The Business Plan driving Hera to 2026 includes investments for 4.12 billion euro, 7% more than the cumulated amount envisaged for the 2021-2025 period.

Organic investments are mainly focused right there where Hera already enjoys a solid competitive position: in the Networks, where the Group has proven to be able to seize the advantages of the regulatory system, and in Waste, where a strengthened asset base will intercept the attractive dynamics of demand. Being ready for catching the new PNRR opportunities and the increasing value-added services demand, the Company has several and well-managed levers to translate the increased investments into healthy returns. Therefore, EBITDA is expected to increase by almost 250 million euro over the five-year period covered by the Plan.

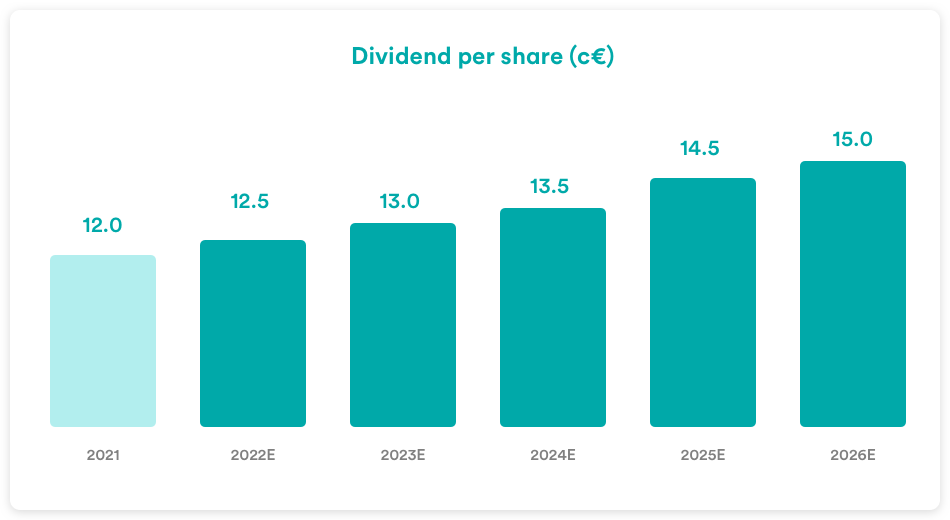

The visibility of the factors underlying the expected returns from capital allocation also lends credibility to the shareholder remuneration policy, with a dividend that is expected to reach 15 euro cents in 2026, while financial leverage is forecast to fall below the 3-times threshold, confirming a well-balanced financial profile.

2022 preliminary results exceed expectations

The 1,287-million-euro EBITDA reached in 2022 – up by 63 million euro, around 5% more compared to the previous year – allows us to read with satisfaction the performance achieved in a year deeply threatened by the energy crisis, following the outbreak of the Russian-Ukrainian conflict, with a result that exceeds both Business Plan and analysts’ consensus forecasts.

The Group’s EBITDA progress reflects the positive contribution of all businesses in the portfolio, with the Energy area showing a significant recovery in the fourth quarter, as the new thermal season started. With the release of gas reserves from storage, the Debt-to-EBITDA ratio also began to decline from its peak of 3.62x recorded at the end of September 2022, reaching 3.3x at the end of the year. The recovery in the Energy area is combined with a particularly strong performance in Waste, which could leverage on the Group’s rich plant equipment in a favourable context, together with solid operating results of the Networks, achieved in a challenging regulatory framework.

“2022 preliminary EBITDA is a new

milestone that completes the picture

of a ten-year growth at an average

annual rate of 10%”

If we look at the dynamics of the EBITDA in the perspective of the last decade, we can detect a high and uninterrupted growth rate, with the progress of the last year being very noticeable also in view of the regulatory WACC cut, which in 2022 had an impact on the EBITDA of about 22 million euro.

The market certainly poses new challenges, but also opportunities, to an operator like Hera that has a solid asset base and a broad portfolio of value-added services

Over the past year, the external scenario has changed a lot. We had to face serious challenges, not only in terms of inflation and monetary policies that have suddenly become restrictive, but also due to the high volatility we experienced in energy commodity prices. These new elements were added in a global context that remains characterised by the need to combat Climate Change, with policies aimed at facilitating the spread of a circular economy and the energy transition towards sources that minimise carbon emissions.

For a well-structured company like Hera, this new scenario presents a number of opportunities. First, we will be able to capitalise on a network infrastructure and waste treatment plant base built over the last twenty years with great foresight, as they aim to offer a concrete response to the need for sustainable resource management.

Secondly, we will have the opportunity to carry out additional M&A deals, especially in liberalised businesses, given the rapid concentration process taking place in capital-intensive sectors, where smaller operators are suffering from the penalising credit conditions. Hera is also in a position to intercept significant PNRR funds, having the required characteristics to be successful in tenders. In addition, our Group has the expertise to leverage various incentives offered in Italy today, both in regulated sectors and in the fields of renewable energy and energy efficiency.

