| 2018 (data in mn€) |

REVENUES 6,134.4 (+9.3%) |

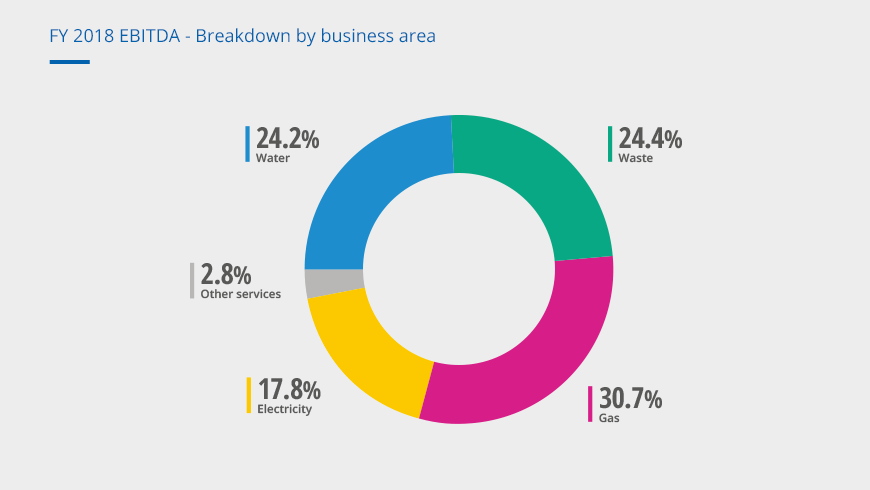

EBITDA 1,031.1 (+4.7%) |

EBIT 510.1 (+6.4%) |

NET INVESTMENTS 431.8 (+9.0%) |

NET FINANCIAL DEBT 2,585.6 (Debt-to-EBITDA at 2.51x) |

Results achieved in 2018 prove, once again, the effectiveness of Group strategic choices over time. A well-balanced portfolio of regulated and liberalised activities, along with the choice to bring forward some circular economy and sustainability initiatives, provided for FY 2018 additional growth, additional financial strength and increased resiliency in various businesses.Group EBITDA grew by 4.7%, driven by a significant contribution from regulated businesses and higher prices in the liberalised business of special waste.

In 2018, Shared Value EBITDA reached 375.2 mn€, up 14% vs. 2017. Its weight on total 2018 EBITDA reached 36%.

The increase recorded in Group Revenues (+522.3 mn€; +9.3% vs. 2017) derives from the positive impact of four factors:

- higher trading activity (215 mn€),

- increase in sales of Gas and Electric Energy (142 mn€), driven by higher revenues,

- rising prices in sales of Gas and Electric Energy (105 mn€),

- system charges and volumes distributed rising by 50 mn€.

Hera achieved a 46.5 mn € rise in consolidated EBITDA (+4.7%), resulting from the positive contribution of most business areas. The performance in the Water area was particularly strong; its EBITDA was up 8.6% due to additional efficiency gains and quality of service, incentivised by the current regulation. Even Gas showed a sound performance, with EBITDA growing at a 4.9% pace, due to the healthy margins in sales and 18.2% increase in volumes sold; moreover, two factors played a non-negligible role: the contribution from incentivised investment for security of distribution networks as well as the positive impact from additional operational efficiencies. The EBITDA of the Waste area also improved, as a result of higher volumes treated (+7.2%) and higher prices in the liberalised market of special waste treatment; those positives more than compensated the impact from the ended waste service in the 13 municipalities of the Forlì province, starting from 2018. The Electric Energy area, on the contrary, experienced a slight decrease in EBITDA (-0.5%), mainly due to lower revenues both from trading and from production of electric energy as a results of the changes in regulation and lower plant availability. Anyway, the customer base increased (1.1 million, up 8.9%), driven by an effective marketing, which focused mainly in Central Italy: that supported the 12.7% increase in volumes sold.

The growth achieved at the level of consolidated EBIT (+6.4%) was even stronger than that achieved at EBITDA (+4.7%). The ‘Depreciation and Provisions’ item rises at a relatively low pace, equal to 3.1%, as a result of higher depreciation reflecting new assets entering into operation, while Provisions to the Loan Loss Fund fell.

The area of financial management shows a drop in net financial expenses (-9.8 mn€ vs. 2017; -9.7%), thanks to debt cost efficiencies and interest proceeds for payments in arrears from safeguard customers.

The fiscal management area benefits from a lower tax rate, 29.1% from 29.6% in 2017. (note that 2017 had some tax lifting), as a result of the continuous effort for fiscal optimization allowed by the legislation in force, which Hera mainly achieved through super depreciation for “Industry 4.0” investment, tax credit for R&D and patent box.

Lastly, Net Profit post Minorities shows a sizeable increase (+12.1%), reaching 281.9 mn€. The Net Profit-to-Revenues ratio therefore moves from 4.5% in 2017 to the level of 4.6% in the last fiscal year.

During 2018 Hera invested 431.8 mn€, net of capital grants, i.e. an increase of 35.6 mn€ over the 2017 level. Net Financial Debt shows a limited change over the 12-month period, amounting to 2.59 bn€ at 2018 year-end, compared to 2.52 bn€ at 2017 year-end, due to the sound operating cash flow, which allowed for funding both the distribution of 2017 dividends and development capex.

In 2018, EBITDA generated by Shared Value activities reached 275.2 mn€, an increase of 14% over the 2017 level. That figure also proves that today the Shared Value component represents a larger portion of the overall EBITDA. Its weight increased by three percentage points, from 33% in 2017 to 36% in 2018.A series of dedicated initiatives and projects underlie this result as well as results to be achieved over the coming years. In 2018, Hera invested 184 mn€ in projects aimed to the creation of Shared Value, i.e. 40% of total Group investments. Out of 184 mn€, Hera dedicated 71.3 mn€ to innovation and contribution to development, 68.9 mn€ to efficient use of resources, and 43.8 mn€ to the intelligent use of energy.The communication of real results in terms of Shared Value is a crucial step in triggering and then feeding a virtuous circle: the production of shared value can only be achieved through the engagement of customers and citizens.

We mean to present the projects put into play and their outcome results on a regular basis, as we believe that only by doing so, Hera can effectively stimulate the active role of customers in operating the change in behaviours that both the society and the environment expect.