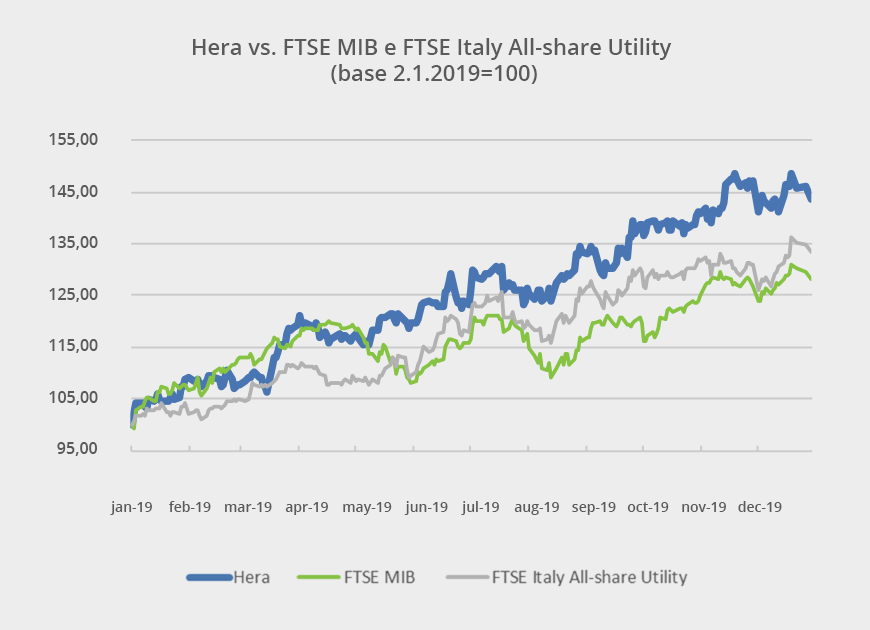

In 2019, Hera stock price surged by 46%, outperforming both the FTSE MIB (+28.1%) and the industry index (+35.0%).

The strong rally of Hera shares took place against a benign backdrop for equity investments, especially favouring the utility sector. The long-lasting scenario of low interest rates has played a key role in paving the way for multiples re-ratings, while geo-political uncertainties were mainly fuelling short-term volatility.

In early 2019, Hera stock price promptly recovered, wiping off the negative performance recorded in 2018. At a Company-specific level, the strong rise in stock price was driven by the entry in the blue chips index of the Italian stock exchange, which took place on 18 March 2019. Passive investors that have to fulfill their tracking mandates, using the FTSE MIB index as a benchmark, had to include Hera’s shares in their portfolios. Moreover, among active investors, Hera gained additional visibility and could approach new qualified institutional professionals, mostly at international level, given its improved liquidity profile.

Therefore, over the last twelve months Hera saw a quick reshuffling in its shareholding basis, with the exit of the PIR funds (Individual Savings Plans) that focus on small & mid-caps, and the entry of a number of new funds, both on the active and the passive side. Most of them were among the 100 institutional investors met during the roadshow for the presentation of the 2018-2022 Plan.

During 2019, consensus target price of the eight analyst covering Hera stock moved from 3.28 euro in January 2019 up to 3.87 euro in December 2019, with an overall 17.8% increase. In the meantime, the stock price – which had first closed the gap with the consensus target price near to the release of FY18 earnings – continued its rally. From October onwards, Hera stock prices remained above the brokers average target price.

So, what does that say to us? Likely, while sell-side analysts are just holding out to update their earnings estimates and valuations following the release of the new Business Plan, buy-side investors state their valuation every day, buying and selling shares. A portfolio manager that either buys or holds Hera’s shares at current prices believes that Hera can increase its market value in the future. The valuation from the buy-side is therefore more generous than that of the brokers just now. That also proves how effective was the 2019 effort we made to disseminate the Hera equity story across the leading international financial centres, even in Australia and in the US.

In presenting the Plan to 2023, we provide the equity story with more growth, more visibility and an authentic sustainable signature

The presentation of the new Plan to 2023, with the extensive roadshow scheduled over the coming weeks, is an event that we address with solid strategic messaging and strong commitment from senior management, as usual.

The new Plan is deeply consistent with the investment case that Hera has been representing to date. From this point of view, those who have invested since they were believers in our story will only welcome it as a sound confirmation. However, the 2019-2023 Plan also includes some new elements that might attract a broader spectrum of investors. The equity story comes out stronger in terms of growth rate; it also shows higher visibility and lower risks; the five-year dividend increase is higher; and, last but not least, it boasts an authentic sustainable signature. Considering that today ESG (Environment, Social & Governance) investors are no more a niche, but a mainstream reality that is present across different asset management classes, we will enjoy an even broader audience, interested in hearing and analyzing our new Plan.