The year of 2018 opened with the presentation of the new Business Plan, which projects the Company’s objectives through 2021. Since 10 January, we have been involved in a wide-ranging roadshow, which has taken us to 12 different financial centres in Europe and the United States, where we have met with institutional investors to present a comprehensive outline of Hera’s commitments and prospects for the coming years. The Executive Chairman and the Chief Executive Officer have responded with much enthusiasm to the questions of portfolio managers, to facilitate the market’s capacity for correctly evaluating Hera shares.

The roadshows are especially significant not only for the opportunity to communicate strategic messages to a large audience, but also through the progress that we can make by listening to and analysing the comments of the shareholders with whom we meet.

In feedback from the most recent roadshow, many investors voiced their appreciation for precise aspects of our equity story, namely, those linked to the multiple growth opportunities and cash-flow generation.

The most attractive and visible growth areas have been identified as:

- Gas tenders, where we have indicated our aim to focus on 13 territorial areas where we control at least 75% of the market share, thus dedicating our efforts where it is more strategic and altogether more probable that we will be awarded the contracts.

- Tenders for safeguarded services, a business in which Hera has already established a sound track record, being awarded six lots for 11 Italian Regions, and thus securing a 50% share of the customers covered by the tenders.

- Deregulation of the so-called protected categories market, since the Italian government has provided that the reform to deregulate this segment of the electricity market will be implemented during the first half of 2019.

- The Waste sector, where Hera can leverage its leadership at a time when the sector is at a turning point, with the forthcoming institution of a dedicated regulatory authority and the renewal of expired concessions. This driver, together with hopefully stronger momentum for the gas tender process, is perceived by investors as a potential catalyst for the revival of more intense M&A activity, where Hera has already demonstrated its capacity to adopt a disciplined approach in the selection process and profitable results upon the integration of acquired businesses.

The market has thus demonstrated that it views the investment in Hera as a growth story with very clear drivers. Furthermore, as many investors have observed, the fact that the Company is a cash generator represents a solid foundation for the planning and implementation of the development strategy; with its capacity to produce significant increases in EBITDA over time, Hera is able to reconcile three objectives:

- to finance the important capex plan that will drive organic growth;

- to support future M&A investments;

- to remunerate shareholders through an increasing dividend (+17% in 5 years);

while also maintaining a favourable situation from the standpoint of the level of debt.

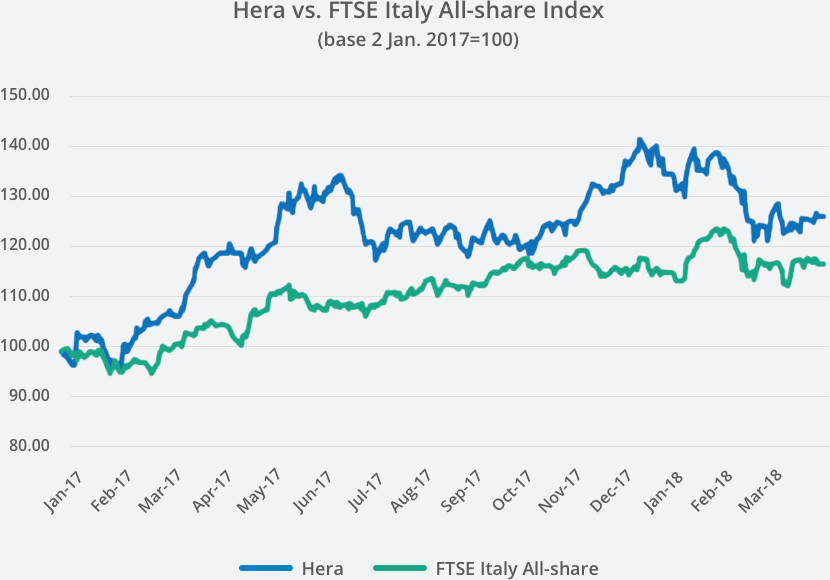

Since 2 January 2017, the Hera shares have consistently outperformed the Italian stock market index, which has nonetheless increased by just under 20% in the period considered. The trend of the Hera share price has been driven by solid fundamentals, as substantiated by the publication of quarterly results as well as by a clear strategy aimed at creating value over time for the shareholders, as also confirmed by the 2017-2021 Strategic Plan.

In early 2018, Hera, like most of the utilities stocks, witnessed some erosion of its market valuation as a result of higher yields on bonds in the Euro Area, with certain investors deciding to take profit on securities that had performed better than the market. In more recent trading sessions, the market is back to focusing on considerations about potential EPS growth, redirecting its attention to the attractive yield offered by the upcoming dividend, with the dividend yield equal to 3.3% of the share price at the end of 2017 (€2.91).

Analyst coverage

The average target price of the analysts covering the Hera shares continues to improve. Positioned at €2.95 following the publication of the first-half results at the end of July 2017, the average target price moved up to €3.04 in October, and then climbed to its current level of €3.34 following the publication of the results for the first nine months of 2017 and the presentation of the new Business Plan. The recommendations remain positively oriented: a good seven of the nine analysts following the stock have assigned a Buy/Outperform rating, while the remaining two have neutral recommendations.

| Broker | Rating | Prezzo target (€) |

| Banca Akros | Buy | 3.30 |

| Banca IMI | Buy | 3.60 |

| Equita Sim | Hold | 3.20 |

| Fidentiis | Buy | 3.30 |

| Hammer Partners | Buy | 3.40 |

| Intermonte | Outperform | 3.40 |

| Kepler Cheuvreux | Buy | 3.40 |

| MainFirst | Neutral | 3.05 |

| Mediobanca | Outperform | 3.40 |

| Average | 3.34 |