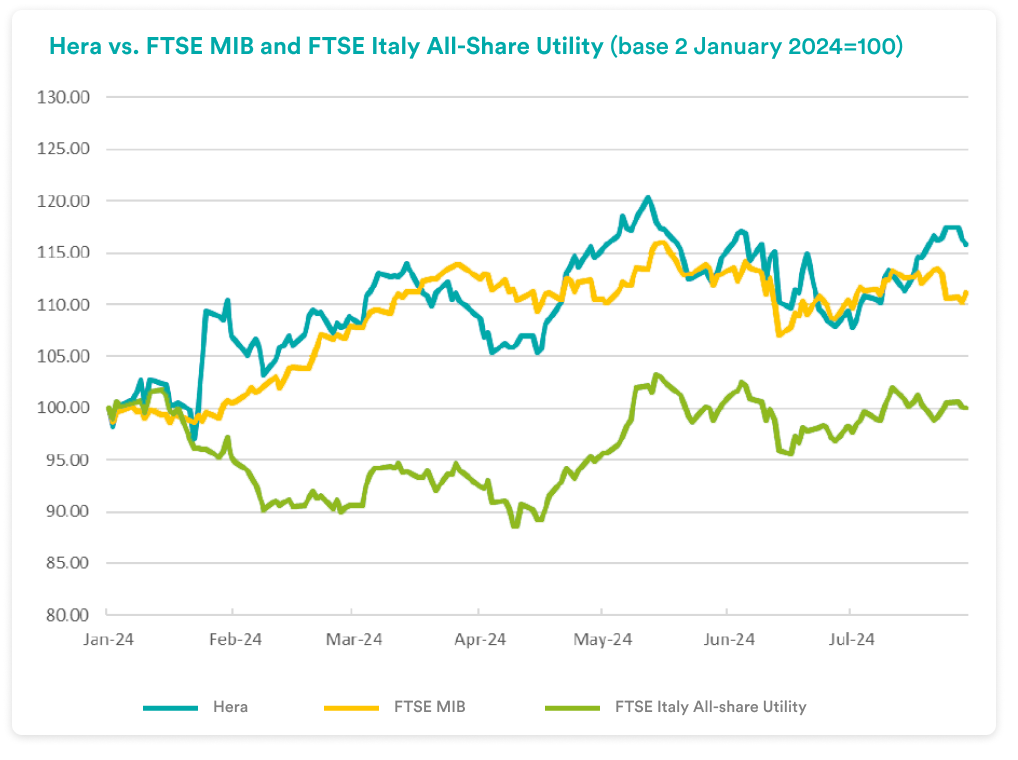

Due to solid fundamentals, confirmed by healthy half-year results, Hera strengthens the visibility of further returns to offer to shareholders, who have been rewarded at the end of last June with the distribution of a dividend of 14 euro cents. On top of the dividend yield, the shareholder return includes a price increase of nearly 20% year-to-date that has led the stock to outperform all benchmark indices.

Lately, the market sentiment on European utilities is improving, as they trade at very attractive price-earnings levels, now below both the market average and their own historical average.

Despite the uplift already achieved since the beginning of the year, Hera can fully benefit from a more favourable perception that would lead investors to greater exposure to the utility sector. Even at current prices, the stock continues to trade at a discount to its historical multiples, with a gap of more than 10% to the consensus target price of 3.90 euro, prior to the publication of the half-year results.

We explore these topics by posing some questions to Jens Klint Hansen, Head of Investor Relations of Hera Group.

How is Hera share price performing?

Very strongly, I would say: compared to the end of 2023, today the absolute performance is near 20%. Hera share is not only largely outperforming the utility sector’s benchmark index, which is stuck at the levels of the end of last year, but is also outperforming the Italian blue chip index, the FTSE MIB: a quite remarkable result, given that the latter index boasts one of the most significant rises among European markets, considering that the Stoxx Europe 600 is gaining just over 6% since the beginning of the year. Actually, the last few months have been characterised by some volatility, caused by scenario factors: Hera stock was also affected to some extent in June. However, considerations of our Group’s solid fundamentals soon prevailed again, with a broad recovery that in July brought the price back close to the year’s high, reached on the last 13 May at 3.56 euro.

