With its sustainable approach to business, the multiutility nature and many circularity projects matching the Recovery Fund, Hera is well positioned to leverage the increasing sustainability demand coming from the policy makers and from the market itself.

Leveraging 98% of investments that are taxonomy-compliant, and for about two-thirds consistent with Shared Value criteria, Hera expects to give a strong “Green” boost to EBITDA growth.

Also Shared Value activities will increase their weight, reaching 55%. The ambitious sustainability targets to 2030 will be a bit closer, since, by the horizon of this Plan, Hera aims to reduce Scope 1+2+3 emissions by 26% and increase the amount of plastics recycled by 125% compared to 2020.

| BUSINESS PLAN 2021-2025 | EBITDA 2025 m€ | CUMULATED INVESTMENTS 2021-2025 m€ | EARNINGS PER SHARE 2025 c€ | DIVIDEND PER SHARE 2025 c€ | DEBT/EBITDA 2025 |

| 1,400 | 3,841 | 27.3 | 14.5 | 2.8X |

Hera enjoys some competitive advantages that are essential to seize the opportunities in the new scenario

The new Plan to 2025 is framed within a scenario that sees sustainability issues that are priorities for European policies, in respect of which Hera can show solid competitive advantages. The business positioning established over time is the result of a vision that is strongly oriented towards the achievement of decarbonisation objectives and the development of a circular economy.

A second advantage for Hera is the multi-utility nature of the portfolio of activities, which today takes on a new value: many innovative and sustainable solutions require a coordinated action between different areas, as in the case of green gas, where water cycle, environment and networks act in synergy. A third advantage is related to the fact that many of these project initiatives are supported by the Italian Recovery Fund. To date, we have already identified about 250 million euro of new projects for which it would be possible to access financing from the Fund, even though we have embedded less than half of them in the Plan to 2025.

The awareness of this positioning, ideal for the new context, has led us to confirm with increasing confidence the strategic framework we introduced last year, which is articulated along the three main drivers of Creating Shared Value: carbon neutrality, resource regeneration and closing the loop, as well as resilience and innovation.

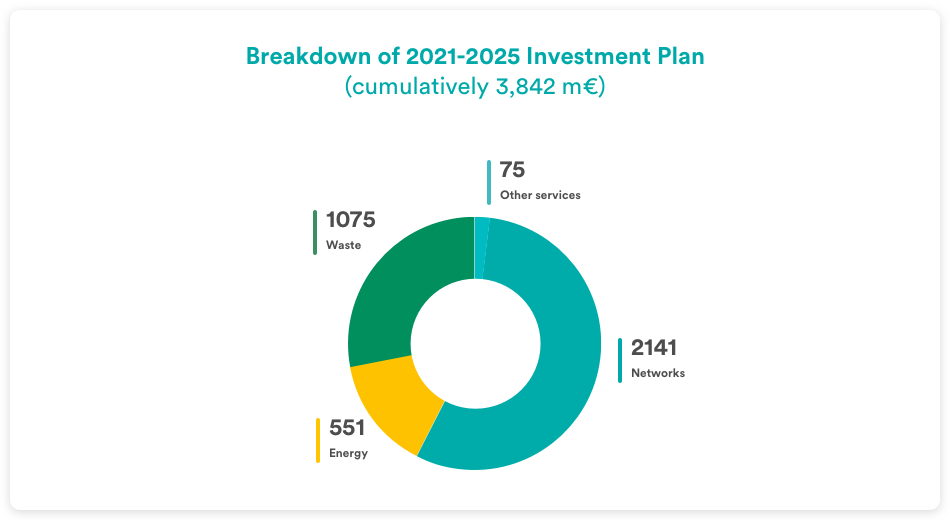

3.8 billion euro investments to boost sustainable development

The capex plan of 3.8 billion euro for the period 2021-2025 are mainly allocated to Networks with around 2.1 billion euro, followed by Waste with around 1 billion euro, and Energy, which absorbs just over half a billion euro.

While around 98% of the investments in the five-year period are taxonomy-compliant, i.e., identifiable according to the criteria of the European taxonomy of sustainable investments, it should be also considered that around two-thirds of the total 3.8 billion euro of investments are also fully consistent with the criteria of Creating Shared Value.

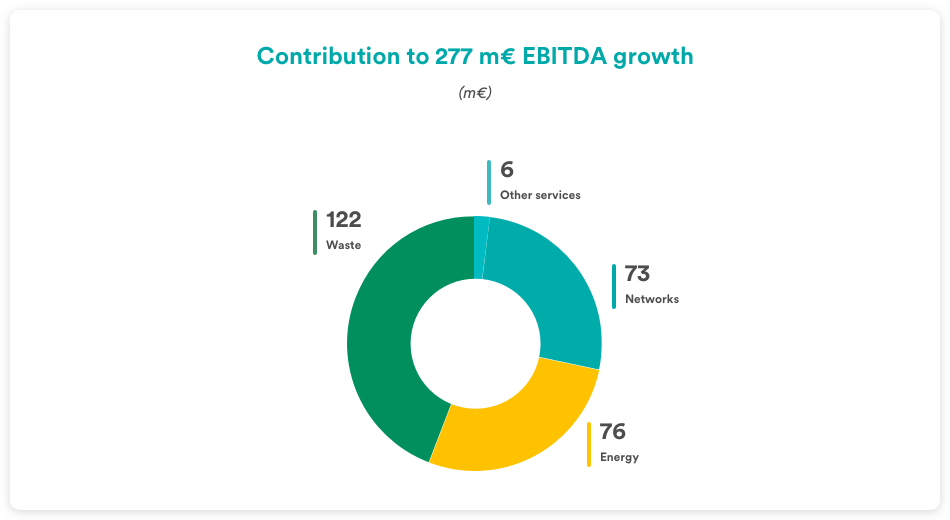

The composition of capex, according to their expected returns, is also reflected in the dynamics of EBITDA.

