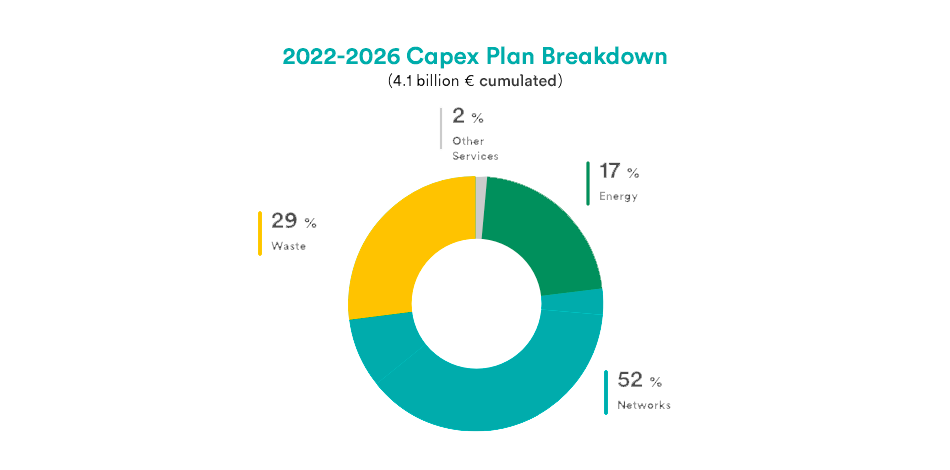

Over the five-year period, Hera will concentrate more than half of its 4.1-billion-euro investment plan on Networks, with the aim of leveraging on the existing infrastructure, a real strategic asset that will be strengthened and transformed to respond to the new challenges of Climate Change, while offering the Group visible returns with a low risk profile.

Hera will also allocate significant capital to Waste (29% of total investments), with this area expected to generate attractive returns that will drive the Group’s EBITDA growth. Hera will intercept a demand for increasing circularity, also in new vertical segments, by offering services that thoroughly meet the needs of business customers.

The Energy area seems to be entering a normalisation phase in these weeks after the high volatility of commodities experienced in 2022. In this business, the Company will leverage a rich portfolio of energy efficiency and value-added services, which can also be offered to a broad target of new customers as part of the liberalisation process of the segment of electricity users with greater protection (“Maggior Tutela” contracts).

Investment returns, new efficiencies and careful financial management will favour the continuation of a profitable growth path in the coming years, with 2026 ROI stable at 9.1% and 2026 ROE above 10%, while a solid financial profile will be preserved, with leverage dropping below the 3 times threshold.

| 2022-2026 BUSINESS PLAN |

EBITDA 2026 m€ 1,470 |

CUMULATED INVESTMENTS 2022-2026 bn€ 4.1 |

DIVIDEND PER SHARE 2026 c€ 15.0 |

DEBT/EBITDA 2.8X |

ROI 2026 9.1% |

4.1 bn€ investments to match market challenges

The 4.1-billion-euro investments that Hera is planning to carry out in the 2022-2026 period are mainly focused on Networks, for around 2.2 billion euro, followed by those dedicated to Waste that absorb around 1.2 billion euro, and those in the Energy area, to which around 600 million euro will be allocated.

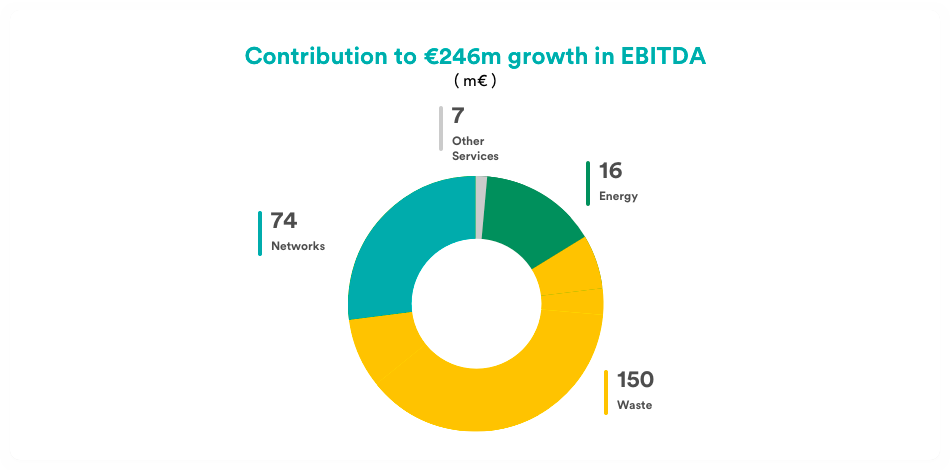

Investments allocation reflects the evolution of EBITDA

ln 2026, Hera forecasts to reach an EBITDA of 1,470 million euro, posting a 246 million euro rise compared to 2021 level. All the areas will contribute to the achievement of such growth: 150 m€ will come from Waste (61%), 16 m€ from Energy (6%) and 74 m€ from Networks (30%).

EBITDA 2026 will thus derive about 50% from regulated activities and the remaining 50% from liberalised activities. The contribution with the highest incidence will be from Networks (37%), while Waste and Energy will each weigh for 30%.

The 2022-2026 projects are essential to reach the sustainability goals at 2030

Hera will create new Shared Value with about 70% of investments planned for the 2022-2026 five-year period. A share of 60% of total investments is aligned with the taxonomy, while significant percentages of the various projects will positively impact innovation and digitisation, as well as infrastructure resilience.

