The 2024-2028 Business Plan reaffirms significant features of the previous one, especially in its strategic design. Hera intends to remain consistent with a business model and management approach proven to ensure continuity of growth while maintaining a low risk profile, even under very challenging external scenarios.

The targeted ROI of 9.5% in 2028 derives from a significant 4.6 billion investment plan, mostly aimed at making sustainability goals a reality. About half of the development investments are dedicated to the strengthening of the Networks’ infrastructure.

Despite the weakening of growth prospects in Europe, Hera expects to succeed in offering its shareholders an average Total Shareholder Return of about 11% per year over the 2024-2028 period, thus improving the extent of value creation compared to the previous Plan while maintaining a prudent Debt-to-EBITDA ratio, expected at 2.8x in 2028.

The commitment to sticking to a strict discipline, not only in capital allocation but also in leverage levels, is not a constraint. On the contrary, it allows for further growth momentum, with approximately one billion euro of resources available to seize the right investment opportunities, going beyond those already included in the Plan.

The better-than-expected preliminary 2024 results and the visibility on future returns justify a more generous dividend policy than under the previous Plan, starting with the dividend per share for fiscal year 2024 that will be proposed at 15-euro cents.

Dear Shareholders,

After presenting, last January, the 2023-2027 Business Plan that was appreciated for its rigorous value creation principles, we are pleased to share the preliminary 2024 results, showcasing its early achievements.

These preliminary figures for the just-ended financial year reassure us, as much for the fact that the strategic choices proved to be sound as for confirming that the Hera’s people can implement them effectively.

2024 EBITDA growing beyond expectations

FY2024’s performance provides reassuring indications on both quantitative and qualitative profile.

With an expected EBITDA above 1,550 million euro, representing an increase of over 50 million euro compared to the previous year, we confirm our track record of continuously improving results over time. The achieved EBITDA level also exceeds the expectations of analysts’ consensus.

On the other hand, the progress achieved in 2024 is also very appreciable due to the structural and repeatable nature of revenues: this achievement comes despite the complete exhaustion of opportunities linked to the 110% Ecobonus tax incentives, which we had successfully leveraged in the previous three years.

The business portfolio made a choral contribution to the achievement of this progress, with the positive dynamics of Waste and Networks, and an Energy business that was able to almost completely offset the depletion of Ecobonus revenues thanks also to the normalisation of the 2023 shaping costs. The significant cash generation also allowed us to keep investing while, at the same time, maintaining the leverage stable at 2.6x at the end of 2024, confirming a situation of virtuous financial strength and the availability of potential resources to seize future acquisition opportunities.

The new Plan remains consistent with the previous one in its strategic approach

The effective response that Hera managed again to provide during the last fiscal year, in an uncertain and complex scenario, posting continuously improving results quarter after quarter, has reinforced our conviction that it is appropriate to stick to the effective strategic framework set in the 2023-2027 Plan.

We will therefore continue,

even in the coming years,

to promote sustainable growth, aiming at value creation.

Real value-creating growth will require satisfactory returns on investment and compliance with appropriate levels of financial flexibility, just as the logic of genuine sustainability will require business choices consistent with a long-term orientation and continuous stakeholder focus. We will also keep on strengthening the resilience of our performance by focusing on the benefits of a well-balanced multi-business portfolio and conservative risk management.

In the Plan to 2028, Hera aims at enhancing value creation for shareholders

According to the logic already expressed a year ago, in Hera we intend to measure the value we create based on the spread between Return on Investment and WACC.

With the goal to move the ROI at the end of the Plan up to 9.5%, we expect to see the ROI/WACC spread expanding from the 370 basis points of 2027 in the previous Plan to approximately 400 basis points in 2028.

Therefore, Total Shareholder Return stands at double-digit levels, around 11%, through the contribution of an average growth of EpS of about 6% and a dividend yield close to 5%.

Despite the weakened growth

prospects in Europe, we maintained a

significant level of TSR with no change in the

conservative risk profile, aware of the resilient features

that our multi-utility portfolio provides.

We confirm our commitment to focus on businesses that create sustainable value

For many companies, being sustainable means having to pay a price in terms of slower growth or reduced profitability. For Hera, it is the opposite.

Sustainability, the second pillar

of our strategy, is a true growth catalyst.

Over the Plan’s period, we expect that cumulative CSV EBITDA – according to the Creating Shared Value approach, referable to activities that create shared value – can post a 350 million increase, far beyond the total growth included in the Plan, moving from 52% in 2023 to 66% in 2028, fuelled by planned investments that are 96% in line with the EU taxonomy.

