While the major European stock markets are at their highs since the beginning of the year, Hera’s share price still has significant room for appreciation, as reflected by the large discount to the average target price of 3.4 euro of the analyst coverage.

Despite the good performance that the share price has put in compared to the 2022 year-end price of 2.53 euro, and despite the 5% yield of the 2022 dividend paid in June, Hera can offer further satisfaction to shareholders, according to Jens Klint Hansen, Hera’s Director in charge of Investor Relations, whom we interviewed.

After the Annual General Meeting, the newly appointed Executive Chairman and CEO met with a large group of portfolio managers representing about half of Hera’s capital owned by institutional investors, confirming that they intend to stick to the strategic approach of the Plan to 2026 and ensure the most effective execution of the Plan as possible.

A fact that is already fully visible in the acceleration of the EBITDA growth for the second quarter of 2023, which the financial community can positively discount.

Which elements have shaped the stock markets’ performance in recent months?

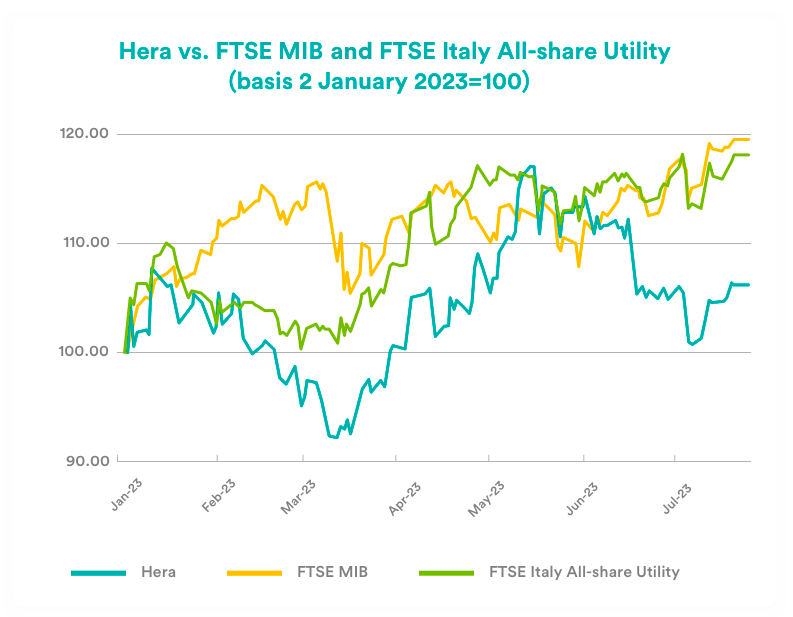

Despite the relentless stance of the Central Banks, which are continuing with restrictive policies pending verification that the first signs of cooling inflation are not a temporary occurrence, and despite continuing geopolitical tensions, the main European equity markets are on their highs since the beginning of the year. Indeed, many investors have seen the moment when the Central Banks will end the rate hike process getting closer and have bet on the idea that restrictive monetary policies will not produce a deep recession. Hence, while the CAC40 and the DAX have performed around 15% since the beginning of the year, the FTSE MIB has largely outperformed the other indices, having gained more than 20%, being driven by some stocks in the banking, luxury, and technology sectors, which have a significant weight by capitalisation in the index itself.

And what about the performance of Hera’s shares?

From the year’s low of 2.38 euro on 13 March, on the back of solid fundamentals, Hera’s share price had made an upward movement that took it to a high of 3.03 euro on 15-16 May. Despite the sound quarterly results, the share later retraced, touching a period low of 2.61 euro on 10 July, from which it has recently pulled back, recovering to around 2.75 euro. Hera is now up about 10% since the beginning of the year, thus in line with the performance of the Stoxx Europe 600 index. However, it should also be considered, in terms of Total Shareholder Return, that as of 21 June our shareholders have been paid a dividend per share of 12.5 euro cents, which represents a yield of around 5% on the 2022 year-end price.

What bearing does the current analyst coverage give us?

Currently, the consensus target price is 3.37 euro, up a touch after the latest research published by Kepler Cheuvreux, which raised its target price from 3.00 to 3.30 euro. Currently, after Intermonte upgraded the stock from Neutral to Outperform, six out of seven analysts recommend buying Hera shares, while only one has a neutral rating. No analysts suggest selling. At its recent price of around 2.75 euro, the stock is more than 22% off the average analysts’ target price.

| Broker | Rating | Target price (€) |

| Banca Akros | Accumulate | 3.40 |

| Banca IMI | Buy | 3.40 |

| Equita Sim | Hold | 3.30 |

| Exane BNP Paribas | Buy | 3.30 |

| Intermonte | Outperform | 3.30 |

| Kepler Cheuvreux | Buy | 3.30 |

| Mediobanca | Outperform | 3.60 |

| Average | 3.37 |

How do you think the release of half-year results approved at today’s Board meeting will be interpreted?

I think the results released today exceed analysts’ expectations, also in their quality. Certainly, we confirm that we are well ahead of the growth path outlined in the Plan, as we have already achieved 65% of the target EBITDA growth in 30% of the time. In the half-yearly report, we also present a significant reduction in debt, which is down by more than 100 million compared to the end of 2022. Eventually, our equity story emerges even stronger from the evidence of half-year results. Therefore, I expect both confirmations and positive surprises to be reflected in a recovery of the share price, which had already shown in mid-May that it could reach above 3 euro again. Not even the ex-dividend of 12.5 cents per share, which took place on 19 June, has been recovered yet, despite the upward mini-trend that started on 10 July. The reasons for reaching new highs are all there, not least because we have conducted several meetings with investors over the last few weeks that we believe have shed new light on Hera and fostered a more direct knowledge of the new top management, appointed after the Shareholders’ Meeting on 27 April.

What activities did you carry out?

In the wake of the new governance, without waiting the classic ‘100 days’ usually given to a new leader, we set off, with the Executive Chairman and newly appointed CEO, on a series of meetings with buy-side investors. Actually, Executive Chairman Cristian Fabbri had already been at Hera since 2005, just as CEO Orazio Iacono had already been co-opted into the role in May 2022. This did not detract from the fact that it was important for investors to have confirmation directly from them that Hera would stick to the strategic approach set out in the Plan to 2026 and that there was a commitment from the management team to the quick execution of the Plan. In Milan, we attended the Unicredit Conference on 25 May, and the Mediobanca CEO Conference on 21 June. In London, we attended the Goldman Sachs Utility Conference on 30 May. Matter of fact, the new senior management has already met investors representing 50% of the capital in institutional hands. In addition, the Executive Chairman and the CEO hold a total of 60,000 Hera shares, thus proving an engagement that is highly appreciated by the financial community.

Do you have new appointments scheduled for the second half of the year?

Absolutely. In early September we will participate in both the Sustainability Day and the Infrastructure Day, two events promoted by Borsa Italiana, while in early October we will have the Banca Akros-BPM Investing Emilia Romagna event, here in Bologna. In mid-November the MidCap CEO Conference of Exane BNP Paribas awaits us in Paris, while at the end of November we will fly to Australia for the Utilities & Infrastructure Conference organised by Mediobanca. In terms of Investor Relations, we will try to seize all possible opportunities to make Hera better known to a wide audience of investors, sure that this will allow them to have more elements of evaluation to make an investment decision.