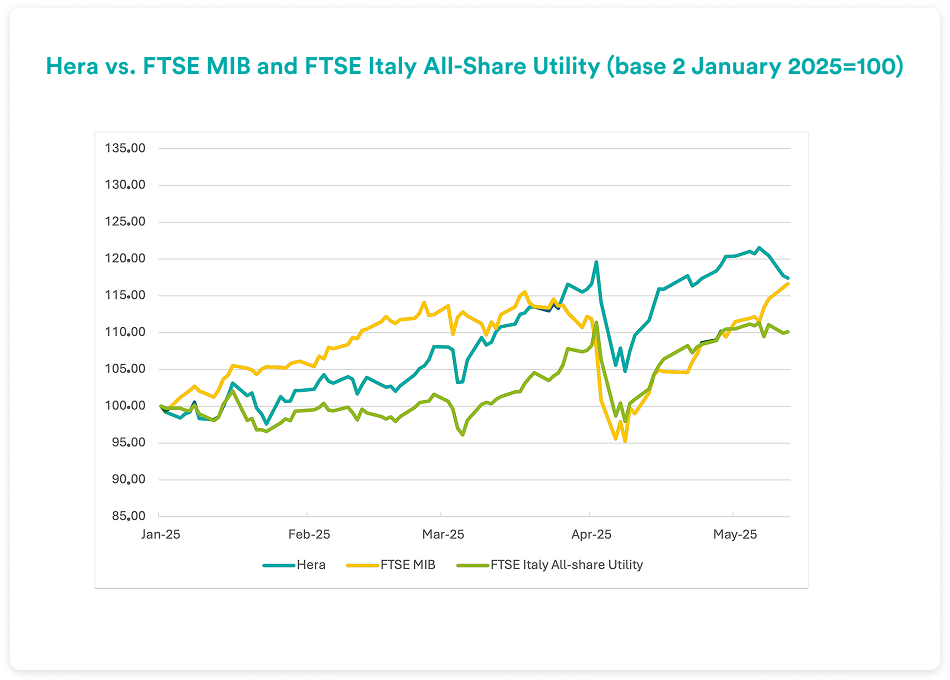

Hera share continued to record gains on the stock market, far outperforming the benchmarks, despite the FTSE MIB index benefiting from the drive of defence and financial stocks, and, in general, utilities being among the favoured sectors in European markets at this stage. Not even the sharp fall in the stock markets at the end of March and the beginning of April, amidst strong geopolitical tension, halted the rally of Hera, whose prices are now at their highest level in five years.

Investors are showing their appreciation for the resilient growth features of Hera, which can deliver solid results even in critical scenarios by leveraging on a strong business model and a strategy focused on value creation.

Despite the significant rerating, at recent price levels Hera continues to trade below its historical average P/E of 15.5x. Although the share price has progressively aligned with the analysts’ consensus target price, there are still visible grounds for the rerating to continue.

The solid results of the first quarter 2025, showing an EpS up by 7%, together with a 15-euro cents dividend that will be paid on the next 25 June, can only give further support to Hera’s investment case.

We explore these topics in a conversation with Jens Klint Hansen, Head of Investor Relations of Hera Group.

How should we interpreter Hera stock performance in early 2025?

Hera share prices increased over 20%, clearly outperforming that of the utilities sector index and the index of the Italian blue chips – both of which gained just over 10% since the beginning of the year. In recent months, the performance of the FTSE MIB has been underpinned by the rally of the financial and defence sectors, with rises between 40% and 85% for some large-cap stocks. However, since the second half of March, this performance has been greatly exceeded by the magnitude of Hera’s rise.

What are the new elements on Hera that the market picked up in this period?

On January 23, we released our new Business Plan, announced a proposed 2025 dividend increase of 7%, to 15-euro cents per share, and signed the M&A deal that strengthens our presence in AIMAG. A wide global roadshow allowed us to make investors increasingly appreciate the breadth of the strategic design. Then, on 26 March 2025, the release of FY24 results increased the visibility of the quality of Hera’s results over the last few quarters, as they leveraged on purely structural elements.