Another important trend that emerged as a result of the energy crisis is the increasingly widespread demand for value-added services, also from citizens as well as business customers, with the aim of optimising their energy consumption and making it more sustainable. Hera can fully meet such demand, as we can rely on the offer of an articulated portfolio of services developed in the last few years.

We will therefore travel all these new routes while maintaining the strategic approach that has enabled us to enter the third decade of our Group’s history with a series of steadily growing results and a credible profile as a genuinely sustainability-oriented operator.

“We will carefully ride the new

development opportunities opening

up through the innovation, while

maintaining a strict risk

management discipline”

In order to intercept a growing demand, Hera strengthens its investment plan by almost 300 million

In the five years covered by the Plan, we have planned investments for a total of 4.12 billion euro.

About 52% of the investments will be allocated to maintenance, with the aim of preserving the high quality of our assets. More than 36% of total investments, almost 1.5 billion, will be dedicated to organic development, particularly in Networks and Waste treatment, where the returns are most attractive and visible. Finally, up to 2026, we plan to commit around 9% of investments to M&A and 3% to projects financed by the PNRR. Here, in addition to the 132 million euro that we have included in the Plan as we have already won the tenders, we can intercept additional 131 million euro through the next tenders, which will be awarded by the end of the year, with a focus on circularity as well as the protection of both environment and water resources.

Organic growth drives the EBITDA

Due to the new investments included in the Plan, we have projected an EBITDA of 1.47 billion euros in 2026, compared to 1.22 billion in 2021, with an average annual growth rate of 3.7% over the five-year period. This growth profile incorporates discontinuities related to the end of incentives on renewable energy production, for 23 million, and the WACC cut, for 22 million. Sterilising these factors, growth would stand at 4.5%.

The expected growth at the EBIT level is even more dynamic. We believe it could reach 750 million euro in 2026, compared to 612 million in 2021, thus increasing at an average annual rate of 5.7% without taking into account the lower WACC and the decay of some incentives.

Organic growth will contribute substantially – around 60% – to drive EBITDA, due to the expansion of market shares in waste treatment and energy sales, also benefitting from a broader asset base and higher revenues coming from energy efficiency and high value-added services.

M&A will continue to play a key role, as in the last five years, with about 100-million-euro incremental contribution in terms of EBITDA, of which 24 million deriving from already completed acquisitions.

Progress in the Waste area drives Group EBITDA

Although Networks will see as much as 2.2 billion of the total 4.1 billion in cumulative investments allocated over the five-year period of the Plan, compared to 1.2 billion dedicated to Waste and 600 million committed to Energy, the largest contribution in terms of Group EBITDA growth is expected to come from Waste, which will cover 150 million of the 246 million of the cumulative growth expected over the period.

We estimate that the returns from this investment plan can cumulatively generate 4.5 billion in Operating Cash Flow over the period. Therefore, we will be able to finance the investments and distribute dividends by continuing the current policy on a linear basis, with the result that we will only have to draw on 900 million in additional debt.

“This will bring the Debt-to-EBITDA

ratio from 3.3x at the end of 2022 to

2.8x at the end of 2026, proving that

we will grow while maintaining a

balanced leverage”

We will therefore also maintain those margins of financial flexibility that would allow Hera to seize any further M&A opportunities that may arise over time.

The dividend policy continues to be structured on an expected annual dividend floor

The analysis of what happened in the last decade shows that the results generated have exceeded the Plan targets and have always translated into higher returns for shareholders, through a more generous remuneration compared to the original dividend policy. In particular, the dividend of 12.5 euro cents – which we will ask the Board of Directors to be held on 21 March 2023 to propose to the next Shareholders’ Meeting – is 19% above the level originally envisaged in the Plan to 2022.

“Therefore, also in terms of dividend

policy, Hera’s Plan to 2026 is in line

with the approach of the past”

For the 2022-2026 period, Hera expects a linear dividend per share growth, up to a 15 eurocents floor for 2026, thus envisaging a CAGR of 4.6%.

Although the new scenario behind the Plan update is very different from the one of one year ago, we can conclude that the megatrends that Hera has sensed well in advance remain as true as ever. Therefore, having allocated its capital in the right infrastructures, today Hera is positioned as a leading player in the implementation of policies to fight the Climate Change.

Therefore, we will invest even more heavily where we already have a solid competitive advantage. We will increase the resilience and security of our network infrastructure, which benefits from regulated returns that protect us from the evolution of inflation and interest rates, as well as from changes in consumption volumes, while aiming to maximise the rewards of the tariff system through new efficiencies. On the other hand, we will expand our plant base in the Waste sector, with returns that we expect to be a driving force for the Group’s EBITDA, as we can leverage a booming demand.

“Higher investments are justified by

factors of great visibility, which allow

us to nurture growth while

preserving a controlled risk profile”

This approach also provides further credibility to the shareholder remuneration policy that we mean to continue.