On 17 June 2019, the Boards of Directors of Hera and Ascopiave signed a binding Term Sheet intended to develop a major operator in energy sales in the areas of North-East Italy. This formal step took place at the end of a competitive process launched by Ascopiave with the aim of making the most of the sales segment of its business portfolio, by involving the major utilities in the Country.

- Through a competitive process aimed at getting sales operations fairly valued, Ascopiave selected Hera’s offer, given the consistency in growth strategy of both companies.

- The agreement further strengthens the preexisting partnership between Hera and Ascopiave, EstEnergy. The company will become the leading commercial operator in North-East Italy.

- With this deal, Hera Group will become the third national operator in energy sale, reaching 3.2 million customers. It will thus exceed the threshold of 3 million customers earlier than targeted in the Business Plan to 2022.

- Hera’s proven know-how in customer management as well as higher economies of scale create visible potential for value creation, through synergies and cross-selling opportunities.

- At the EBITDA level, Hera reaches 50% of the growth through acquisition included in the Plan targets, while presenting itself as the reference point for the consolidation of the fragmented area of Triveneto.

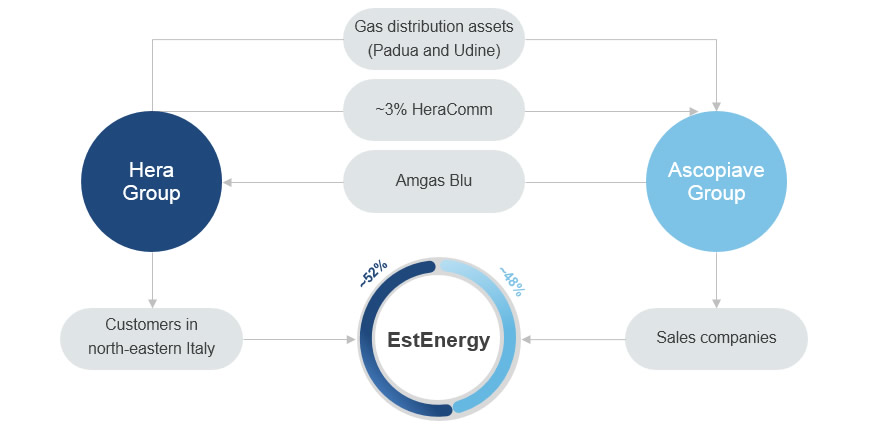

Our offer proved to be the best, from a strategic point of view. Through a well-developed asset swap, which does not foresee any cash outflows for either one of the groups, Hera will be able to grow through acquisition, consolidating its presence in the fragmented area of Triveneto. Ascopiave will focus on gas distribution activities, without a complete exit from the sale business, benefitting from the synergies that the partnership will provide.

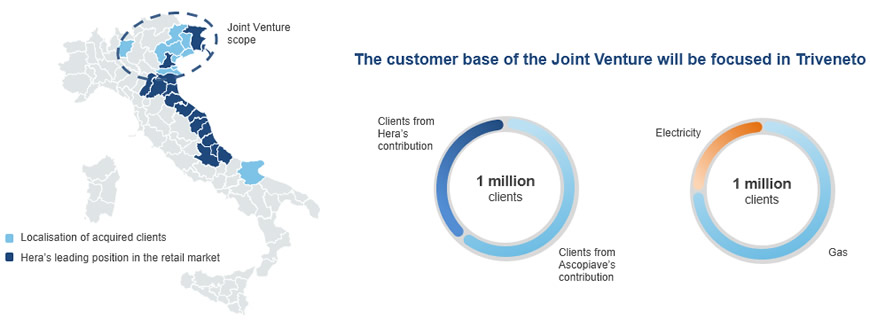

The cornerstone of the operation is the strengthening of EstEnergy, the Joint Venture through which Hera and Ascopiave already jointly manage 223,000 customers. The JV will include 256,000 Triveneto customers of Hera Comm and 581,000 customers that Ascopiave presently manage in the same area and Lombardy. This way, EstEnergy will become the main player in North-East Italy, with over one million customers in its portfolio.

To compensate the higher number of contracts provided by Ascopiave, Hera will transfer its gas distribution activities in the Southern area of the Udine province to the partner, at a price around the Residual Industrial Value (VIR), a higher level compared to that recognized by the regulator. That will result in a capital gain. The acquisition of 50,000 Amgas Blu customers by Hera Comm and the acquisition of 3% of Hera Comm shares by Ascopiave will complete the transaction.

This will lead to perfect balance of the respective contribution values, with no cash flows between the parts. The entire project represents a pure asset swap.

We have also granted Ascopiave the right to sell, wholly or in part, its share in the joint venture, up to the seventh year from the closing date. Our shareholdings in EstEnergy might therefore increase in the future to reach full control.

The deal structure

Through this agreement, we access a unique asset in the industry in terms of size, quality and growth perspectives. Reaching 3.2 million customers, the Group portfolio will rank third at national level and will exceed the target of 3-million customers well in advance compared to the schedule set in the Business Plan to 2022.

Furthermore, the clients that will be acquired present better characteristics than the Italian average:

- Higher consumptions of commodity, being based in northern Italy, where winters are colder

- Strong loyalty, around two times above market average

- Outstanding creditworthiness, around six times higher than market average.

We will then integrate the acquired client portfolio inside our management platform: by leveraging on economies of scale and process efficiency, such platform will be able to produce visible synergies in cost-to-serve reduction and raw material procurement. We also see attractive opportunities of business development through the sale of dual-fuel contracts, since 3/4 of clients only have a gas contract, together with value-added services (VAS), given the proven experience of Hera Comm in Group’s core areas.

Geographic localization and client portfolio structure of the Joint Venture

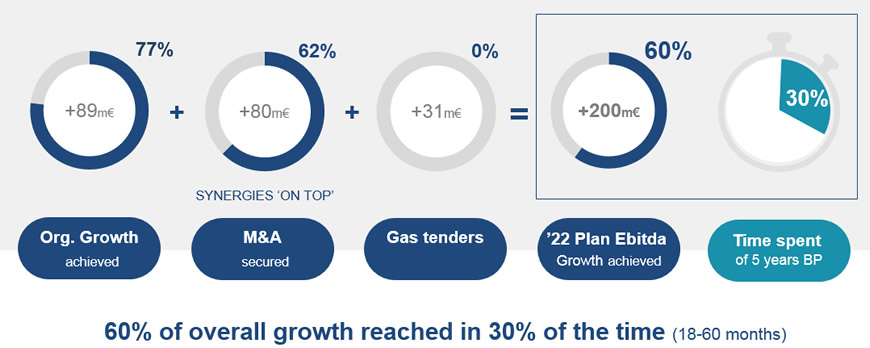

The Joint Venture consolidation will allow us to achieve, together with the acquisition of Pistoia Ambiente, after only one year 62% of the targeted EBITDA growth through M&A that had been included in the five-year Business Plan to 2022.

Organic growth achieved over the first 18 months of the Plan’s period (Full-Year 2018 and First-Half 2019) shows that we achieved 77% of the growth target in 30% of the time. This indicates that we will likely reach the Plan’s targets in advance.

Table showing the achievement of the 2022 Business Plan’s targets

The partnership signed is another milestone in our growth path. Looking ahead, it represents a reference platform for the consolidation of the fragmented area of Triveneto.