In 2023, Hera achieved an EBITDA increase of 15.4%, in a framework featuring a 25.8% decline in Revenues, as energy commodity prices returned to levels closer to those before the outbreak of the conflict in Ukraine.

The EBITDA of Energy areas, which has determined 182.5 m€ of the total Group EBITDA progress of 199.7 m€, posted a significant increase (+40.6%), due to the fast expansion of the customer basis (+c.330,000) and the broadening of the services offered, including those in the Energy Efficiency business.

In the Waste area (+4.6%), where also the second bio-methane plant entered into operations, Hera recorded a growth both in prices and in volumes, while leveraging the successful integration of the activities of ACR Reggiani, after the acquisition of 60% of its capital in March 2023.

The flattish performance in Networks EBITDA (-0.8%) is definitively valuable, considering the time lag in the recognition of the high inflation experienced in Italy and the increase in interest rates.

During 2023, the robust cash flow, combined with a release of Net Working Capital, allowed for the funding of investments and dividends (both on the rise vs. 2022), as well as M&A deals, while generating a free cash flow of 422.1 m€, which brought the leverage (Debt-to-EBITDA) back to 2.56x – a level providing Hera with strong financial firepower for accelerating growth in the current fiscal year, should appealing acquisitions opportunities arise.

| FY 2023 (data in m€) |

REVENUES 14,897.3 (-25.8%) |

EBITDA ADJUSTED 1,494.7 (+15.4%) |

EBITD ADJUSTED 741.0 (+18.0%) |

TOTAL NET INVESTMENTS AND M&A 779.2 (+13.1%) |

NET FINANCIAL DEBT 3,827.7 (-422.1 m€ vs 4,249.8 as of 31 Dec. 2022) |

As illustrated in detail in the Annual Financial Report at 31 December 2022, starting from last year, Hera’s management decided to present the results by valuing the natural gas inventories according to a managerial criterion, in order to provide a representation consistent with a market context that shows significant and sudden changes in price compared to historical trends. At the end of the first quarter of 2023, once the winter season was over, and due to materialisation of the expected flows, the previous valuation mismatch was fully reversed. The following injection campaign, launched starting from the second half of March, was also subjected to a double valuation process, consistent with the approach used in the previous fiscal year.

In 2023, Group Revenues amounted to 14,897.3 m€, showing a 5,184.7 m€ (-25.8%) decrease compared to 2022.

The difference is mainly attributable to the Energy area, which experienced a 5,570 m€ decrease in revenues due to the fall in energy commodity prices and lower volumes of gas traded and sold, also deriving from the impact of the mild weather experienced in early 2023, despite the awarding of several tenders in the segments of Last Resort and Default. This negative component was partially offset by higher electricity volumes sold (+19.0%), as a result of the effective commercial effort in the liberalised market and the awarding of tenders in Safeguard and Public Administration (CONSIP tenders), in addition to the SuperEcobonus activities and Value-Added Services, with a positive contribution that reached a total of 421 m€.

Revenues from the Waste business provided a contribution of 85.9 m€ to growth, mainly due to the acquisition of ACR Reggiani.

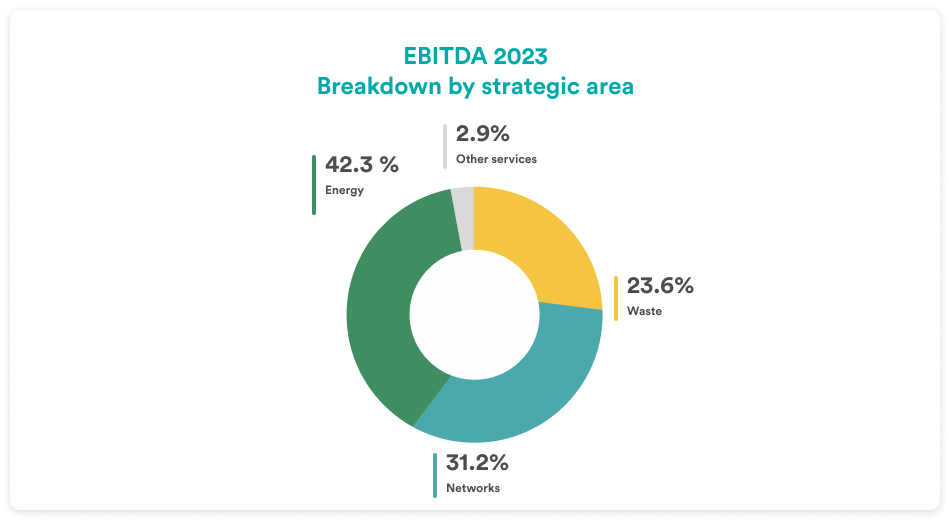

In 2023, Group’s adjusted EBITDA amounts to 1,494.7 m€, up by 199.7 m€ (+15.4%) compared to the previous fiscal year. The drivers of such a significant expansion at consolidated level can be identified in Organic Growth (+65 m€) and in the broader perimeter, as a result of the M&A deals (+25 m€), but they include short-term opportunities as well – such as those seized in the Ecobonus business and in the tenders of the Safeguard clients – which have cumulatively contributed 110 m€.