What drove Hera’s share appreciation in the first part of the year?

We presented a Plan with very clear and ambitious targets, committing to create value for shareholders, so that we can offer them returns that reflect the Group’s progress. The results we publish quarterly continue to provide evidence that the Hera delivers results aligned with Plan forecasts: this cannot but be reflected in the market price. Let’s not forget that on the past 24 June the dividend for the fiscal year 2023 was paid, up at 14 euro cents. Therefore, also the component of the Total Shareholder Return linked to the dividend yield has found actual execution, offering a remuneration above 4% at recent prices.

Is there still room for further appreciation based on the valuations of brokers covering Hera stock?

The room not only exists but is still very attractive. After the release of 1Q 2024 results, the consensus target price increased from 3.83 to 3.90 euro. This is still more than 10 percent above recent price levels. The gap has led five out of six analysts to recommend buying Hera shares, while only one broker suggests holding the stock in the portfolio.

| Broker | Rating | Target Price (€) |

| Banca Akros | Buy | 3.80 |

| Equita Sim | Hold | 3.50 |

| Intermonte | Outperform | 4.00 |

| Intesa Sanpaolo | Buy | 3.90 |

| Kepler Cheuvreux | Buy | 3.90 |

| Mediobanca | Outperform | 4.30 |

| Average | 3.90 |

We mentioned that, in recent weeks, stock markets have shown some volatility. What is the current investor sentiment?

The volatility we have recently experienced is largely driven by swings in technology stocks, as well as political uncertainties, which have increased the risk premium particularly in the French market, downstream of the outcome of the European elections. Overall, the scenario of resilient global growth with declining inflation remains valid, despite some short-term uncertainties about the timing and trajectory of a rate lowering by monetary authorities, with the ECB already starting the easing process anyway, having made an initial 25bp cut last June 6. In addition, corporate half-yearly reports released so far have mostly beaten analysts’ estimates. Therefore, a certain erratic nature in market prices could be explained, rather than in terms of disappointment over results, by the investors’ wish to take profit on stocks that have reached all-time highs, to reposition themselves on sectors that have remained neglected.

Could utilities be one of them?

If we look at the current price-earnings ratio of European utilities, we see that the sector trades more than 5 percent below its long-term average, which at 15 years is 12.3 times. Even relative to market P/E, the sector currently trades at a discount, even though utilities typically trade at a premium because of the defensive characteristics they offer. This picture is also reflected in the managed portfolios’ exposure, which is on average lower than the weight the stocks would have on benchmark indices based on capitalisation. The lack of enthusiasm toward the sector, however, is mainly referable to the perplexities that investors have at this stage about the renewables business – as proven by regulated utilities instead trading in line with their historical average P/E. Recently, several brokerage houses, however, are beginning to point out that utilities are one of the cheapest sectors in Europe.

Could this improvement in the perception of the sector have a positive impact on Hera?

Hera has all the characteristics to benefit from a rotation that would favour stocks providing attractive and visible returns and at the same time are traded at a discount compared with their historical multiples.

In our case, the spaces are as clear as ever, as Hera P/E, based on consensus estimates, is now around 12.2 times, compared to 15.3 times on average for the past 10 years. Investors have always recognised a premium to our stock, considering the attractive dividend stream distributed over more than 20 years of history, with growth fuelled by continuous records in business results, even during downturns in economic cycles and in the face of critical scenarios, such as in the case of the pandemic or disruption in energy commodity supply chains. These semi-annual results will only provide further evidence to the equity story, in a context that is finally geared to favour the utility sector.