Recently, Hera has successfully placed a 500 million euro green bond with 8-year maturity, at the same time repurchasing 210.60 million euro of issued bonds with shorter maturity and higher coupons. An operation with a positive impact on the Company’s financial profile, confirming how strategic Hera approach to sustainability really is.

We talk about these transactions with Luca Moroni, Hera’s CFO.

| Size | 500 €m |

| Maturity | 5 July 2027 |

| Coupon | 0.875% fixed, annual |

| Price | 98.407 (1.084%) |

| Spread | +105 bps |

| Listing | Irish Stock Exchange |

| Luxemburg Stocl Eschange | |

| ExtraMOT PRO of Borsa Italiana | |

| Trading Date | 26 June 2019 |

| Offeror | BNP Paribas |

| Target Notes | EUR 3.250% 2021 Notes |

| EUR 2.375% 2024 Notes | |

| Accepted Amount | 39.99 mn on 500 €m Oct-2021 |

| 170.61 mn onu 500 €m Green Jul-2024 | |

| Total Amount | 210.60 mn |

| Commencement of the tender offer | 19 June 2019 |

| Settlement Date | 1 July 2019 |

Originally, the green-bond market was designed to fund climate change related projects. Recently, it is expanding to embrace several projects linked to the pursuit of UN’s Sustainable Development Goals (SDGs). Does that find a validation also in the evolution of the nature of Hera’s issues?

Hera’s issues actually reflect this trend. In 2014, we were the first in Italy to issue a bond linked to sustainability performance, on projects mainly connected to energy efficiency and recycling. In the case of this new issue of 500 million euro, we considerably widened the scope, identifying some eligible projects that would meet the SDGs in three specific areas: first of all, “Water Infrastructure”, secondly, “Energy Efficiency and Energy Infrastructure”, and lastly, “Circular Economy and Sustainable Waste Management”.

The company ISS-oekom, which evaluated our Green Financing Framework, also awarding Hera the Prime status as Issuer with B- rating, has verified in its Second Party Opinion that many of our projects significantly contribute to SDGs’ pursuit. More specifically, among the projects financed with the new green bond, ISS-oekom reckoned we really have a meaningful impact on the following SDGs: 6 “Clean water and sanitation”, 12 “Responsible consumption and production”, 7 “Affordable and clean energy” and 13 “Climate Action”.

Was the nature and effectiveness of the projects presented a key factor in convincing investors to underwrite the new green bond?

Definitely it was. Investors, to mention a few examples, have particularly appreciated the features of our new sewage plant in Servola, close to Trieste, which is able to fine-tune its intervention based on the salt concentration in the water and the nutrients that the sea needs. In the environmental business, investors realised that Hera’s leadership is not purely based on volumes of waste treated, but that it also leverages on the quality of service provided to citizens, as in the case of the consumption-based charging we could develop in Ferrara, or the biomethane plant entered into operations in Sant’Agata Bolognese. Even more, from the smart metering projects will clearly derive more efficient management and maintenance of the network, but even higher visibility to households on the pattern of their own consumptions. During our roadshow in Milan, Paris, Amsterdam, Frankfurt and London, from 20 to 25 June 2019, investors’ attention was highly focused on the analysis of each projects, in terms of its impact, technology content, and length. From this last point of view, they indeed appreciated that we had presented a good mix of projects over a three-year time span.

Is there any specific reason why you focused on European financial centres?

Sustainability wise, Europe has larger assets under management and still a better ability to evaluate and appreciate what is worth financing compared to the other Continents, despite in the last few years, US fund raising on green bonds is increasing very fast.

How does Hera’s financial profile change after this bond issue?

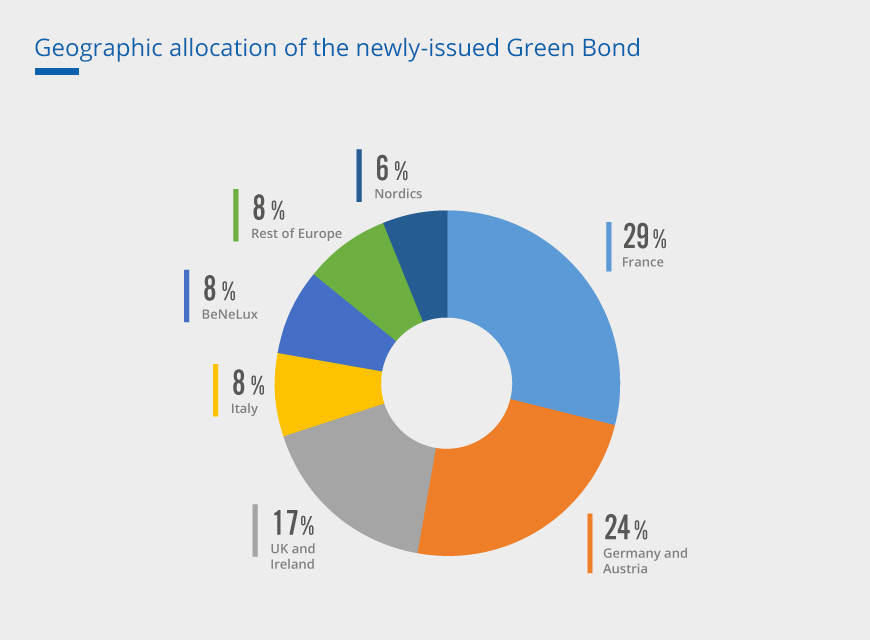

Through the combined operation of the tender offer, with which we withdrew from the market 210.60 million euro of bonds, and the 500 million euro green bond issue, we could meet different needs. We extended the average maturity of Hera’s debt, reduced its cost, and diversified the bondholders’ base. Not only did we place bonds with investors in different European countries, we took on board several new institutions focused on sustainable investing.

Could you leverage on the good visibility and sound track-record of Hera’s shares?

Despite quite rigid divisions between equity and income structures inside the single institution, our reputation on the stock market, thanks to economic and financial targets always achieved over time, and the solid positioning in terms of credit ratings and ESG commitment, clearly helped us to raise new funds at a competitive price on the debt market. Thanks to the strong interest we have found – demand was actually seven times the amount offered – we were able to issue the bond at an undeniably good price. With this operation, we reached the lowest NIP, ie New Issuance Premium, ever achieved by an Italian company in a public issuing of a Eurobond.

The benefits for Hera are clear. What are the advantages of the green bond from the investor point of view?

The investor has complete transparency on the allocation of the funds raised. We put in place an accurate monitoring and reporting process for any project. Every year, in our Sustainability Report, we will track the amount of funds used for the single initiative, together with the environmental performance consequently reached.

Hera has taken the road of sustainability in a strategic way.

The newly-issued green bond reflects how this is true also in the financial management of the Company.

Green bond issues continue to increase: from less than 20 bn USD in 2013, they scored more than 180 bn USD in 2018. They reached a cumulative stock of more than 600 bn USD by the end of 2018, according to Climate Bond Initiative’s data.