| (m€) | 2023 | 2022 | Change |

| Waste | 353.4 | 338.0 | +4.6% |

| Networks | 465.9 | 469.5 | -0.8% |

| Energy | 631.6 | 449.1 | +40.6% |

| Other services | 43.8 | 38.4 | +14.1% |

| TOTAL | 1,494.7 | 1,295.0 | +15.4% |

The Group’s 15.4% EBITDA increase was basically driven by the Energy areas, up by 40.6% (+182.5 m€) compared to 2022. In this business, which shows a track record of continuous growth over the years, Hera has achieved a real outperformance, being able to cleverly exploit the opportunities of the market liberalisation context. Sales activities posted a 158 m€ progress, leveraging on a broadened customer base (+330,000, mainly in the electricity segment), which more than offset the lower gas volumes, due to both mild winter temperatures and energy efficiency improvements of buildings.

Energy Efficiency Services reported an EBITDA of 25 m€, despite the depletion of government incentives.

Lastly, an accounting change in stored gas should be noted, with a positive balance of 93 m€, compared to the negative figure of 94 m€ recorded at the end of 2022. This change indicates how the accounting difference of gas injected into storage in 2022 was completely reabsorbed.

Even the Waste area provided a positive contribution at Group level, through an EBITDA increase of 4.6% (+15.4 m€), driven by the contribution of the newly acquired ACR Reggiani, operating in the business of industrial remediation and special waste treatment. The total improvement of this area is a combination of a decline of 2 m€ in the regulated activities of waste collection, against a continuous growth in the treatment component, which benefitted from a 6.6% increase in volumes, in urban waste as well as in market ones. In 2023, the asset base was also enriched with a new Biomethane plant, in Spilamberto, near Modena. The various tenders won in 2023 on the urban collection front will also offer a positive contribution in terms of synergies and efficiencies to be gained in the coming years; they will also provide a strategic contribution to treatment activities, which benefit significantly from the possibility of intercepting large waste flows.

Lastly, the Networks EBITDA recorded a slight decrease of 3.6 m€ (-0.8%). The result derived from a strong EBITDA performance in Water (+9.5 m€), against a reduction in District Heating (-11.4 m€) and Gas Distribution (-1.6 m€), while Electricity Distribution remained stable (-0.1 m€).

In Networks, Hera benefitted from the inflation adjustment in Regulated Revenues starting in the second quarter of 2023, while still awaiting the next adjustment of 110 basis points of the WACC to reflect higher interest rate levels. Therefore, the Networks’ EBITDA reflects the positive impact of development investments, especially in the Water Cycle, and further cost efficiencies, while absorbing a negative impact of about 12 m€ due to inflation.

The total RAB, up from 3.19 €bn to 3.33 €bn, reflects increases across all businesses: electricity distribution, gas distribution and the integrated water cycle.

In 2023, Group’s adjusted EBIT amounted to 741.0 m€ (+18.0%). It rose at a faster pace than EBITDA (+15.4%) as a result of the weaker growth rate of Depreciation, Amortisation and Provisions (+13.0%).

The Result from Financial Operations posts an increase of 52.6 m€, compared to the negative balance of 125 m€ in 2022. Such result reflects the more expensive cost of money, due to the ECB tightening policy and the higher average net debt resulting from the NWC increase driven by higher prices of energy commodities. Following the liability management transactions completed during 2023, Hera has optimised its financial structure and cost of debt.

In 2023, after the absorption of 146.4 m€ of taxes, with a tax rate that remained stable at 26% as it was in 2022, Net Profit after minority interests reached 375.2 m€, posting a 16.5% increase over the level of the previous fiscal year.

Net Financial Debt at the end of December 2023 improved by 9.9%, posting a decrease from 4,249.8 m€ as at 2022 year-end to 3,827.7 m€.

As at 31 December 2023, therefore, the Debt-to-EBITDA ratio is 2.56x, well below the threshold of 3.0x that Hera has set as the reference maximum level in a high interest rate scenario.