During 2021, Hera achieved significant growth in all key indicators of the Profit and Loss Account, from EBITDA, which increased by 9%, to Net Profit post minorities, which rose by 10.2%.

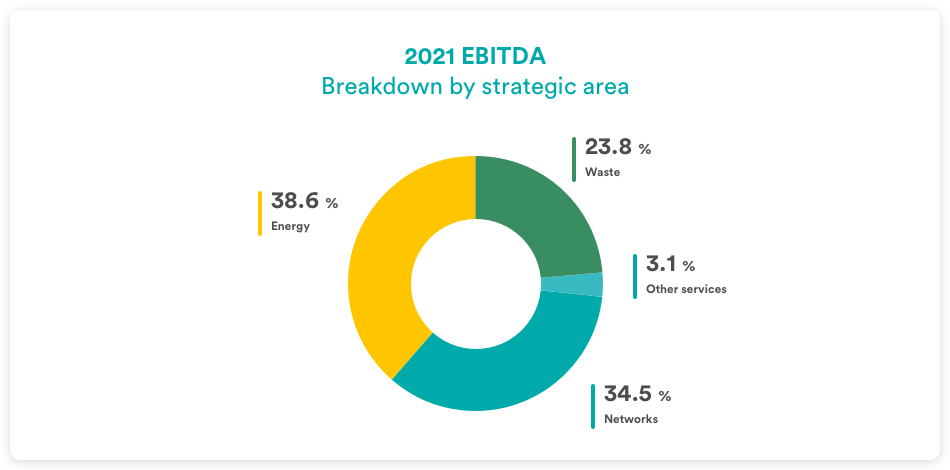

All business areas brought a positive contribution to consolidated EBITDA, with Energy and Waste leading the progress, increasing respectively by 14.9% and 13.1%.

In a year of strong development, Hera managed to strengthen its financial profile, thus reducing the Debt-to-EBITDA ratio to 2.66x. Strong cash generation from operations allowed for funding almost the totality of cash outflows, despite the intense investment programme, the M&A activities and the higher dividends paid. Therefore, Net Debt at the end of December 2021 was substantially stable compared to that at the end of 2020, but with a profile that benefited from the liability management transactions undertaken during the year.

Hera’s 2021 growth is also characterised by the increasing contribution of CSV activities, now accounting for 46.6% of Group EBITDA. This proves how investments dedicated to achieving sustainability objectives can offer attractive returns also from a financial point of view.

| FY2021 (data in m€) |

REVENUES 10,555.3 (+49.1%) |

EBITDA 1,223.9 (+9.0%) |

NET PROFIT 335.5 (+10.2%) |

NET INVESTMENTS 570.3 (+7.9%) |

NET FINANCIAL DEBT 3,261.3 (+1.1% vs. 31 Dec. 2020) |

In 2021, Group Revenues amounted to 10,555.3 m€, up 49.1% compared to the previous year. All business areas took part in this improvement. A significant contribution, of more than 3 bn€, came from the Energy activities, mainly due to higher trading (2,068 m€), higher sales of both gas (554 m€) and electricity (385 m€). Energy efficiency services, driven by tax incentives, together with added-value services made a significant contribution of 243 m€.

In 2021, Group EBITDA reached 1,223.9 m€, recording a total growth of 100.9 m€ (+9,0% vs 2020). Excluding M&A, which provided roughly 10 m€, Hera posted an organic growth of over 90 m€, the highest ever achieved by the Group yearly, driven by businesses with a high impact on environmental sustainability, such as buildings energy efficiency and plastic recycling.

The Energy businesses drove more than half of the consolidated EBITDA progress, achieving a growth of 54.8 m€ (+14.9%). In this area, where the expansion was driven by an enlarged customer base and value-added services, we demonstrated our ability to promptly and effectively seize the opportunities of the incentives linked to the Italian government’s Recovery Plan, reaching a 42 m€ EBITDA in energy efficiency services for residential buildings. In 2021, we also won three of the nine tenders for the “Maggior Tutela” services and increased our presence in the Default and FUI segments, which partially offset the reduction in the number of customers in Safeguarded status. The result achieved was not significantly affected by the volatility of energy commodity prices, as risk-protection policies made the mentioned price hike fully transitory.

