Despite the 6.7% reduction in Revenues, reflecting the pullback of energy commodity prices from past peaks, Hera achieved significant growth in the first half of 2023, with double-digit growth rates in EBITDA and EBIT.

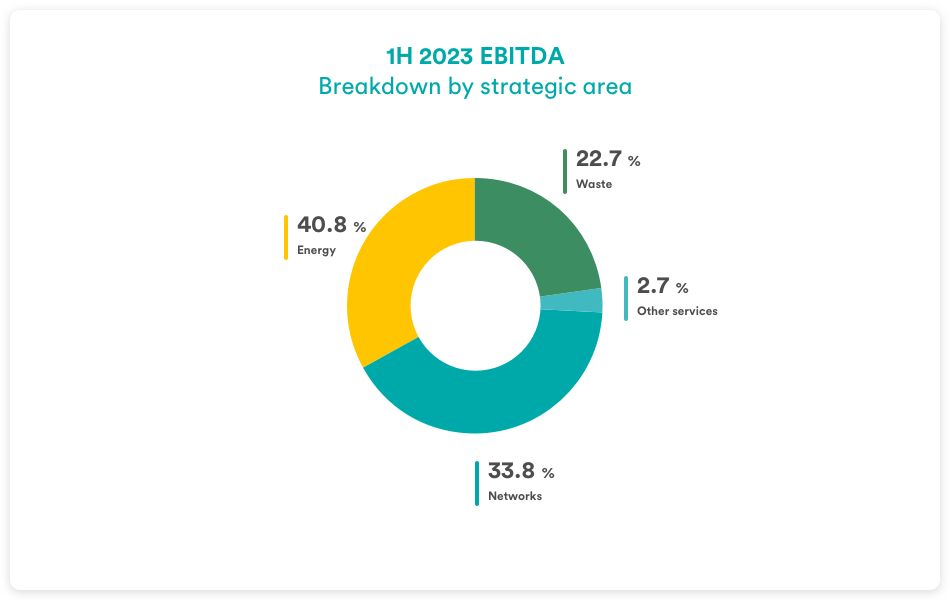

Not only did all major P&L balances show improvement compared to H1 2022, but also all strategic business areas made a positive contribution to the 13.8% growth in consolidated EBITDA.

The Energy areas saw a very dynamic development (+30%), due to the strong expansion in the number of customers and the broad portfolio of services offered, with a robust contribution from Decarbonisation services.

In the Waste area (+8.1%), the benefits of WTE coming back into operation and the broader scope of consolidation were tangible, while prices and volumes grew.

Finally, in Networks (+1.3%), while waiting for the Regulator to set new bonuses, Hera benefited from accounting for the impact of inflation, as well as from the efficiencies achieved.

During the period, despite the 14.5% increase in investments and the payment of a 4% higher dividend at the end of June, a net positive cash flow of EUR 104m was generated, which allowed leverage (Debt-to-EBITDA) to be kept within the 3.0x threshold.

| H1 2023 (data in m€) |

REVENUES 8,297.5 (-6.7%) |

ADJ. EBITDA 718.3 (+13.8%) |

ADJ. EBIT 374.7 (+11.9%) |

NET OPERATING INVESTMENTS 330.3 (+14.5%) |

NET FINANCIAL DEBT 4,145.7 (-104.1 m€ vs. 4,249.8 as at 31 Dec. 2022) |

As illustrated in detail in the Half-Year Financial Report at 30 June 2022 and in the Annual Financial Report at 31 December 2022, starting from last year, Hera’s management decided to present the results by valuing the natural gas inventories according to a managerial criterion, in order to provide a representation consistent with a market context that shows significant and sudden changes in price compared to historical trends. During the first quarter of 2023, at the end of the winter season, and due to materialisation of the expected flows, the previous valuation mismatch was fully reversed (with an effect of €93 m on reported data, compared to those calculated under a managerial method). The following injection campaign, launched starting from the second half of March, was also subjected to a double valuation process, consistent with the approach used in the previous fiscal year.

In the first half of 2023, Group Revenues amounted to €8,297.5m, down €598.5m (-6.7%) compared to the same period of the previous year. The drop was mainly attributable to the Energy area (-€897.7m), whose revenues reflected the drop in energy commodity prices and lower volumes of gas sold, due to the mild temperatures in the first part of the year. This negative impact was partially offset by higher volumes in electricity – both due to the effective commercial action in the liberalised market segments, and to the awarding of tenders in the gradual protection and safeguarded segments – as well as by the incentivised activities of energy efficiency in residential buildings and Value-Added Services, with a positive contribution that reached a total of €223m. Also not negligible was the positive impact of Revenues from the Waste area (+€74m), whose expansion reflects the benefits of the expansion of the perimeter via M&A.