April saw a sudden and sharp fall in global stock prices as geopolitical tensions intensified and the tariff war escalated. How did Hera’s stock react during this phase?

Against a background of extreme uncertainty, Hera showed great resiliency, also from a stock-market standpoint: the MSCI World index recorded a 17% downturn, while the FTSE MIB dropped by 18%. Early in April, even Hera was somewhat affected by the “panic selling” effect, but the drop was limited to 13%. A prompt rebound then gave impetus to overcome the previous high: today, few stocks can say they have fully absorbed the March-April downturn, while Hera has already gone beyond the previous year’s peak.

Some advantages will also be attributable to Hera’s belonging to the world of utilities, one of the favoured sectors for investors these days…

That is true. In general, flight-to-quality – i.e., investors’ search for safe havens in which to shelter while waiting for the headwinds of new tariff announcements and escalating wars in Ukraine and the Middle East to calm down – saw utilities and infrastructure companies as an ideal opportunity. The visibility of cash-flows makes perspective dividends a solid pillar of the equity story, while the concentration of business – especially for small- and medium-sized utilities – at a national level provides total protection against the threat of new tariffs. Only the defence-aerospace sector in general achieved higher gains since the beginning of the year, as demand is surging due to the rearmament drive, foreshadowing even higher profits. However, since in our industry, globally, there was no significant revision of companies’ EpS estimates in early 2025, the stock price rise translated into a strong expansion of multiples. Basically, investors were willing to pay more for the same expected level of earnings of utilities and infrastructure companies, based on the stability and visibility of these businesses.

In Hera’s case, apart from following this wave of multiples expansion, has any Company-specific factor justified a premium?

Compared to other companies in the industry, Hera is characterised by a very low-risk profile, which the strategy aims to preserve going forward. The broad diversification of businesses in the portfolio, with a balanced presence in the regulated markets, solid competitive advantages in liberalised markets, as well as the explicit commitment to value creation, are Company-specific factors that the financial community highly appreciates. Even the visibility of Hera’s dividend is based on results that have proven their consistent growth through economic cycles and during different kinds of crises.

Today Hera trades at around 13 times its earnings, in line with sector’s P/E. Do you believe there is still room for a further rerating?

If we look at brokers’ estimates, we realise that the spaces can be very different depending on the sensitivity of the individual utility to fluctuations in energy prices and renewable production. Over the last 15 years, Hera has traded at an average of 15.5 times its annual earnings, having no exposure to any of these variables and being completely immune to commodity price levels.

How do analysts covering Hera’s stock see these potential spaces?

The analysts’ average target price today is 4.17 euro per share. Following the publication of the 2024 annual results, we indeed recorded another improvement, considering that the revisions due to the new Business Plan had already shifted the consensus target price from 3.94 euro per share to 4.05 euro.

Although recent share price movements pushed the market price close to the current average target price, analysts’ recommendations remain largely Buy-oriented, with a couple of Neutral ratings and no Sell suggestions.

| Broker | Rating | Target Price (€) |

| Banca Akros | Accumulate | 4.20 |

| Equita Sim | Hold | 3.70 |

| Intermonte | Neutral | 4.20 |

| Intesa Sanpaolo | Buy | 4.00 |

| Kepler Cheuvreux | Buy | 4.40 |

| Mediobanca | Outperform | 4.50 |

| Average | 4.17 |

Then, what could be the factors supporting a recovery of historical P/E levels?

It will be our priority, as Investor Relations team, to make visible to analysts and investors the factors that differentiate us today from the past, when we had already reached these price levels: on 19 February 2020, right before the Covid explosion, we had reached 4.45 euro. Compared to those times, today we have significantly healthier earnings, with a very high quality of both the structural and the sustainable component; we have a clear commitment to value creation; we can count on a customer base that makes us the third largest operator in the Italian market; we proved to be very resilient to energy crises, inflation, economic weakness, and extreme weather events; and above all, we achieved a significant deleveraging that now puts us in a very strong position, also in terms of financial firepower to drive external growth.