This approach entails focused and ambitious investment decisions, which will absorb resources on three fronts over the 2024-2028 five-year period: initiatives dedicated to improving the circularity of resources for approximately 2 billion euros, projects that will progressively lower CO2 emissions for 1.1 billion, and, not least, activities aimed at making our assets even more resilient and ready to cope with the increasingly frequent and intense exogenous phenomena, for 2.4 billion.

We want to create sustainable value while maintaining the risk as low as possible

Our third strategic priority, strictly connected to the previous two, is to safeguard the resilience of results and ensure visibility to cash flows. Over time, Hera has refined its ability to protect itself against operational and macroeconomic risks through an evolved Enterprise Risk Management system that centrally oversees all the Group activities.

To this effect, in addition to using the leverage of properly calibrating the weight of the different businesses in our portfolio, with a balance between regulated and unregulated activities, we are always striving to manage the liberalised activities according to a rationale that sets the right degree of risk-taking against the achievable returns.

This approach guides all our investment decisions, both in operations and M&A, as well as our policies in supply, finance and hedging.

In line with the previous Plan, we confirm a structural growth of EBITDA at an average rate of 7%

In the 2024-2028 Plan, we aim at reaching a 2028 EBITDA of 1.7 billion. This hike over the five-year period will be driven by 375 million coming from organic expansion and by 100 million deriving from the M&A activity – which thus counterbalances the exhaustion of non-recurring market opportunities.

Therefore, we are aiming at a growth rate aligned with that included in the previous Plan, but with greater visibility regarding the second component. The recently announced agreement to increase our stake in AIMAG covers, net of synergies, around 77% of the 100-million EBITDA increase stemming from the perimeter expansion.

We expect all businesses to offer a positive contribution to the Group growth, leveraging factors with a structural nature. By 2028, with the incentivised energy efficiency interventions for buildings no longer in place, we anticipate the rebalancing of a well-diversified business mix, with 36% of EBITDA coming from Networks, 28% from Waste and the remaining 34% from Energy.

We will continue to invest with full belief: we plan to dedicate 250 million euro more to the five-year Investment Plan compared to the previous Plan

Behind this expected operating performance there is a 4.6-billion-euro Investment Plan, 2.4 billion of which is dedicated to development.

We aim at strengthening our assets: more than half of development investments will be devoted to raising the RAB in the Networks, while 0.7 billion will be dedicated to Waste, for the construction of new treatment plants or the acquisition of companies that own already existing plants, following a make-or-buy logic.

With as much as 60%

of development capex focused on

regulated infrastructures, we can

count on a high visibility of future returns.

We will dedicate 500 million to Energy, which typically absorbs less invested capital than other businesses, with the aim of supporting the expansion of the customer base and strengthening the renewable asset portfolio.

A large share of the Free Cash Flow generated will support investments in development, driving new growth.

Hera will generate significant operating cash flows, which we expect to reach a total of 5.5 billion euro over the Plan period. Net of investments to maintain the high quality of our assets and absorption in working capital and provisions, we expect to have a Free Cash Flow of about 3 billion – resources that will be approximately 80% reinvested in development capex and M&A.

The 900-million-euro FCF generation from Waste will be fully dedicated to development capex and M&A in the same business, to enhance the strong competitive advantages that we enjoy as a leader in a market with a structural shortage in plant treatment capacity relative to demand. Such a position allows us to benefit from attractive returns against a controlled risk profile; therefore, we aim at making it increasingly solid.

Also in Networks, 700 million FCF will be fully reinvested with the aim of expanding the RAB, covering roughly 50% of the overall capex planned.

Lastly, in the Energy area, we expect a robust FCF generation, of approximately 1.5 billion cumulatively over the five-year period. Since this is a low capital absorption business, we plan to reinvest in development capex and M&A only 30% of that amount. Around 40% of FCF will be therefore dedicated to funding the Networks investment plan. Finally, the remaining 30% will finance the distribution of dividends to Hera shareholders.

Therefore, Hera creates value not only

ensuring the most viable profitability in

each business but also providing portfolio balance

and reinvesting the excess cash from a business

to support the investments in the other ones.

Given this carefully weighted allocation of the cash flow generated, at the end of 2028 we expect to achieve a cautious financial leverage of 2.8x.

We strengthen our risk/return profile

A careful optimisation of capital allocation is at the heart of the high returns that we expect to deliver. Against invested capital up from 7.6 billion euro in 2023 to 9.6 billion at the end of the Plan, we forecast a 80 bps increase in the ROI over the five-year period, from 8.7% in 2023 adj. to 9.5% in 2028, while keeping the same features seen in the past, such as low-volatility of results and consistency in the growth path.