The Group’s adjusted EBITDA at 30 June 2023 amounted to €718.3m, up by €87.1m (+13.8%) compared to the figure for the first half of 2022. The factors driving this increase can be identified mainly in organic growth (+€47m) and the progress of activities dedicated to Decarbonisation (+€28m) – which include energy efficiency services for condominiums, P.A. and industrial companies, as well as value-added services for individuals – but also in the contribution from recent M&A transactions (+€10m), i.e., Macero Maceratese and ACR Reggiani.

| EBITDA (m€) | 1H 2023 | 1H 2022 | Change |

| Waste | 162.9 | 150.7 | 8.1% |

| Networks | 242.7 | 239.6 | 1.3% |

| Energy | 293.4 | 225.1 | 30.3% |

| Other Services | 19.4 | 15.8 | 22.7% |

| TOTAL | 718.3 | 631.2 | 13.8% |

The EBITDA breakdown by strategic business area show the driving contribution of the Energy areas, which grew at a rate of 30.3% compared to H1 2022 (€68.3m).

Sales and trading activities progressed by €40m, driven mainly by an increase in new customers (+245,000) in all segments, which more than offset the lower volumes, due to both mild winter temperatures and the reduction in consumption resulting from energy efficiency improvements. Decarbonisation services showed additional growth (+€28.4m), despite the drop in tax incentives provided by the Italian government.

Value Added Services dedicated to retail customers recorded an increase of €3m, driven by continued demand for solutions that help reduce the cost of energy bills through consumption optimisation. Lastly, an accounting change in stored gas should be noted, with a positive balance of €93m, compared to the negative figure of €93m that had been recorded at the end of 2022 – this implying that the accounting difference of gas sent to storage in 2022 has been completely reabsorbed.

The Waste area also showed a brilliant dynamic: in the first half of 2023, it improved its EBITDA by 8.1% (+€12.2m), although it was only partly able to benefit from the installed plant capacity, since the second WTE under revamping will be back in operation in the second half of the year. The overall improvement of €12.2m in Waste reflects a decrease of €5m in the regulated activities of collection, while the liberalised market component increased by €5m, due to the combined effect of a 5% increase in waste treated, an additional increase in prices, and the positive contribution from the energy production of the WTEs. Finally, the contribution of M&A was decisive (+€10m), due to the consolidation of Macero Maceratese and ACR di Reggiani Albertino, a leading company in the remediation of industrial sites.

Finally, the EBITDA of Networks improved slightly, by €3.1m (+1.3%). In this area, Hera mainly benefited from the inflation adjustment, which had not yet been accounted for in Q1, as well as from new efficiencies gained and returns from development investments.

Group adjusted EBIT, which amounted to €374.7m (+11.9% vs. 1H22) in 1H2023, grew at a slightly slower pace than EBITDA, mainly due to the €47.3m increase recorded by the item Depreciation, Amortisation and Provisions (+16.0%), which mainly reflects new investments and the acquisition of additional customers, as well as the broader scope of consolidation.

The result from financial operations shows an increase of €39.6m, having recorded a negative balance of €90.5m in the first half of 2023. The figure is influenced in the most significant part by the higher cost of money, as a result of continued increases in interest rates, and the consequent higher expenses associated with financing the expansion of net working capital. Through careful liability management, Hera continues to optimise its financial structure, which remains solid.

The tax rate calculated on adjusted pre-tax profit stood at 26.8%, significantly down from 29% in the first half of 2022 (which included an extraordinary contribution against the ‘high utility bills’ of €2.3 million), mainly due to the benefits of tax credits for the purchase of electricity and gas.

In the first half of 2023, adjusted Net Profit after minority interests was therefore €187.7m, up 2.4% compared to the same period in 2022.

Net Financial Debt at the end of June 2023 amounted to €4,145.7m, down by €104.1m compared to the figure at the end of December 2022, when it stood at €4,249.8m. This change mostly reflects the sound cash generation, with operating cash flow reaching €460m, and the release of cash from working capital management (+€280m) as a result of the depletion of gas storage, in line with what Hera had previously indicated.

The Debt-to-EBITDA ratio as at 30 June 2023 stood at 3.0x, thus remaining within the maximum threshold that Hera had prudently set for itself and at a level substantially in line with that of 30 June 2022, which was 2.96x.