficiaries of higher energy commodity prices and rising interest rates, respectively. On the other hand, on the lesser strength of our stock’s recovery, it should be considered that the market will be able to verify only now, with the preliminary results we are publishing for 2022, how the Energy area returned to positive results in the fourth quarter. At the beginning of winter, in fact, we began to use the huge amount of gas that we purchased and placed in storage fields to ensure the continuity of supplies to customers; this also allowed the leverage to gradually decrease. Moreover, the macroeconomic outlook appears less negative every day, with several institutes and brokers expecting that Europe may avoid recession despite the restrictive monetary policy that the ECB has decided to implement to fight inflation. On top of these general expectations, which seem to be evolving in a positive direction, is the update of Hera Business Plan to 2026.

What impact are you expecting from the presentation of this new Plan?

I believe that, together with the preliminary 2022 results, it will offer new elements for analysts and investors to update the stock’s valuations. On the other hand, the new Plan is also an important confirmation for the large asset managers who are our shareholders. In our capital there are mainly funds and ETFs that focus their investments on infrastructure players, as Hera once again proves its intention to be. The Plan indicates precisely that we will aim to play a central role in the material realisation of a circular economy, and that we will continue to evolve assets to facilitate the energy transition, as well as provide concrete answers to the major issues opened up by Climate Change, such as water scarcity. The commitments we have made by investing 4.1 billion over the five years of the Plan prove that Hera is an operator determined to put its tangible and intangible assets at the service of decarbonisation and a more sustainable use of resources.

Are there any discontinuities from the Plan presented a year ago, considering for example the higher cost of money today?

This is a Plan in complete continuity with the previous one, not only in terms of strategic approach but also in terms of the targets that the management believes that are achievable. Given the expected returns from the activities in which we are going to allocate capital, by 2026 we will have a very well-balanced presence in different business areas, which will generate a very visible operating cash flow. This will mean being able to finance investments while maintaining a solid financial profile.

What returns can shareholders expect?

The Total Shareholder Return component linked to the dividend is very attractive in terms of yield, particularly at these share prices. The shareholder remuneration policy envisages a steady growth of the dividend per share over time, up to 15 cents in 2026. The potential capital gain component also looks attractive, if we compare current prices to the average target price of the brokers that cover the stock.

At what level is the consensus target price on Hera’s stock today?

Today it stands at €3.60. We therefore continue to have about 35% potential room for appreciation compared to the price in recent trading sessions. Given this ample room, all the analysts that cover Hera suggest either buying the stock or holding it in the portfolio. Noteworthy, three out of six analysts have a target price above 4.00 euro per share.

| Broker | Rating | Target Price (€) |

| Banca IMI | Buy | 4.10 |

| Equita Sim | Hold | 3.40 |

| Exane Bnp Paribas | Buy | 4.35 |

| Intermonte | Neutral | 2.85 |

| Kepler Cheuvreux | Neutral | 2.90 |

| Mediobanca | Outperform | 4.00 |

| Average | 3.60 |