Dear Shareholders,

the 2017-2021 Business Plan presents the ambitious goals the we target and the criteria to which we will stick in executing the strategy.

The Plan starts from a great 2017

The forecasts for 2017 – the first year in the new Plan – indicate that Hera starts from a virtuous position. An EBITDA estimate around 980 million euro, 63 million higher than the 2016 figure, confirms that in the last two fiscal years we have achieved a performance that was 18 million euro above the average annual growth planned, mostly leveraging on the organic component.

Plans for the future are based on a solid platform that we have built over time

In its 15-year history, Hera has demonstrated transparency in objectives, reliability in earnings estimates and consistency in strategic direction, with a significant capacity to adapt to new challenges posed by the external environment. Moreover, the Company has long invested in highly innovating projects; it also manages different business activities continuously striving for excellence. Another positive premise: the relevant deleveraging achieved over the years provides precious financial flexibility; this will help us in sizing the growth opportunities of a sector that will experience substantial discontinuity over the coming five years. Just to mention the most important issues, regulated businesses will face a tender process that will change the present structure both in gas distribution and in waste collection, while in Italy regulatory powers for electricity, gas, water and waste will be concentrated under one authority, ARERA, destined to replace the current AEEGSI. We expect a complete deregulation in some segments of the Energy services. In general, the challenge to seize the largest benefits from liberalised activities will be even more attractive, given the recovery expected in the economy outlook.

Hera puts into play 2.9 billion euro investments

How are we preparing to exploit those opportunities over the next five years? We mainly count on allocating available capital as efficiently as possible. We plan to invest 2.9 billion euro, of which 1.6 billion for maintenance and 1.2 billion for development. The whole amount exceeds by 62% the capex of the last five years. Those investments will allow a growth of 218 million euro at EBITDA level, bringing the CAGR above that of the 2016-2020 Plan (4.4% vs. 4.1%).

A thorough capital allocation forms the basis for visible returns

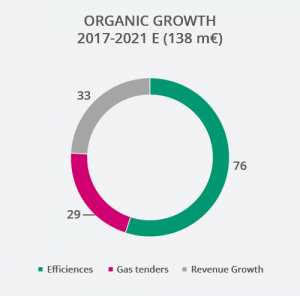

Such EBITDA increase will be fuelled by 138 million euro coming from organic growth and 107 million euro from external growth, net of 27 million euro of negative impacts, mainly due to lower incentives on renewable energies. In more detail, concerning organic growth, the component of new efficiencies – equal to 76 million euro – will take shape through a decrease in costs for 53 million euro, representing 5% of the addressable cost base; the remaining part, which amounts to 23 million euro, will derive from innovation processes already partly underway. The contribution from gas tenders is expected to be 29 million euro; the estimate is based on the assumption that we will win in 13 ATEMs in which Hera’s market share exceeds 50%, out of 17 ATEMs in which we are already operating. The third factor contributing to organic growth is represented by additional 33 million euro at revenue level. This estimate includes further expansions of the customer base in Energy, the increase in market shares in waste treatment, and the tariff increase in regulated businesses, due to the indexation component.

Lastly, external growth is expected to provide an overall contribution of 107 million euro. Such growth derives for 17 million euro from the EBITDA of Aliplast, whose share capital is already 80% controlled by Hera, and for the remaining 90 million euro from further M&A deals. In looking for targets, we will focus on our territories, which feature a high degree of fragmentation.

In comparison with the former plan, the new one presents more diversified opportunities of growth, better visibility on the returns of the different projects and, all in all, a lower execution risk.

Financial strategy and shareholder returns

Financial resources ensuring readiness to intervene

Considering the capex plan of 2.9 million euro, in 2021 Hera would have a Debt/EBITDA ratio of 2.9x: a level that would provide scope for further investment options, without eroding the virtuous situation of financial flexibility.

The more generous shareholder remuneration is based on the accelerated earnings growth

With an EPS CAGR of 5% (was 4.5% in the previous 5-year Plan), Hera can provide more generous returns to shareholders, through the distribution of a dividend per share of 9.5 euro cents for 2017, 10 cents for the 2018-2019 two-year period, and 10.5 cents for the 2020-2021 two-year period, with a payout above 60% in the Plan’s period.

The financial flexibility that will be maintained over the five-year period will guarantee the sustainability of the dividend policy, taking into account the stated capex plan.

Hera’s growth strategy leverages on consolidated strengths and follows the directions of well-targeted business strategies with a view to size the opportunities provided by the external environment and orientate future investments as effectively as possible. In doing so, Hera creates the conditions for sizeable improvements in terms of operating performance.

While keeping a virtuous and well-balanced debt structure and a low cost of debt, thorough financial management will help in translating better operating performance into higher P&L bottom line. We will thus be able to fund future growth, while offering at the same time an attractive remuneration to shareholders.