The 2026 horizon is simply a milestone along the 10-year path to 2030, already defined in 2021, which sees precise targets in terms of carbon neutrality and circular economy.

On the first side, that of carbon neutrality, SBTi’s certified target to 2030 is a 37% reduction in Scope 1+2+3 emissions. By 2026, Hera expects to reduce these emissions by 23%.

On the circular economy front, the Group has also set challenging targets. In plastics recycling, Hera aims to make a significant step forward over the Plan period, increasing regenerated volumes by 102% by 2026, with the aim to move closer to achieving the target of a 150% increase by 2030, with both targets calculated against 2017.

As a result of these actions, by 2026 Hera aims to reach 62% Shared Value EBITDA as a percentage of total EBITDA, raising the weight by as much as 15 percentage points from the 47% level recorded in 2021. Given the clarity of the levers that will be used to hit the intermediate target of 2026, the achievement of the 70% incidence target for 2030 also becomes even more visible.

A wise business strategy guides investments in the different business areas

Ensuring increasing resilience in the Networks

In the Networks, the actions will be aimed in the short term at maximising the allowed returns, exceeding the efficiency standards required by the Regulator, and investing in the security of the infrastructure so that it can prove resilient against severe weather events that might be induced by Climate Change.

A priority will be the reduction of service interruptions due to breakdowns and the minimisation of network leakages, especially in water networks, through predictive maintenance and remote monitoring that the digitisation makes possible.

To play as a catalyst for energy transition, Hera will also prepare its networks to accommodate green gas and hydrogen.

An expansion of the electricity grid is also crucial to accommodate the increasing electrification of consumption, while the acceleration of district heating is crucial to foster decarbonisation.

Growth in this area will be fuelled by major investments, amounting to 2.2 billion euro, as well as the search for new efficiencies, with RAB expected to increase by almost 1 billion euro, from 3.3 billion in 2021 to 4.2 billion in 2026.

Strengthening leadership in Waste

In the Waste area, development will centre, first of all, on a significant expansion of Hera’s plant base, against a backdrop of continuously rising market prices as a consequence of the structural shortage of treatment capacity.

A second front will be to offer Global Waste Management solutions, in response to the new needs of business customers to for a 360-degree service. The Company will also respond to the drive offered by the regulations to achieve greater circularity by expanding its area of intervention to the treatment and recycling of additional vertical waste segments, such as carbon fiber and rigid plastics. Last but not least, the effort to establish an aggregating platform of small niche operators will continue, favouring greater concentration in the market through M&A operations, while new partnerships will be signed to ensure an adequate response to the need to expand intermediation, where necessary, beyond national borders.

In Energy, putting the customer’s needs at the centre

The Energy area will benefit greatly from the reduction in commodity volatility, with the rapid downward trend in gas prices experienced in recent weeks that suggests a gradual normalisation.

The demand for value-added services, fuelled by the energy crisis, will continue to find effective answers in Hera’s rich offer portfolio, which leverages on a new CRM that will foster customer loyalty and improve profitability, within a favourable operating context also due to existing incentives.

The liberalisation of the higher protection retail market is an opportunity for Hera, which expects to succeed in offering new value-added contracts to an audience of more than 400,000 customers.

In addition, on the renewable energy front, Hera plans to install 140 MW by 2026, of which 85 MW operated on owned basis by taking advantage of the Group operation areas. The plan also envisages the construction of small-scale plants for energy communities.

M&A is a lever that will definitely be activated, also in view of the difficulties faced by many small operators due to commodity inflation and credit restrictions.

The growth of the overall customer base will continue, with the expected acquisition of 600 thousand new customers in the electricity business – mainly due to the liberalisation process, but also for the organic expansion of the market. As a result of the new entries in the electricity business, it is estimated that there will be a reduction of 100 thousand customers in the gas business, in line with the electrification of consumption. Therefore, the Group would serve a total of 4 million customers in 2026.

Services related to the energy efficiency of buildings will continue to represent an important revenue line for Hera, which will leverage the extension of tax bonuses, albeit at slightly lower benefits.

High-level returns, with solid risk control and balanced financial profile

ROI, Return on Investment, is expected at 9.1% in 2026: broadly stable compared to the 9.2% level of 2021, despite the WACC cut, given a lower risk profile in view of the allocation of the capital invested, given the concentration on regulated or semi-regulated businesses.

ROE, Return on Equity, should reach a level of more than 10% in 2026, as occurred in 2021, benefitting from a tax rate that would remain below 28%.

Despite the upward shift in the interest rate curve, the average cost of debt is expected to rise moderately, from 2.9% in 2021 to 3.6% in the last year of the Plan, due to the lengthening of the average duration gained after recent issues and liability management operations. The bonds to be refinanced over the five-year period will be around 800 million euro, about one-quarter of the total stock.

The strong cash flow generation from operations, cumulatively expected at 4.5 billion euro, would allow Hera to fully cover the 4.1-billion-euro capex plan. Considering that the investments needed to maintain high asset quality amount to 2.1 billion euro, net of the absorption of working capital a Free Cash Flow of 2.2 billion euro would be available for shareholder remuneration and minority interests (which amount to approximately 1.1 billion euro) as well as for funding development investments.

Assuming an increase in debt of about 900 million and considering the expected growth in EBITDA, financial leverage, calculated as the Debt-to-EBITDA ratio, could fall to around 2.8 times at the end of 2026. This will preserve the financial flexibility needed to make any further acquisitions beyond those included in the Plan.