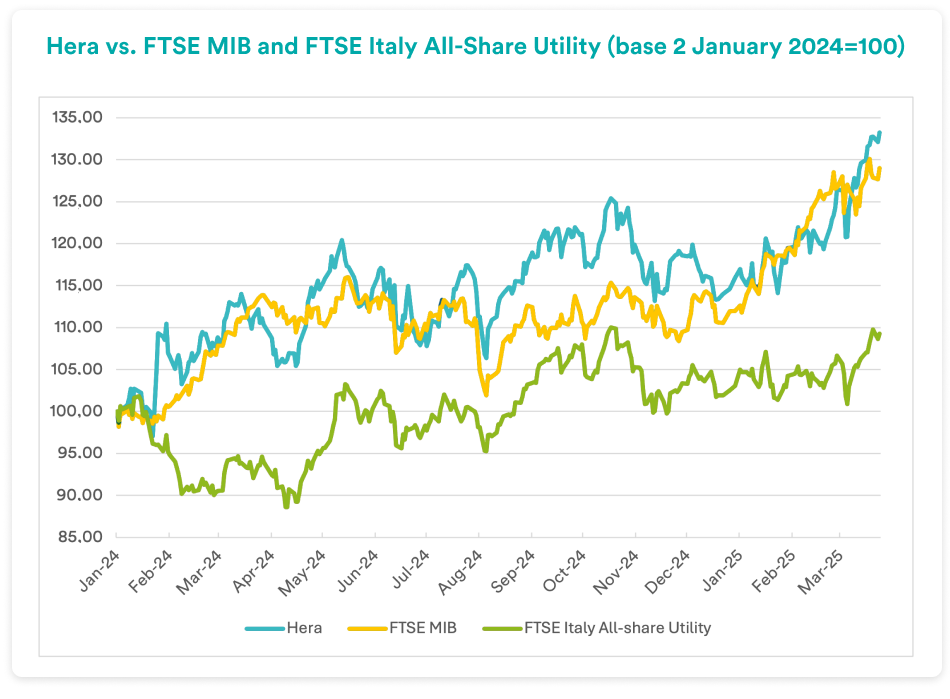

Investors have welcomed the Plan that Hera’s management presented on 23 January 2025. Since then, shares started a rally that led the price to approach 4 euro – a level representing a five-year high. The wide overperformance achieved vs. the index of Italian utilities shows that the Company-specific component was a fundamental driver in nurturing the rise.

Hera has characteristics that are particularly attractive in a phase of great uncertainty in the external scenario, given its low risk profile and the ability to deliver growing results regardless of the macroeconomic variables, the regulatory framework and the evolution of the competitive environment. Being a purely domestic player also meets the favour of investors in the face of the tariff war that is destabilising the operating scenario for multinational companies.

The healthy 2024 results, which indicate a Total Shareholder Return of 36% and allow to confirm – subject to the Shareholders’ Meeting approval – the dividend of 15-euro cents indicated in the Plan, are additional bolsters in terms of credibility and visibility of what Hera can offer to its shareholders.

We explore these topics by asking some questions to Jens Klint Hansen, Head of Investor Relations at Hera Group.

How is Hera’s share performing in early 2025?

Since the end of 2024 to date, our stock put up nearly 15%, significantly outperforming the benchmark utility index, but also the Italian blue-chip index itself, which has been driven by the brilliant performance of banking and defense stocks. On 23 January 2025, when the new Business Plan was presented, Hera’s share price was around the level of the beginning of the year. From there on, in the wake of the favorable reception of the Plan’s strategic messages, a significant upward movement took shape, bringing Hera prices back to record levels not seen since February 2020.

The new Plan remains broadly in line with the strategy of the previous one, despite projecting targets to 2028 at even better levels. What awakened the market’s attention to Hera’s stock?

In a highly turbulent environment, in the midst of the tariff war and with great uncertainty on the geopolitical chessboard, investors saw volatility becoming endemic.

Hera appeared to be a very attractive investment particularly at this stage – even compared to peers – because of the low risk profile it can boast and maintain. A risk profile that not only reflects a presence in regulated businesses, but also a way of managing liberalised businesses aimed at running appropriate risks for the returns that different investments can offer, in a logic of broad portfolio diversification: Hera operates in businesses that proved solid growth trends over time, with highly defendable competitive advantages.

The track record gained in the past, with growth really creating value, is also a good premise for consistency in future performance, given the structural nature of the business model features.

Moreover, in this period of new duty impositions, investors have a preference for companies with domestic businesses, as in our case.

A fact not to be overlooked, over time the Group has proved its ability to produce continuous growth regardless of changes in external environment variables, being immune to the effects of inflation, high interest rates, economic crises, changes in competitive environments…

The combination of these factors, coupled with the high visibility of the dividend, was the mix that I believe drove the stock upwards.

How does Hera’s current stock price compare with analysts’ consensus?

Following the presentation of the new 2024-2028 Plan, analysts updated their earnings forecasts and, consequently, their valuations: the consensus target price went from 3.94 euro per share to 4.05 euro.

With the recent rally, Hera prices have gradually moved closer to the average target price. It should be considered, however, that the consensus includes some very conservative valuations and two target prices from brokers highly valued by investors, which, standing at 4.30 and 4.50 euro, respectively, still indicate huge room for growth.

Most analyst recommendations remain buy-oriented, with only one neutral rating and no suggestion to sell.

| Broker | Rating | Target Price (€) |

| Banca Akros | Accumulate | 3.80 |

| Equita Sim | Hold | 3.70 |

| Intermonte | Outperform | 4.00 |

| Intesa Sanpaolo | Buy | 4.00 |

| Kepler Cheuvreux | Buy | 4.30 |

| Mediobanca | Outperform | 4.50 |

| Average | 4.05 |

Where is it possible for investors to see room for additional share price rise?

Hera has built its reputation over time for setting up Plans that the management has then consistently executed. In their evaluations, analysts include that consideration, based on the investment plan presented.

In the current situation, Hera has

the availability of ample financial flexibility,

which investors, especially the more intuitive ones,

expect that the Company will not continue to hold only as a potential weapon.

The investment of those financial means, through acquisitions that could reasonably materialise, given the large number of inefficient utilities still crowding the Italian market, would immediately translate into higher EBITDA, from which shareholders themselves would eventually benefit. While the Plan today includes 5 billion euro of investments, it is clear to many investors that Hera could easily ground around 15-20% more, selecting the best opportunities in the market, thus providing additional returns that would be earnings accretive in one or two years. This aspect is a potential catalyst that can create further boost for the rise of Hera’s share price.