To explain how the new Plan to 2025 signs a substantial change of pace compared to the Plans that Hera presented in the past, we focus on evidence emerging from the key targets.

From this exercise, some of the features that characterise the Group’s new strategic commitment for the coming years appear crystal clear:

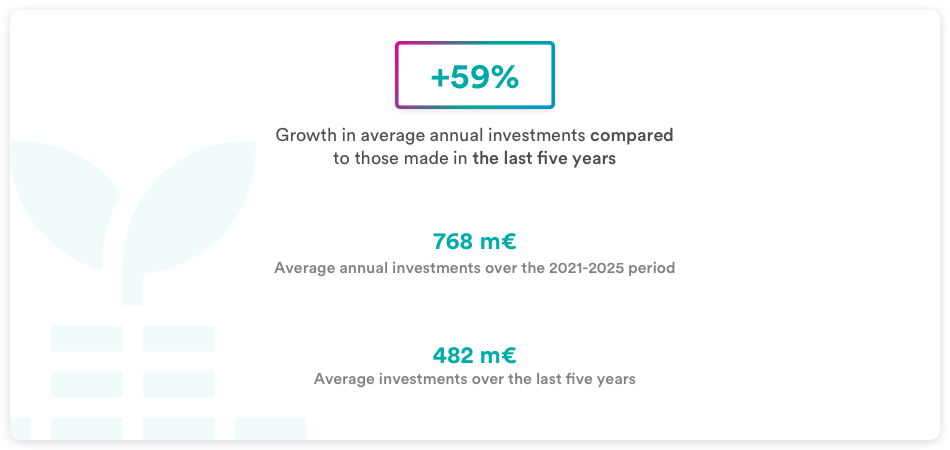

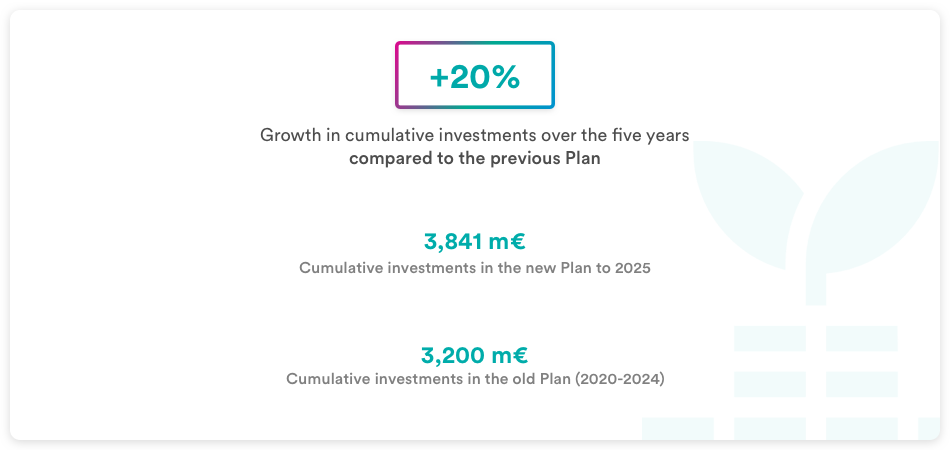

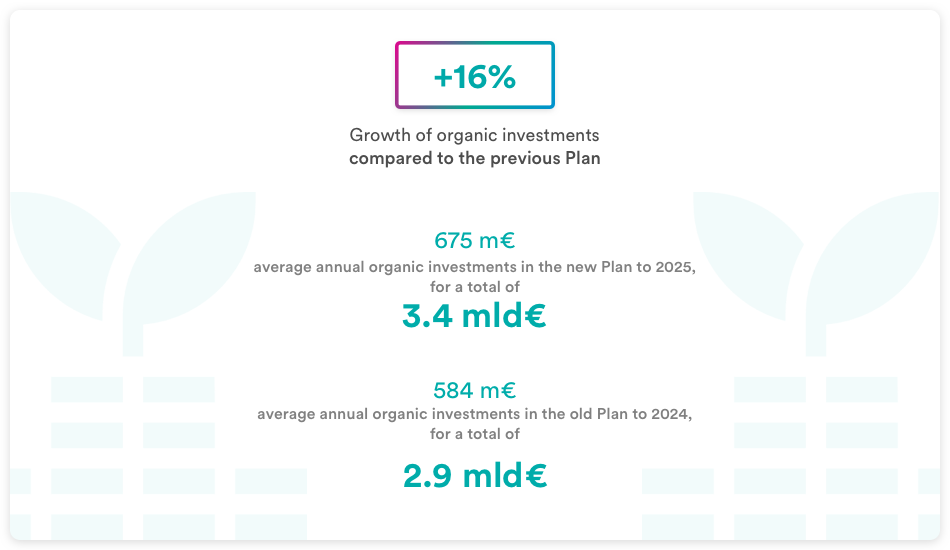

- The average annual investments planned are in total 59% higher than those made in the last five years and 20% higher than those in the Plan to 2024, with a significant contribution from organic investments (+16%)

