Hera’s price remains well below its fair value, despite showing the features of a defensive stock, because of the uncertainties concerning the way Italy will exit the deepest phase of the crisis originated by the pandemic.

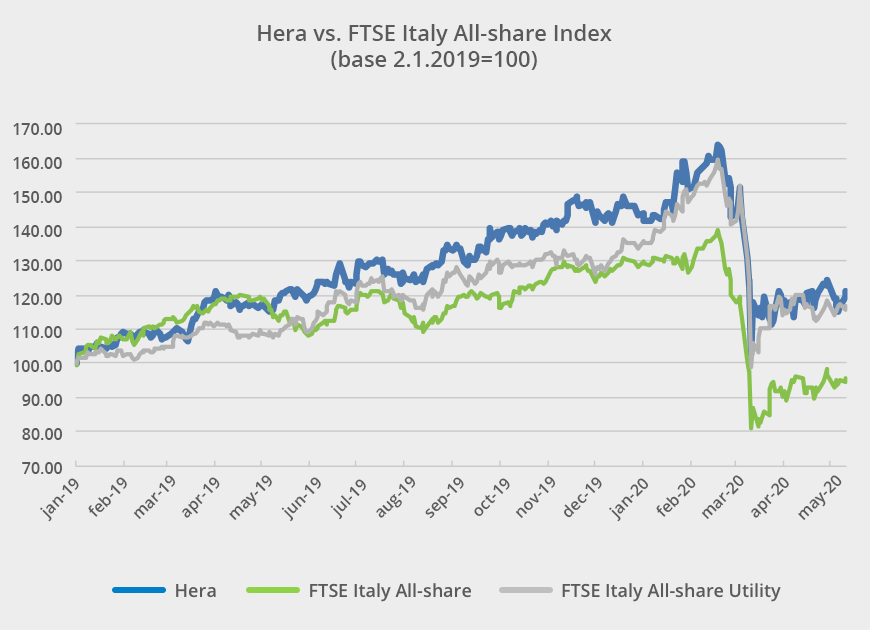

When the emergency related to the Covid-19 outbreak first hit Italy, Hera’s share price was at its record high of 4.5 euro, reached on 19 February 2020. The sell-off that generally involved all stock markets led Hera to experience a sharp correction, even though more limited compared to that experienced by the FTSE MIB index and the other multi-utilities.

The factors that supported the path to the all-time high of Hera’s stock price, also played a positive role in limiting the size of the correction. Investors have indeed appreciated the new targets presented in the Business Plan to 2023, as they envisage an even more significant growth path and higher satisfaction for all stakeholders compared to previous Plans. Moreover, the new targets are placed in the framework of a well-defined risk profile, which allows the Group to also evaluate new opportunities.

In the highest and most uncertain time of the crisis, Hera promptly developed a sensitivity analysis on the impacts of Covid-19 and on the related response solutions from the Group: an analysis that was first presented in a structured and transparent way to the financial community on 25 March 2020, when FY19 earnings were released; those results confirmed an healthy framework of corporate fundamentals and a solid financial position. Moreover, in a moment of deep uncertainty, the share could count on its belonging to an industry – public utility services – that represents a safe harbor for those who seek defensive characteristics. Many investors who know the quality of Hera’s business portfolio and the track record of its financials have therefore seized the occasion of the low prices in March to buy, thus limiting the impact of “forced-sellers”.

In a context of limited trading volumes, with portfolio managers still very cautious due to the uncertainties on the future evolution of the pandemic, during the last weeks the performance of the share price was characterised by high volatility, without a real recovery happening, despite the clear room for potential appreciation.

Asset managers surely wish for a clearer prospective on laws and rules that will be in place in Phase 2, the one that will lead Italy towards the exit from the maximum emergency. A progressive reduction of restrictions, while keeping watch on the containment of infections, would allow the economy to recover and would reduce the systemic risk of the stock market. Against this scenario, investors could focus again on evaluating opportunities based on corporate fundamentals and, therefore, return to trade Hera on higher multiples.

The consensus target price of the analysts covering the Hera’s stock, currently equal to 3.96 euro, remained substantially unchanged from the level of 4.08 euro of 25 March 2020, when full-year 2019 results were released. Based on the level 3.29 euro as at 12 May 2020, the potential gap to close exceeds 20%.

Most brokers in coverage have buying recommendations (Buy/Outperform). Neutral ratings are the result of considerations related to the more limited price decrease experienced by Hera compared to its peers from 19 February 2020 to date – all analysts with Hold/Neutral ratings express target prices that are way higher than Hera’s recent price levels.

| Broker | Rating | Target price (€) |

| Banca Akros | Buy | 3.90 |

| Banca IMI | Buy | 4.70 |

| Equita Sim | Buy | 3.80 |

| Fidentiis | Hold | 4.20 |

| Intermonte | Outperform | 4.20 |

| Kepler Cheuvreux | Hold | 3.50 |

| MainFirst | Neutral | 3.40 |

| Mediobanca | Outperform | 4.00 |

| Average | 3.96 |