In first-quarter 2021, Energy areas drove the EBITDA of Hera Group. Overall, EBITDA grew by 3.7%, against a scenario that proved to be less penalizing than that of the same period of 2020, in terms of both weather conditions and severity of anti-Covid restrictions.

Quarterly results provide a clear picture. On the one hand, Hera is constantly looking for new efficiencies, especially through innovation; on the other hand, it continues to expand its customer base in a selective way, by leveraging also on value-added services and high-impact activities for the implementation of circular economy. With such a model, Hera achieves healthy returns.

In first-quarter 2021, Hera has also proven its nature of strong cash flow generator. The €149.4 million reduction of Net Financial Debt allowed for a decrease of the Debt-to-EBITDA ratio to the virtuous level of 2.71x.

| Q1 2021 (data in m€) |

EBITDA 362.0 (+3.7%) |

NET PROFIT 132,2 (+6.3%) |

NET OPERATING INVESTMENTS 112.6 (+23.1%) |

NET FINANCIAL DEBT 3,077.6 (-4.6% vs. 31 Dec. 2020) |

In first-quarter 2021, Hera Group’s Revenues amounted to 2,271.8 m€, thus showing an increase of 216.0 m€ (+10.5%). Of these, as many as 174.0 m€ are attributable to the Energy area, essentially due to higher revenues from trading, higher volumes of gas sold, and prices that were higher for both electricity and raw natural gas.

The quarterly Group’s EBITDA reached 362.0 m€, up by 12.8 m€ (+3.7% vs. the same period of 2020). This performance is the result of different factors.

On the one hand, following last autumn’s tender, the market-share reduction in the safeguarded customer segment had a negative impact of 7.5 m€; another adverse factor was the lack of ancillary services at the Teverola plant in Campania, which was shut down for maintenance in the first three months of 2021, while in Q1 2020 it contributed a total of 4.2 m€. On the other hand, two elements provided a positive contribution to improving EBITDA:

- organic growth, contributing 12.5 m€, which was sustained by new efficiencies, the expansion of the customers number – especially in electricity and gas – and higher volumes of urban and special waste;

- a less penalising context compared to the first quarter 2020, which allowed for a 12.2 m€ recovery of the negative impacts experienced in first-quarter 2020; in terms of weather conditions, recorded temperatures proved to be colder and more aligned with historical averages, while restrictions to fight the pandemic were less severe than during the first lockdown.

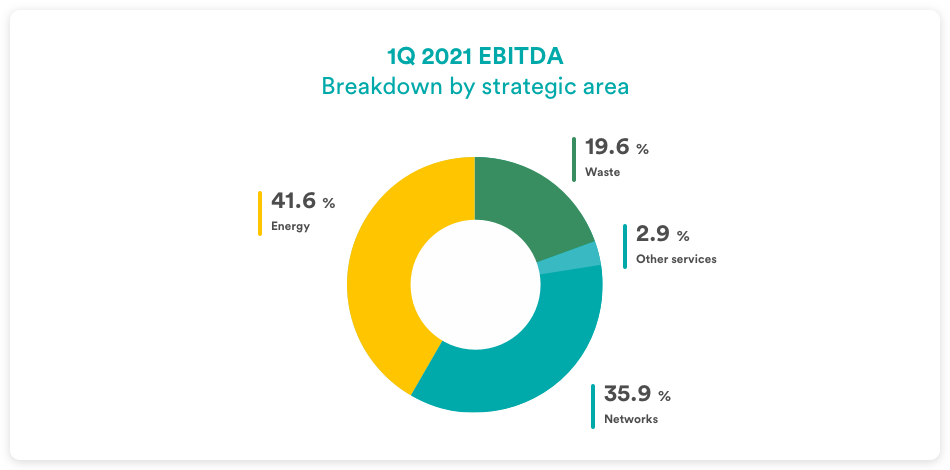

Looking at the breakdown of the business portfolio, the largest incremental contribution to the 3.7% growth in consolidated EBITDA came from the Energy areas, which recorded an 8.9% increase (+ 12.3 m€), reaching 150.6 m€. While around 70% of the negative effects from mild weather and anti-Covid restrictions that impacted the first quarter of 2020 were recovered, the expansion of the customer base continued, with around 30 thousand new users acquired.