Also the Waste area offered a decisive contribution to consolidated EBITDA growth, increasing its results of 33.7 m€ compared to 2020 (+13.1%). Among the main drivers, an increase of 170 thousand tons in terms of volumes handled and generally rising prices. Aliplast benefited of sustained demand of regenerated plastic, posting a 21 m€ result, while the newly acquired companies, which have consolidated their presence within their reference territories, contributed for 8 m€.

The Networks made an incremental contribution of 11.5 m€ to Group’s EBITDA, having achieved a 2.5% growth, driven by new connections, a 6.6 m€ contribution of white certificates and new efficiencies gained through innovation and digitalisation. The investments made also contributed to a 2.4% RAB increase; this means that the reference basis for the application of the tariffs set by the Regulator is therefore also growing.

| EBITDA (m€) | 2021 | 2020 | Change |

| Waste | 291.7 | 258.0 | +13.1% |

| Networks | 472.2 | 460.6 | +2.5% |

| Energy | 422.6 | 367.8 | +14.9% |

| Other services | 37.4 | 36.7 | +1.9% |

| TOTAL | 1,223.9 | 1,123.0 | +9.0% |

The 7.1% increase in Depreciation & Provisions, lower than the 9% growth recorded at EBITDA level, allows the EBIT, equal to 611.7 m€, to achieve an 11% increase.

The financial management result also improved, with a balance of 119.8 m€, up 2.7% compared to 2020. The change of €3.1m is essentially attributable to higher expenses of 25.7 m€ linked to the sale of tax credits related to the “ecobonus” activities, which were largely offset by the benefits of liability management transactions, such as the partial repurchase of some bonds, lower IAS expenses and higher profits from associates and joint ventures.

The tax rate was 26.8%, slightly up from 25.7% in the previous year. In fact, net of the benefits from price adjustments in some acquisitions, the tax rate would have been slightly lower than in 2020, due to tax benefits linked to investments in technological, digital and environmental transformation.

In 2021, Net Profit post minorities therefore reached 333.5 m€, an increase of 10.2% compared to 2020.

The Net Financial Debt, at 3,261.3 m€, shows a marginal increase of 34.3 m€ compared to 3.227 m€ at the end of 2020. Therefore, Hera’s level of debt remains substantially stable despite in 2021 the Group has invested 130 m€ more than in 2020, reaching a total of 666 m€ considering both capex and M&A, and had higher cash out, for a total of 199 m€, due to the payment of dividends and minorities. This was possible leveraging on the funding provided by significant cash generation, as in 2021 we reached 838 m€ of cash flow from operating activities.

Given the 9% increase in EBITDA, against a substantially unchanged debt, in 2021 Hera reduced the leverage ratio, in terms of Debt-to-EBITDA, from 2.87x to 2.66x.

We can therefore face the challenging operating context of 2022, with significant tensions on energy prices induced by the Russian-Ukrainian conflict, from a position of strengthened financial solidity.

Investments in sustainability projects generated valuable returns, even from a financial perspective

In 2021 we also carried out our commitments on the sustainability side.

We achieved significant milestones, including an 11.6% reduction in CO2 emissions vs. 2019 (calculated according to SBTi standards), as well as a 36% increase vs. 2017 in the amount of plastic recycled and sold by Aliplast.

The CSV (Creation of Shared Value) accounted for 570.6 m€, posting a sharp increase compared to the 455.1 m€ of 2020. The CSV EBITDA weight on consolidated EBITDA therefore grows from 40.5% in 2020 to 46.6%.

The increased contribution of CSV activities reflects the returns generated by investments in projects dedicated to three specific objectives: in the Environment area, regenerating resources and closing the loop; in the Local and Business area, enabling resilience and innovating; and, lastly, in the Energy area, pursuing carbon neutrality. In 2021, investments in these areas amounted to a total of 452.7 million euros, representing 68% of total investments.