In the first quarter of 2024, Hera achieved an increase of 1.7% at EBITDA level and of 4.2% in EBIT, despite the 40.9% decline of Revenues due to the normalisation of energy commodity prices.

Networks EBITDA provided an incremental contribution of 13.5 m€ at Group level, leveraging on the positive impacts of the new regulatory framework, while the Waste area added for 2 m€, offsetting the negative impacts of the scenario.

The Energy area delivered a strong organic growth due to the broader customer basis, thus almost wholly compensating for the lower contribution of Energy Efficiency services, as the 110% Ecobonus tax incentives expired at the end of 2023.

The leverage, calculated in terms of Debt-to-EBITDA, remains at a very conservative level (2.66x) – a financial strength that leaves room to fund future new acquisition opportunities.

| Q1 2024 (data in m€) |

REVENUES 3,399.0 (-40.9%) |

ADJ. EBITDA 417.1 (+1.7%) |

EBIT 246.9 (+4.1%) |

TOTAL GROSS OPERATING INVESTMENTS 156.8 (+0.7%) |

NET FINANCIAL DEBT 3,986.6 (+158.9 m€ vs 3,827.7 as of 31 Dec. 2023) |

In Q1 2024, Group Revenues were back to more normal levels, reaching 3,399 m€, down by 40.9% compared to the same period in 2023, which was affected by a critical scenario for energy prices. Indeed, such decline mainly reflects the Revenue performance of the Energy area due to lower prices in the energy commodity prices and weaker volumes of gas traded and sold. In addition, lower Revenues from services for energy efficiency in residential buildings and lower Revenues from WTE energy production had a downward impact.

These negative components were partly offset by the higher volumes of electricity sold, driven by a successful commercial activity.

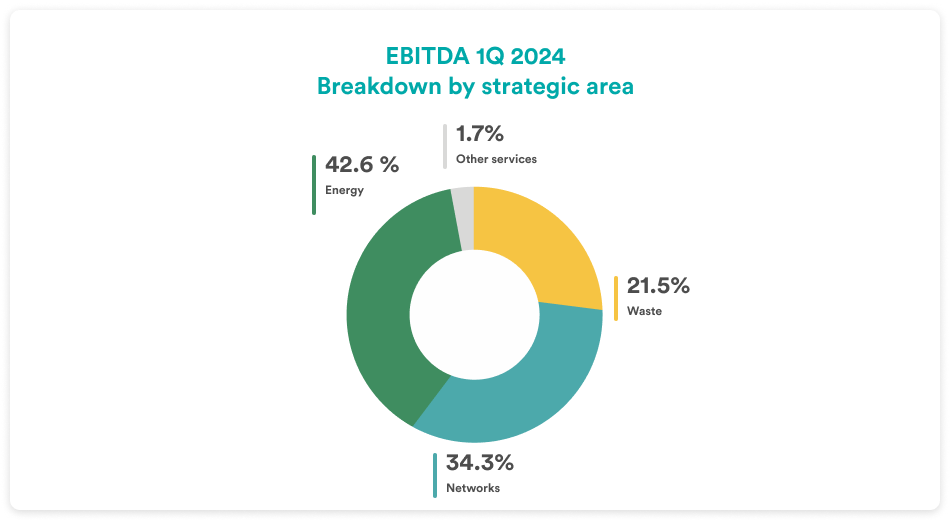

In Q1 2024, Group’s EBITDA amounts to 417.1 m€, up 1.7% compared to the same period of 2023.

| EBITDA (m€) | 1Q 2024 | 1Q 2023 | Change |

| Waste | 89.6 | 87.6 | +2.3% |

| Networks | 143.0 | 129.5 | +10.4% |

| Energy | 177.5 | 187.5 | -5.3% |

| Other Services | 7.0 | 5.6 | +22.7% |

| TOTAL | 417.1 | 410.2 | +1.7% |

A significant contribution to the overall 1.7% rise in Group EBITDA came from the 10.4% improvement in Networks EBITDA (+13.5 m€). From 1 January 2024, Hera’s regulated businesses can count on new regulatory parameters set by ARERA in terms of higher WACC (+110 basis points). The adjustment of RAB and allowed costs to the new inflation levels also had a positive incremental impact. Among Networks, worth noting is the contribution of the Water business, which is the largest regulated business with a value of regulated assets around 1.8 billion euro.