Especially in the gas business (+17.7 thousand customers), the new lots awarded through tenders offset the reduction in the number of safeguarded users. A significant contribution, of around 5 m€, also came from energy services, with the “ecobonus” incentive activities; in this segment, given the tax complexities of the instrument, Hera can provide very effective solutions to condominiums that plan to carry out works for the improvement of the energy efficiency of the buildings.

The Waste area also offered an incremental contribution to Group EBITDA, with a 0.9% (+0.6 m€) growth, reflecting a 5.1% increase in the volumes of urban and special waste, besides the positive contribution of Aliplast, whose volumes increased by 17%. Special waste prices stabilised at the beginning of 2021, after a series of consecutive increases; in this quarter, their impact is therefore substantially neutral. Finally, it is worth noting the reduction in landfill treatments despite the increase in volumes – a sign that an increasing proportion of waste is being optimally exploited, in the implementation of a circularity process.

Networks show a 2.1 m€ (-1.6%) decrease in EBITDA, despite the sound results achieved in district heating (+1.1 m€) due to colder temperatures than those of the same period of 2020. The change in EBITDA of Networks also reflects some negative factors: a reduction of 2.2 m€ in the water cycle, where operating costs increased, and 1.1 m€ in gas distribution, where the ongoing pandemic has led to a reduction in new connections. Moreover, in Q1 the value of white certificates slightly decreased, while the tariff cut set by the Regulator in January 2020 continued to weigh heavily. Networks remain the focus for Hera: in recent months, two bids with very well-structured features have been submitted, respectively for the Udine gas concession and the Rimini water concession, the results of which will be known shortly.

TABELLA

| EBITDA (m€) | 1Q 2021 | 1Q 2020 | Change |

| Waste | 70.8 | 70.2 | +0.9% |

| Networks | 130.1 | 132.1 | -1.6% |

| Energy | 150.6 | 138.4 | +8.9% |

| Other services | 10.4 | 8.4 | +23.8% |

| TOTAL | 362.0 | 349.2 | +3.7% |

The relatively small increase (+1.0%) in Depreciation and Amortisation, from 137.5 m€ to 138.9 m€, allows the EBIT to reach 223.1 m€, thus scoring an improvement of 5.4%, which is higher than that recorded at EBITDA level.

The result of the area of financial management is 28.8 m€, an increase of 0.1 m€ (+0.3%) compared to first-quarter 2020. Such performance reflects the increase of 1.0 m€ in financial expenses for the sale of tax credits related to the “ecobonus” activities, in addition to the higher income for late payment indemnities on credits in the “last resort” segment.

Tax rate continues to improve, falling by one percentage point compared to the first quarter of 2020 and thus reaching 27.8%, mainly as a result of tax reliefs allowed on investments in innovation.

Net Profit post minorities therefore reaches 132.2 m€, achieving a 6.3% increase.

Net Financial Debt, which stood at 3,077.6 m€, sees a 149.4 m€ reduction compared to 3,227.0 m€ at the end of 2020. This improvement reflects the significant cash flow generated in the quarter. Together with a reduction in working capital of around 28 m€ – to which the reduction in customers under safeguards made a significant contribution – the strong cash flow made it possible to finance capital expenditure of around 117 m€, in addition to the use of funds and other items of c.20 m€ and disbursements for the buyback of c.11 m€.

As a reflection of the improvement in Net Financial Position, the Net Debt-to-EBITDA ratio as of 31 March 2021 decreases to 2.71x, compared to the 2.87x ratio at 2020 year-end.

Such performance is confirmed by the one-notch upgrade by S&P Global Ratings, which assigned Hera debt a BBB+ rating, with an Outlook qualified as Stable. The rating agency’s review was based on an analysis carried out prior to the release of Q1 results, being based on the picture provided by the data of the 2020 Annual Report.

Therefore, Q1 Free Cash Flow, which allowed for a reduction in debt of almost 150 m€, proves the features of Hera as a company capable of generating new resources on an ongoing basis, while gradually reducing its Debt-to-EBITDA ratio. This is all part of a highly visible growth path, fuelled by continuous investment, which can at the same time offer attractive returns to shareholders and dedicate great attention to the Planet.

The target of a 37% reduction in CO2 emissions by 2030 is a challenge that requires great commitment – but one that Hera feels it can meet, also being aware of the virtuous behaviour in terms of consumption that it can stimulate in its customers.