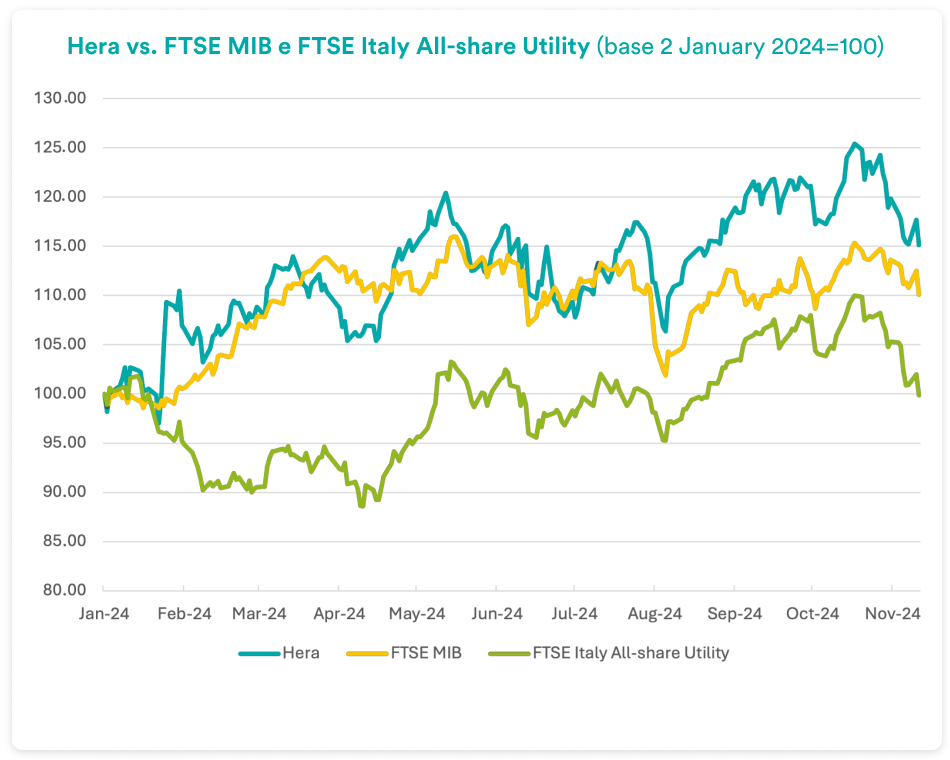

Hera continues to overperform its benchmark indices, despite the recent reversal, started after the share price reached the year-high at 3.7 euro in mid-October.

The solid fundamentals, again proved by nine-month results, provide strong support also prospectively. To date, Hera has already offered a Total Shareholder Return of 12%, which is almost twice the annual average indicated in the Plan, considering that a 4% dividend yield adds up to an Earnings per Share growth of more than 20% over the first nine months of 2023.

While geopolitical tensions are conditioning the investor sentiment, Hera seems like the ideal candidate to benefit from the downward trajectory of interest rates and an economy growing at a shaky pace, due to the proven resilience of its multi-business portfolio.

We explore these topics by posing some questions to Jens Klint Hansen, Head of Investor Relations of Hera Group.

How do you explain Hera’s share performance in 2024?

Despite the recent reversal, which began after reaching a high at 3.7 euro on 18 October, the stock is trading at levels about 15% higher than those at the beginning of the year, while comparing with the performance of the Stoxx Europe 600 index, which does not even reach 6%. Hera’s shares are also significantly outperforming the FTSE MIB, up about 11% year-to-date, under the drive of the brilliant performance of financial stocks that have a heavy weight in the index. I believe that this appreciation of our stock during 2024 – most noticeable when comparing it with the Italian sector index, which is around the levels of the beginning of the year – can be mostly attributed to the healthy fundamentals and the clarity of management’s commitment to bring even better results in the future, in terms of value creation.

In the Plan to 2027 presented last January, Hera targets a Total Shareholder Return of 12% per year. Do you believe to be in the right direction to keep up this commitment?

The results as at 30 September 2024 that our BoD approved today speak for themselves: the Earnings per Share increased by 20% compared to the 2023 data, while the yield coming from the dividend distributed last June is around 4%. Thus, we are now almost double the level of what we promised to offer as TSR on an annual basis.

Have the brokers covering Hera stock changed their views in recent months?

Not at all. Except one view that remains neutral, the other five brokers in coverage continue to suggest buying Hera shares. The consensus target price has slightly increased, from 3.90 to 3.92 euro, following an upward revision from an analyst after the release of the half-year report. Considering the gap of more than 15% separating recent stock prices from the average of analyst valuations, the scope for potential appreciation remains very wide. Moreover, we should consider that three out of six analysts have ratings at or above 4 euro.

| Broker | Rating | Target Price (€) |

| Banca Akros | Buy | 3.80 |

| Equita Sim | Hold | 3.50 |

| Intermonte | Outperform | 4.00 |

| Intesa Sanpaolo | Buy | 3.90 |

| Kepler Cheuvreux | Buy | 4.00 |

| Mediobanca | Outperform | 4.30 |

| Average | 3.92 |

There has been a lot of volatility in equity markets in recent weeks, with the most recent sessions leading to a correction from the mid-October highs. How do you interpret the current investor sentiment?

The scenario has become even more complex than it was before. On the one hand, there is the clear prospect of monetary policies going in a more accommodative direction, but elements of uncertainty continue to exist on multiple fronts. Investor sentiment is negatively affected by geopolitical tensions, particularly about the conflict in the Middle East and the tariff war – even more threatening after Donald Trump’s appointment as U.S. President, with the uncertainty of China’s recovery, which at this point will be looking for more opportunities to sell its goods in European markets at any cost.

Overall, a stunted economic growth on the European scene, with Germany’s locomotive seemingly at a standstill and France failing to find viable fiscal policy solutions, makes the need for a further decline in interest rates even more pressing.

Could this scenario favour utilities?

Utilities are undoubtedly among the biggest beneficiaries of such a scenario, because their valuations improve as interest rates fall and because they operate businesses that are resilient to economic downturns. If we look at the performance of European utilities, however, we see that after the rally in the summer months and the marginal revisions in estimates following half-year reports, the utility sector has virtually closed the valuation gap that separated it from its long-term Price-Earnings ratio, also greatly reducing its underperformance relative to the stock market in general. The picture is different for Italian multi-utilities, which are delivering results that beat analysts’ expectations. These are stocks that were long neglected by institutional investors, partly because they cannot boast large capitalisations. Today this segment, in which Hera itself belongs, is subject to a careful re-focus.

Is this new focus on the Italian multi-utility sector something you have also directly experienced?

Yes, in the recent period we noticed a renewed interest, with requests for more insights from investors who contacted us. After all, Italy is a country where there is still a high fragmentation of operators. A movement leading to a consolidation of the sector would produce greater efficiencies, even more so in a regulatory framework that investors have experienced to be reliable and rewarding for those operators who have resources to invest in a forward-looking way and are able to run the different businesses wisely, also considering the latest tariff reviews set by ARERA. As Hera can leverage solid fundamentals and a visible growth trajectory for the future, it is ideally positioned to represent the right player when following this investment theme.