Even the Waste area made a positive contribution to the Group’s performance, through an increase in EBITDA of 2.3% (+2.0 m€), which also benefited from the sound results of the newly acquired ACR Reggiani, active in industrial remediation and special waste treatment.

The overall improvement in this area expresses the synthesis of a 4 m€ decrease in Waste-to-Energy production, against an increase of 1 m€ in the regulated activities of waste collection (reflecting the WACC rise) and a 5 m€ increase in the treatment business, which could leverage higher volumes in both special and urban waste. This performance confirms the strong competitive position of Hera, which manages to keep waste treatment prices at profitable levels even in weak economic scenarios.

The Energy areas, which come from a long path of growth, achieved by riding the market liberalisation process, in this first quarter of 2024 showed a decline in EBITDA of 5.3% (-10.0 m€).

This area leveraged the improvements in the “shaping” activity as well as the broader customer base, which increased by 300,000 units over the last 12 months, mostly in the electricity segment.

Therefore, sales activities made an increase of 20 m€, purely organic in nature, which succeeded in partly counterbalancing the decrease in EBITDA (-30 m€) in Energy Efficiency services due to the expiry of government incentives for the 110% Ecobonus. In the quarter, however, Hera reported EBITDA of about 5 m€ in Energy Efficiency activities, which continued even after the reduction of the tax bonus to 70% and the discontinuation of the transfer of credits to the banks. This EBITDA result was also combined with lower provisions for bad debts, owing to the normalisation of the energy market, thus offsetting the distances from the excellent results achieved in the first quarter of last year at the EBIT level in the Energy area.

In Q1 2024, Group’s EBIT amounted to 245.9 m€ (+4.2%), growing at a faster pace than EBITDA (+1.7%) as a result of the 2.9 m€ decline in Depreciation, Amortisation and Provisions (-1.7%). While depreciation and amortisation increased mainly due to new operating investments in the Networks and Waste area, provisioning for bad debts decreased significantly, following the drop in commodity prices.

The Result from Financial Operations, with a negative balance of 33 m€, improved by 11.4 m€ compared to Q1 2023. This performance is mainly the result of the liability management activities to optimise the financial structure that were successfully carried out during 2023, resulting in a reduction in the cost of long-term debt.

Following 59.6 m€ taxes, which indicate a tax rate of 28% compared to that of 26.8% in Q1 2023, Adjusted Net Profit after minority interests reaches 143.1 m€, posting an 11.6% increase over the level of the first quarter of the previous fiscal year.

At the end of March 2024, Net Financial Debt amounts to 3,986.6 m€, a 4.2% increase vs the 2023 year-end level, basically coming from the higher net working capital. This is partly due to the seasonality for the ending of the thermal season and, partly, to the lower trade debts for the payment of incentivised works and the relevant tax credits, which have not yet been used for offsetting.

As at 31 March 2024, the Debt-to-EBITDA ratio stands at 2.66x – a level that remains well below the threshold of 3.0x that Hera has set as the reference maximum level within the current high-interest-rates scenario.

As illustrated in detail in the Annual Financial Report at 31 December 2023, starting from fiscal year 2022, Hera’s management decided to present the results by valuing the natural gas inventories according to a managerial criterion, in order to provide a representation consistent with a market context that shows significant and sudden changes in price compared to historical trends. Already at the end of the first quarter of 2023, and for all the following quarters, included the current reporting quarter, the previous valuation mismatch was fully reversed, thus affecting the change in inventories in the Income Statement for the year 2023, but not the value of inventories in the Balance Sheet. The latter, in particular, reflects a write-down resulting from a book value that is higher than the management value, due to the residual gas in storage whose average cost is still affected by purchases made in 2022 with an extremely high price scenario compared to the current one. In summary, therefore, the statutory and management valuation of inventories at 31 March 2024 is aligned, while the economic period of comparison reflects the reversal of the misalignment that has arisen in the year 2022 (thus affecting the change in the period, but not the stock).