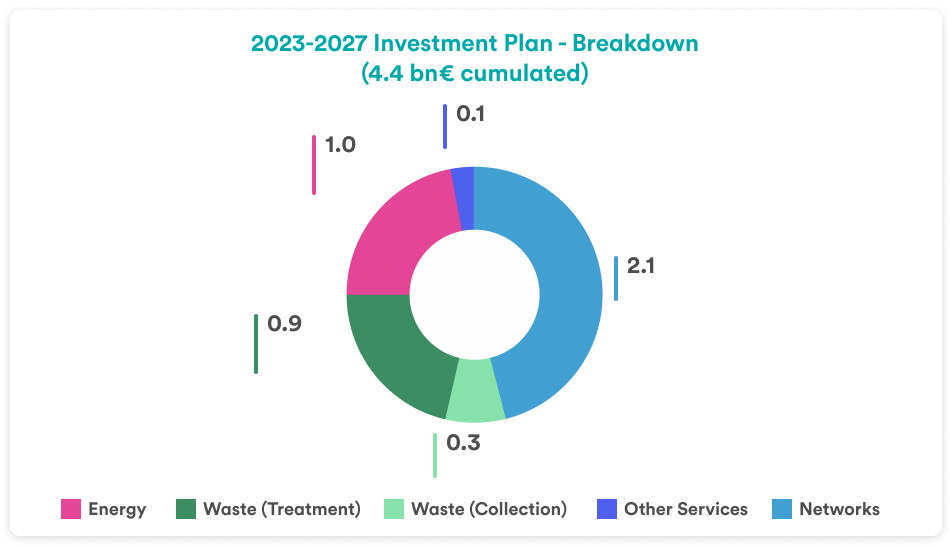

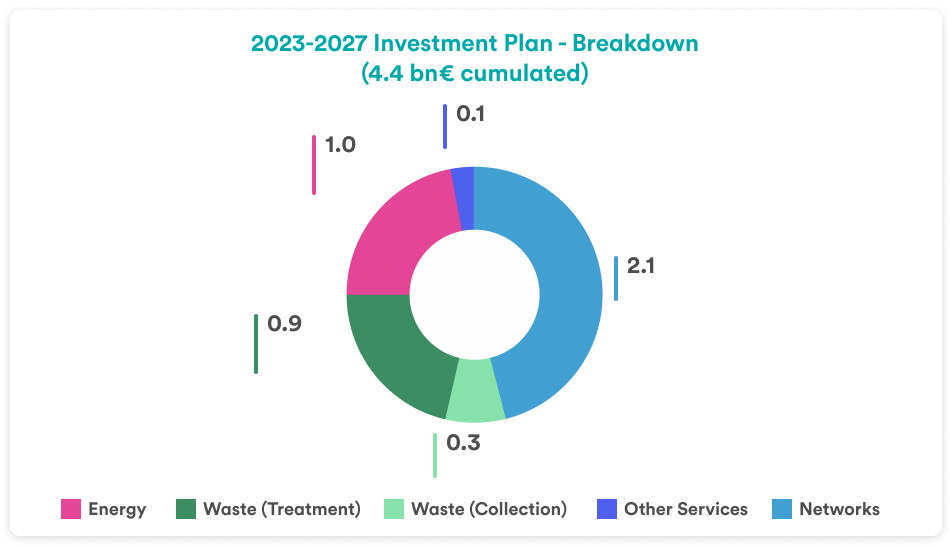

Over the five-year period, Hera will concentrate more than half (about 55%) of the 4.4 billion euro investment plan in regulated businesses (Networks and Waste collection), with the aim of enhancing the existing infrastructure and seizing the opportunities of the regulatory framework, thus generating returns with high visibility and keeping the risk profile low.

Over the Plan’s period, Energy will have available investments of about one billion euro. This area will benefit from a normalisation phase following the crisis in 2022, even in terms of lower absorption of working capital. Therefore, in Energy, Hera aims to provide a qualified offer of value-added services to a rapidly expanding customer base, as part of the electricity market liberalisation process.

For the deregulated segment of the Waste area (Special Waste for business customers), the Group has also planned a significant capital allocation (0.9 billion euro in cumulative investments) with the perspective of strengthening its leadership position and boosting returns. Through enhanced asset capacity, the goal is to seize the opportunities that come from a rapidly expanding demand for waste treatment and the drive for increasing circularity, including in specialised niches, where Hera can fully meet the articulated needs of business customers.