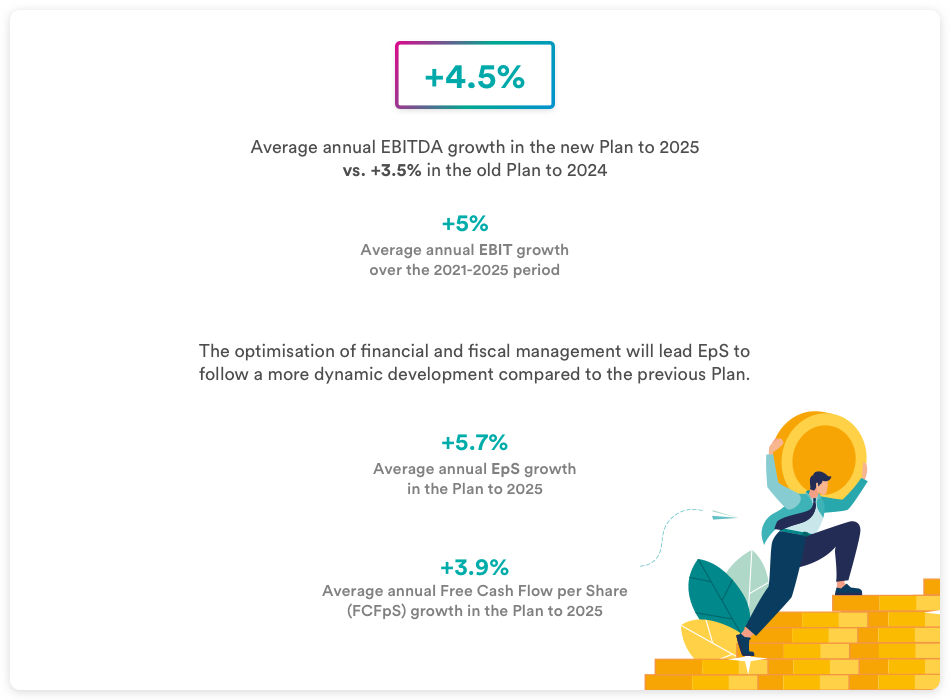

- EBITDA growth accelerates in the 2021-2025 period compared to the 2020-2024 period (+4.5% vs +3.5%)

- the increase at EBITDA level translates into Earnings per Share increase (+5.7% annual average over the 2021-2025 period) to a greater extent than in the past

- the cumulative Free Cash Flow increases by 29% compared to the previous Plan, allowing for a full funding of investments and dividend distribution while leaving the Debt/EBITDA ratio substantially unchanged

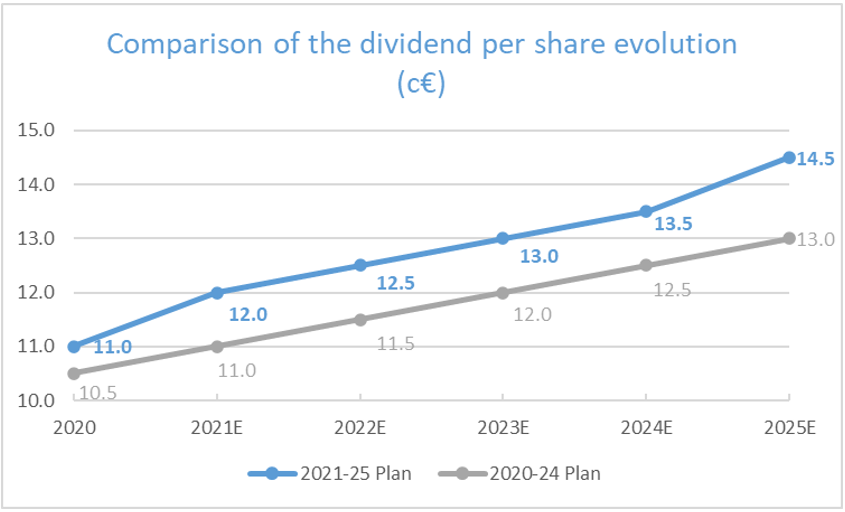

- Over the five years of the Plan, Hera will distribute a Dividend per Share growing according to a progression that reflects the pace of increase of Earnings per Share (+5.7%). Therefore, the cumulative annual dividends rise by 14% compared to the previous Plan.

The investments that Hera will deploy over the five-year period have a far greater size.

The new investments plan for the 2021-2025 period is more focused on organic investments – maintenance and development of network infrastructure, development of new plants and application of technological innovations to Group assets.

Hera also increases the investments planned for both M&A and participation in tenders for the renewal of regulated service concessions.

As a result of the ambitious 2021-2025 investment plan, EBITDA is expected to accelerate compared to the previous Plan.

Given the strict discipline in the selection of investment projects and benefitting from increased efficiencies, the higher Free Cash Flow projected in the 2021-2025 Plan make it possible to fully fund both the capex and the dividend distribution.

Based on an average annual EpS growth of 5.7% over the 2021-25 period, Hera can offer a higher remuneration to its shareholders compared to the previous Plan.