The road to reach a 2025 EBITDA of 1.4 billion euro passes through a contribution of 122 m€ from Waste, 76 m€ from Energy and 73 m€ from Networks.

The Waste area doubles its contribution compared to the previous plan, reflecting the greater visibility of the growth opportunities that the market presents. In the Energy area, by leveraging the efficient operating structure, we expect to be able to expand market shares, to offer new value-added services and to continue to pursue the opportunities of energy efficiency. Finally, the contribution of Networks, in the 73 m€ forecast, incorporates the negative effect of 22 m€ linked to the reduction in WACC announced at the end of 2021.

This will lead us to have an EBITDA in 2025 that will express a 43% contribution from regulated activities, while a share of 57% will be generated by liberalised activities, in line with the trend that has emerged over the last two years.

To achieve the ambitious 2030 sustainability goals, targeted initiatives will already be implemented in the 2021-2025 period

However, the 2025 outlook is merely a step along the path to 2030 already defined last year, which we have updated in light of the initiatives included in the new Plan.

On the carbon neutrality front, the first SBTi-certified 2030 target is to reduce Scope 1+2+3 emissions by 37%, with an intermediate step to 2025, where the target is set at 26%. One of the most important levers will be to increase the penetration of renewable energy sales to industrial customers, as Hera can already boast a 100% penetration rate of renewables in the residential sector.

Similarly, on the circular economy front, which is the second pillar of Shared Value, the targets are very ambitious. In particular, in plastic recycling, we aim to make significant progress over the five-year period covered by the Plan, increasing by 125% the volumes recycled by 2025, which will bring us very close to the target of a 150% increase by 2030, in both cases compared to 2017.

With these premises, we have given ourselves the objective of increasing to 70% the incidence of Shared Value EBITDA on total EBITDA, thus uplifting the 55% weight that we target for 2025 by additional 15 percentage points.

A clever business strategy guides capex in the different business areas

In the Waste area, the intention is to exploit the strong expansion and increasingly sustainable direction of demand, to go beyond the mere waste treatment and become more and more involved in the circular economy, with the expansion of our plastics processing capacity. We also aim to play a role in the development of green gases. Therefore, in biomethane we have planned to double our production capacity by building two new plants.

In the Energy area, our promise is to increasingly act as an enabler of our customers’ energy transition, by leveraging an already well-structured and scalable platform. We will invest in further improving the customer experience, not only to make it more effective, but also to keep the cost-to-serve constant over time, despite the broader range of new features offered.

At the heart of development in the Energy area will also be the creation of an increasingly rich “Product Factory”, to be brought to market with a very short lead time through a number of value-added services.

As part of the process of liberalising the “maggior tutela” segment, we want to gain around one million customers in order to have a dominant share in the electricity area by the end of the Plan. The dual offering logic will help us lead customers towards the energy transition, which involves an electrification of consumption.

With regard to Networks, the main growth drivers are development capex dedicated to infrastructure, which will bring the total RAB to 4 billion euro, and new efficiencies on the side of structural costs, for 40 million euro, through innovations that will enable more advanced management models.

Hera aims at continuous innovation in networks to enhance their resilience, also considering the climate changes, by increasing the digitisation level of the infrastructure to have more efficient control systems available.

Green gases represent for Hera another strategic area of development, since the Group can produce renewable gas and hydrogen from organic waste or sewerage water residues and deliver them to industrial customers, or even inject them into the gas distribution network so that they can be used for private customers, sustainable mobility, or heating. The Power-to-Gas Project, which integrates with the water system, is already in the execution design phase.

Higher financial returns, with positive results in all lines of P&L

Driven by the growth in the results of operations, we estimate an improvement of 10 basis points in Return on Investment, ROI, which we expect to reach 8.7% in 2025. This is a considerable achievement in view of the WACC cut affecting the capital invested in regulated businesses, which accounts for 60% of the total.

Return on Equity, ROE, should reach 10.6% in 2025, compared to 10.2% in 2020, as it benefits from the stability of tax rate, expected to remain at 27%, and the optimisation coming from financial management.

The liability management operations completed in the last two years allow us to have only 17% of our debt maturing over the five-year period of the Plan, with an average duration of debt of more than 7 years. Considering the modest size of the debt to maturity, the expectation of reducing the cost of debt to 2.3% in 2025, from 2.9% in 2021, is highly visible.

Strong cash generation from operations, expected to reach 4.5 billion euro, will allow for a fully funding of investments and dividend payments, except for financial investments for M&A, which we estimate to be around 700 million euro. Free Cash Flow per share would therefore amount to 28.5 euro per share in 2025, showing a CAGR of 3.9% over the Plan period.

The Debt-to-EBITDA ratio will remain around 2.8 times in 2025, compared to 2.9 times at the end of 2020. Therefore, we still retain the financial flexibility needed to seize additional M&A opportunities, on top of those already identified.