The higher returns expected from investments in all business areas will lead Hera along an increasingly profitable growth path in the coming years, with ROI 2027 expected to grow to 9.5%, up from 7.9% in 2022, against a controlled risk profile.

|

BUSINESS PLAN 2023-2027

|

CUMULATED INVESTMENTS 2023-2027 bn€ |

EBITDA 2027 m€ |

ROI |

4.4 bn€ investments carefully allocated to fuel growth and future returns.

The 4.4 bn€ investments Hera has planned for the 2023-2027 five-year period will mainly focus on Networks, for about 2.1 billion euro. One billion will be dedicated to projects in the Energy area. A total of 1.2 billion will be allocated to Waste, of which 900 million euro in the free market business.

All strategic areas will offer a fundamental contribution to boost EBITDA

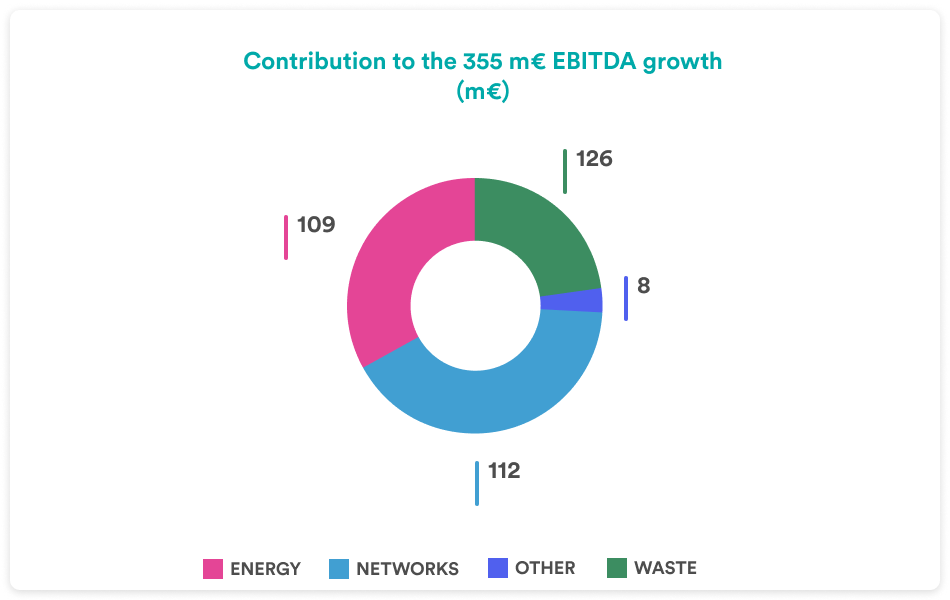

In 2027 Hera aims to achieve a 1,650-million-euro EBITDA, up by 355 million compared to 2022. A goal to which all business areas will contribute with very similar weights: 35% of growth is expected to come from Waste, 32% from Networks and 31% from Energy.

All strategic areas will offer a fundamental contribution to boost EBITDA

In 2027 Hera aims to achieve a 1,650-million-euro EBITDA, up by 355 million compared to 2022. A goal to which all business areas will contribute with very similar weights: 35% of growth is expected to come from Waste, 32% from Networks and 31% from Energy.

Therefore, 2027 EBITDA, expected at 1,650 m€, will be attributable for 40% to regulated activities and 60% to free-market activities. Networks and Energy will each come to account for 35%, while Environment will weigh in at 28%. Together, the regulated activities – Networks and Waste Collection – will come to account for about 40% of Group EBITDA.

Investments in the different business areas reflect clear priorities in terms of business strategies

In the Networks, Hera aims to take full advantage of the opportunities provided by the regulatory structure, beating the efficiency standards required by the Authority.

The robust 2.1 billion euro investment plan will enable 4.2 billion RAB to be reached in 2027, with a particularly significant increase in the water sector, whose RAB is projected to rise from 1.7 to 2.3 billion euro over the Plan’s period.

Priorities include reducing service interruptions due to breakdowns and minimising network losses, particularly in water networks, through the extensive use of predictive maintenance and remote monitoring, by leveraging on digitisation.