…while we continue to rely on roughly 1 billion euro of financial resources that can be triggered when further investments are on the horizon

The end-of-Plan financial leverage, which we have calculated at 2.8x, implies that we will continue to have the option of being flexible, possibly extending it up to 3.3x – a level which, we have experienced, allows us to maintain a sound credit rating.

This would mean that approximately 1 billion euro of additional resources could be allocated to the execution of deals that we have not included in this Plan, but which could materialise.

The utility sector needs to find a new, more consolidated structure

We operate in a market, the Italian one, that offers attractive opportunities, given the very low consolidation of operators and a persistent lack of infrastructure, both in regulated and liberalised businesses.

The intense tender process ahead could be the catalyst for a virtuous consolidation process, inducing smaller companies to enter partnerships with major players, such as Hera, if they want to have any chance of winning tenders and continuing to operate in their reference areas.

These opportunities, which would be on top of the returns that the 2024-2028 Plan provides, would deliver additional value creation while preserving the low risk profile that Hera can boast today. As we have always proven, we will only close M&A deals at multiples that do not dilute our results, looking at territories and businesses that are consistent with our current portfolio, refraining from venturing into projects that involve lengthy and uncertain authorisation processes.

Shareholders will share the healthy results of 2024 and those of the following years, benefiting from a stronger growth in earnings that justifies a higher dividend distribution than in the previous Plan

Considering the 2028 EBIT target of 911 million euro, by leveraging the contribution of efficient management even from the financial and fiscal areas, we expect to reach a 34-cents EPS in 2028, with a CAGR of approximately 6% over the Plan’s period.

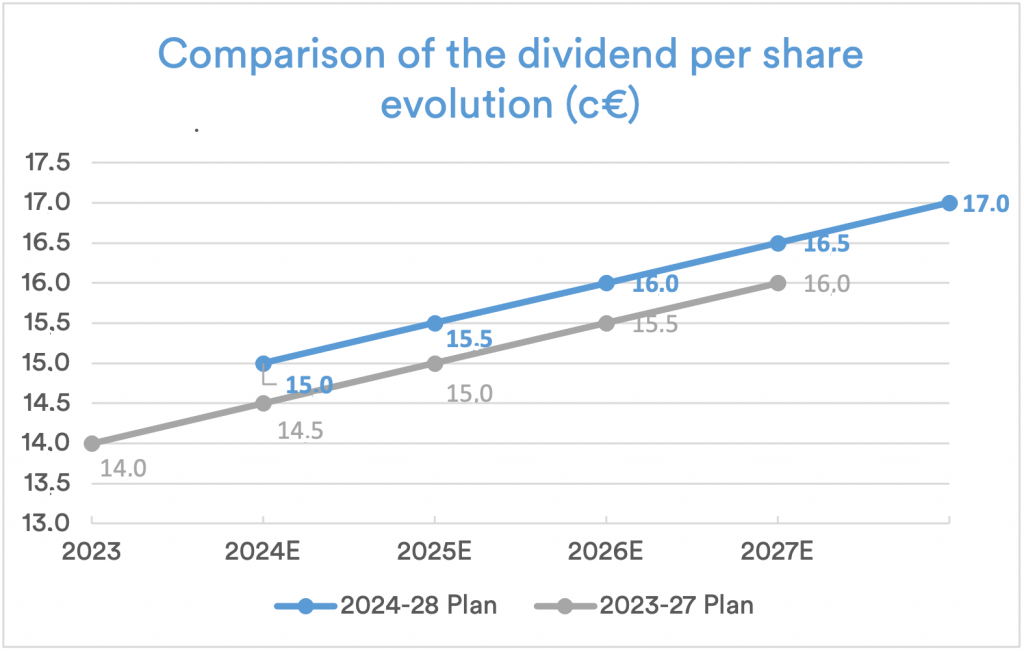

For the 2024 fiscal year, we will propose the distribution of 15 eurocents per share, compared to the 14.5 eurocents envisaged by the previous Plan.

Value creation, which in 2024 went

beyond expectations, hence results

into a more generous dividend distribution.

We also chose to increase the planned dividend per share for all the following years by 0.5 eurocents, thus mirroring the improved earnings growth profile.

With a 17-eurocent floor for the 2028 dividend per share, the 5-year CAGR would be approximately 4%.

With the focus on the targets that we have set and the consistency in our policies, we are confident that we will be able to successfully meet the challenges that the execution of this 2024-2028 Plan entails and give further satisfaction to our shareholders.