The solid results of fiscal year 2020 represent a milestone in Hera’s growth path considering the scenario in which they were achieved. Therefore, they provide an anchor of certainty in a context of stock markets suffering from a severe lack of visibility, especially on the timing of exit from anti-pandemic restrictions.

Investors can read in a very positive way these 2020 results, which surprise while overperforming the preliminary data released in January. Hera confirms its characteristics of a company capable of promptly intercepting economic growth by improving its cash generation. Moreover, shareholders will be able to benefit from this “extra growth” through a distribution of dividends higher than that indicated when the Plan to 2024 was presented, considering that the BoD proposes a 0.5 cent increase in the annual dividend per share, which will be extended to the whole five-year period.

We discuss the impact on Hera’s equity story with Jens Hansen, who is at the helm of Group Investor Relations.

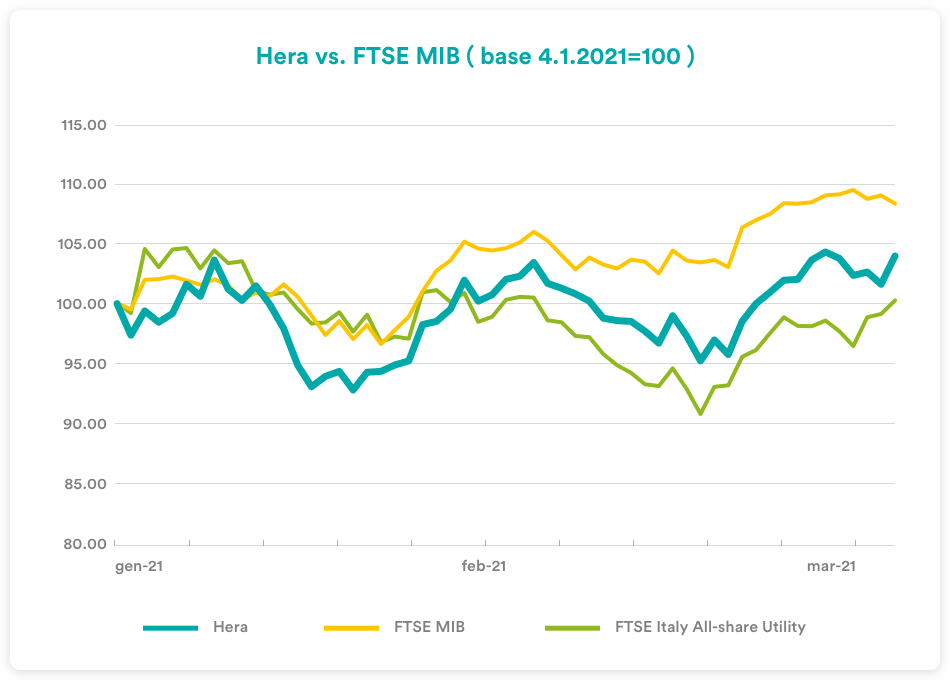

How has 2021 opened from a stock market perspective?

The stock market’s outlook is affected by uncertainties over the time needed to implement the vaccination programme and consequently lift the restrictions aimed at containing infections once the population has reached a sufficient level of immunity. Although interest rates in Europe seem likely to remain low for a long while, according to the clearly expressed intentions of the ECB itself, only the easing of anti-virus restrictions will allow for a strong recovery in real economy. At that point, companies will also be able to benefit from the support of fiscal policies, with the substantial resources of the Next Generation EU package that will finance the Recovery Plan measures launched by the government of each European country.

Although the long-term direction is clear and the firepower of the resources supporting the recovery is sizeable, short-term uncertainty means that any news of an inflationary surge in commodities, for example, leads to fears of higher interest rates and makes the multiples at which some sectors, like tech stocks, are traded “more expensive”. For this reason, some portfolios have started a rotation strategy, with value stocks again being favoured after a long period of neglect.

What are the elements that specifically affect Hera’s valuation?

While on the one hand the presentation of the new Business Plan confirmed the growth features we target, on the other hand the 2020 Annual Report data proved that results have been improving from quarter to quarter, since last spring, after the first wave of the pandemic. In the last quarter of 2020, therefore, new evidence has come to light. First, Hera can rely on resilient results leveraging on a diversified business portfolio; secondly, its asset structure – supported by solid competitive advantages – can generate an immediate acceleration in growth as the anti-Covid restrictions are lifted.

But Q4 data have been disclosed to the market only today

It is true. In the presentation of the Business Plan to 2024, last January, we showed some preliminary 2020 results, which were the starting point we used for our five-year forecast exercise. Actually, reported results went beyond those figures, showing that in the final weeks of 2020 the recovery in demand, especially from industrial operators, offered immediate benefits in terms of both P&L and cash flows. This means that when the economic cycle starts again in a robust manner, Hera is and will be in the ideal conditions to intercept that growth. I am confident the market will appreciate this change from the 2020 numbers that we anticipated in the Plan, especially since it is precisely on the basis of these results above forecasts that Hera’s Board of Directors have decided a 0.5 cents increase in the dividend compared to the Plan’s expectations, not just for this fiscal year, but permanently for all the next years that the Plan covers.

Shareholders will benefit from a 2020 dividend yield higher than that expected on the basis of the Business Plan presented in January. Is that so?

Exactly. If we consider the closing price of 2020, the dividend per share of 11 cents results in a 3.7% yield. This is an attractive level of return, but it appears even more attractive given the low risk profile that Hera can boast also in a tough year like 2020.

What indications does the current consensus target price provide?

Following the presentation of the new Business Plan last January, the target price of the analysts that cover the stock went from 3.93 to 3.96 euro. Three out of seven brokers have target prices ranging from 4.00 to 4.70 euro.

Even at the minimum target price level of 3.5 euro, given the current share price, the room room for potential appreciation for Hera shares remains very attractive.

| Broker | Rating | Target price (€) |

| Banca Akros | Buy | 4.00 |

| Banca IMI | Buy | 4.70 |

| Equita Sim | Hold | 3.50 |

| Intermonte | Outperform | 4.20 |

| Kepler Cheuvreux | Buy | 3.60 |

| Mediobanca | Outperform | 4.00 |

| Stifel | Buy | 3.70 |

| Average | 3.96 |

Hera’s shareholders can therefore benefit from attractive perspective returns, both in terms of potential share appreciation, based on expected earnings growth, and in terms of dividend yield that reflect an improved dividend policy.