Hera will also be committed to investments that make the infrastructure increasingly resilient against the risk of severe weather events, which are increasing due to Climate Change.

In the logic of implementing the energy transition, investments will also prepare Hera’s networks for hydrogen distribution.

Due to these investments and the correct actions to achieve the highest returns allowed from the current regulation structure, the Networks EBITDA is expected to grow at a CAGR of 4.4%. Of the total growth of 112 million euro expected over the five-year period, approximately 69% is attributable to organic growth, while the remaining 31% comes from the new levels of WACC.

In the Waste area, Hera intends to take full advantage from the opportunities provided in Italy by a highly fragmented competitive environment and an operating scenario with favourable market price dynamics. The rise in prices is induced by a structural deficit in the capacity of existing plants compared to an ever-increasing demand, as a result of stricter requirements, including regulatory requirements, for treatment, recycling and reuse of the materials produced. For this reason, Hera intends to invest in the coming years to strengthen its asset base. Approximately 600 million euro will be allocated to building new capacity or revamping the existing one.

The goal of increasing the share of differentiated waste collection to 80%, a level exceeding the European average, is also part of the logic of releasing treatment availability in the plants with the aim of expanding its market share.

Over the Plan’s period, Hera therefore expects to expand its activities, thus generating an average annual growth of 4.2% in total volumes.

The prospects for increased ROI will come not only from new investments, carefully selected, but also from the competitive advantages built over time, through, for example, the offer of Global Waste Management solutions for business customers who need a 360-degree service, and the ability to manage waste with circular economy models in highly specialised niches, which entail higher added value, such as carbon fibre and rigid plastics.

As a result of these actions, planned investments, including M&A, and the reinvestment of all cash flows generated by the business, EBITDA in the Waste area is expected to grow at a CAGR of 7% over the 2023-2027 period. Almost 40% of the five-year growth of 126 million euro will be driven by acquisitions, while the remaining part will come from organic growth.

In the Energy area, the financial resources of the Investment Plan will be mainly dedicated to M&A transactions (to implement vertical or horizontal integrations) and to expanding the customer base, targeting 4.3 million in 2027 by exploiting the market liberalisation process. More in detail, while gas customers are expected to decrease by 100 thousand at the end of 2027 compared to the level of 2.1 million in 2022, electricity customers are expected to expand strongly, from 1.4 million in 2022 to 2.3 million in 2027.

Hera aims to defend its margins on the sale side of this business. At the same time, the intention is to strengthen the protection against possible risks, while maintaining a limited presence in power generation and continuing to match commodity purchases with the level of demand.

Development of Value-Added Services, in which Hera can leverage a recognised level of expertise, will also continue, with a CAGR around 9%, while planning a gradual extraction of value from customers in last resort markets.

EBITDA in the Energy area shows the highest expected growth over the Plan’s period, when considered gross of non-recurring ‘temporary opportunities’ until 2027. The goal is to achieve a 4.3% CAGR over the five-year period and the production of cash flow that funds investments in the business, releasing financial resources for almost 1.05 bn€.

High level returns, with a solid risk control and a balanced financial profile

As a result of the actions indicated for the various areas, the Group’s Return on Investment is estimated to reach 9.5% in 2027, vs. 7.9% of 2022.

In the five years covered by the Plan, returns on invested capital are expected to grow in all businesses.

In the Networks and Waste collection component, Hera will benefit from the 110-basis point increase in average regulated returns set by ARERA.

In the Waste area, for the waste treatment component, ROI will benefit from the upward trend in market prices and the increasing weight of value-added services.

In Energy, in addition to the expansion of market share, ROI will benefit from a lower denominator, due to the reduction in net working capital compared to the level required during the energy crisis.

| m€ | 2022 ROI |

2027 ROI | Change |

| Networks | 5.1% | 6.2% | +110bp |

| Waste (Collection) | 5.6% | 6.3% | +70bp |

| Waste (Treatment) | 12.6% | 13.1% | +50bp |

| Energy | 10.6% | 18.2% | +760bp |

| HERA GROUP | 7.9% | 9.5% | +160bp |

The strengthening of consolidated ROI by 160 basis points takes shape – an element, which should not be underestimated – against an overall conservative risk profile, considering the significant incidence of regulated or semi-regulated businesses, the visibility of returns on planned projects in free-market businesses, and the strong competitive advantages that the new Investment Plan will only further enhance.