In a context of bullish stock markets, Hera can boast a number of Company-specific drivers.

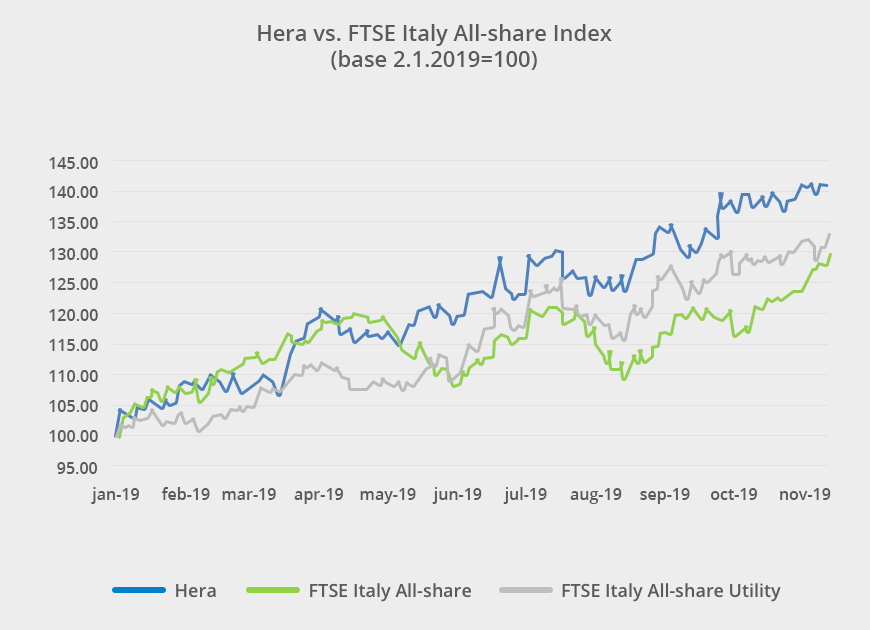

During 2019, Hera’s stock rose following a continuing upwards path. It over-performed both the FTSE MIB and the FTSE Italy All-share Utility Index, despite both indices had a significantly positive rally since the start of the year.

At the base of the general uptrend in the stock markets, it should be considered the underlying favourable reaction investors have been showing towards the expansive policies of Central Banks, willing to avoid economies to enter into recession as a result of geopolitical tensions caused by the trade war between USA and China and the uncertainty over the Brexit results.

The shares in the utility sector were among the most preferred by portfolio managers, especially in the last few months, since they can offer a limited exposure to the cycle and, at the same time, their valuations are inversely correlated to interest rates.

Hera’s shares have represented a good opportunity to ride this investment theme, being also supported by solid fundamentals, as shown by the quarterly results published through the year and the visible growth perspectives included in the Business Plan to 2022, presented in January 2019. Moreover, Hera is serving only domestic markets; therefore, it is virtually not exposed to the risks related to the outcome of the trade war.

There are also additional specific elements that provided a substantial contribution in driving Hera’s share price performance and that should not be neglected. In the first part of the year, the stock benefitted from the inclusion in the Italian blue chips index and the disappearing fear of a change towards a public management of the water business. Then, in the second part of the year, a leading factor was the announcement of the M&A deal that has allowed Hera to strengthen the partnership with Ascopiave in the energy sale business.

ANALYST CONSENSUS

The average target price of the eight brokers covering the Hera stock has continuously improved during the year. Currently, it is 3.74 euro, compared to 3.58 euro as at 29 July, 3.51 euro at 14 May and 3.34 euro at 26 March. Half of the brokers have buying recommendations, while none of them is advising to sell. Considering the recent price level achieved, around 3.8 euro, it is likely that following the release of nine-month 2019 results there will be an update in their valuations. As of today, only two analysts have target prices higher than market prices.

| Broker | Rating | Target price (€) |

| Banca Akros | Accumulate | 3.80 |

| Banca IMI | Buy | 4.40 |

| Equita Sim | Hold | 3.70 |

| Fidentiis | Buy | 3.30 |

| Intermonte | Outperform | 3,90 |

| Kepler Cheuvreux | Hold | 3.70 |

| MainFirst | Neutral | 3.52 |

| Mediobanca | Outperform | 3.60 |

| Average | 3.74 |

COMING INVESTOR RELATIONS ACTIVITIES

Investor Relations activities will continue also in late 2019, with some key events on the agenda.

After the IR-only roadshow of last year, which was aimed to preliminary scouting, this year, from 3 to 5 December, Hera’s CEO will be in Australia to meet large infrastructural funds, interested in long-term development issues like Climate Change.

Concerning ESG themes, after participating on 2 July to the Sustainability Day of Borsa Italiana and on 20 September to the round table at the Circular Economy Day organised by Banca IMI, the Company’s senior management will attend the “Salone SRI” that will take place in Milan on 20 November 2019. Hera is invited to take part into one of the three talks “BlackRock meets …”, a format seeing BlackRock -one of the major asset managers in the world and one of Hera’s shareholders- discussing with the management of the Company, addressing topics of engagement between listed companies and investors.

The “Salone SRI” is the main event on sustainable finance in Italy, dedicated to consultants and individual investors. This year it will be hosted at the Palazzo delle Stelline. The talk that Hera will attend is scheduled for 10:15 AM.

As usual, in 2020, at the beginning of the year, Hera will release the new Business Plan, which in the following weeks will be presented to institutional investors during a roadshow across the main financial centres in Europe and USA.