| Q1 2019 (data in mn€) |

REVENUES 1,940.4 (+11.4%) |

EBITDA 330.8 (+2.5%) |

EBIT 205.0 (+3.7%) |

NET OPERATING INVESTMENTS 92.7 (+9.6%) |

NET FINANCIAL DEBT 2,622.0 NET DEBT/EBITDA 2.5x |

- Results achieved in Q1 2019 prove Hera continuing growth, while showing a performance on track with the Business Plan.

- Consolidated EBITDA grows by 2.5%, benefitting above all from the positive contribution of regulated businesses, where the tariff systems remunerates the efficiency and quality of Hera’s operational effort. The sound performance of EBITDA also reflects rising prices in special waste, continuous expansion in the customer base, as well as attractive margins in both power generation and default-gas segment.

- Such factors offset the negative impact of certain drivers, among which: the margin reduction in the safeguarded-customer business, lower volumes due to above-average winter temperatures and early maintenance at the WTE plant in Padua.

The 199.1 mn€ increase in Group Revenues, at a double-digit rate (+11.4% vs. Q1 2018), has been essentially driven by organic factors:

- Higher trading activity (98 mn€),

- Increase in revenues from gas and electricity sales (36 mn€), led by the higher commodity price,

- Higher volumes in gas and electricity sales (28 mn€),

- In addition to higher revenues in power generation (25 mn€).

Changes in the consolidation scope due to recently acquired companies provide a 6.5 mn€ contribution to overall growth.

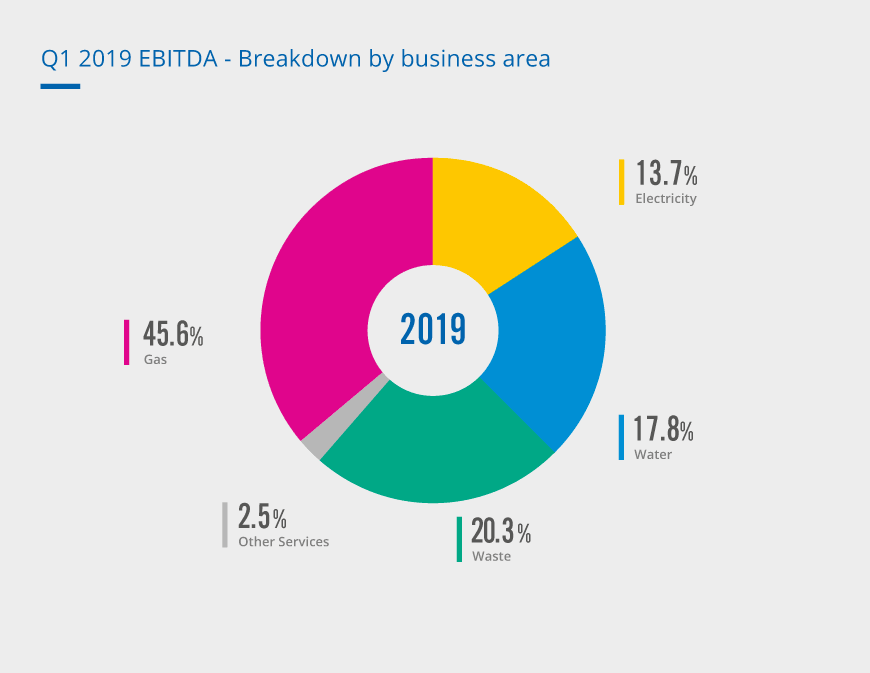

The 8.1 mn€ increase in Consolidated EBITDA (+2.5%) reflects the positive contribution from all business areas.

The Water business shows the stronger growth rate (+6.0%), due to a slight contribution from new delivery points (1 mn€) and additional synergies and efficiency achieved during the first quarter, which were recognised by regulation.

Also the Gas area reached satisfactory results, with EBITDA improving by 1.9%, led by the 23.3% increase in volumes sold; the customer base expanded by 5.6% – in addition to the contribution of recently acquired companies, even the new customers in the last resort supply and default market played an incremental role.

EBITDA grows also in the Waste area. Higher prices in special waste treatment and increasing revenues in the electricity production have offset the effects of a 65,000 tons reduction in marketed waste. Noteworthy, on the one hand, the positive contribution of the Biomethane plant in Sant’Agata, which entered into operations at 2018 year-end, and higher volumes in Aliplast activities. On the other one, the WTE plant in Padua stopped for programmed maintenance, even though in the meantime it has resumed operations.

The Electricity area recorded a slight drop in EBITDA (-0.2%), essentially due to the margin contraction in safeguarded activities. Anyhow, this area experienced a 10.3% rise in the number of customers, which now amount to 1.1 million, with volumes sold up 6.1%. The regulated part of the business has moreover benefitted from a 30 bps increase in WACC, as a result of the ARERA review that entered into effect starting from 1 January 2019.

| EBITDA (mn€) | Q1 2019 | Q1 2018 | Change |

| Waste | 67.3 | 66.5 | +1.2% |

| Water | 58.9 | 55.6 | +6.0% |

| Gas | 151.0 | 148.2 | +1.9% |

| Electricity | 45.2 | 45.3 | -0.2% |

| Other services | 8.4 | 7.2 | +16.7% |

| TOTAL | 330.8 | 322.7 | +2.5% |

Consolidated EBIT grows by 3.7%, at a quicker pace than EBITDA (+2.5%), against higher Depreciation for new investments coming into operations and lower Provisions to the loan loss fund.

The area of financial management shows a net result of -21.1 mn€ (+3.6 mn€ vs. Q1 2018), due to 2.9 mn€ dividends from a subsidiary in Q1 2018, which were no longer paid in Q1 2019. Such performance also reflects of the application of the IFRS 16 on operating leases.

The fiscal management area presents a lower tax rate, equal to 29.5% (vs. 30.1% in Q1 2018), as a result of the fiscal optimization allowed by the legislation in force.

Lastly, Net Profit post Minorities shows a 3.1% increase; therefore it reaches 124.2 mn€.

In the first three months of 2019 Hera invested 92.7 mn€ net of capital grants, an increase of 8.1 mn€ over the same period of 2018. In Q1 2019, net cash generation amounted to 64.9 mn€. Net Financial Debt moved from 2,585.6 mn€ at 2018 year-end up to 2,622.0 mn€ as at 31 March 2019; this marginal change is mainly due to the application of the IFRS 16 on operating leases (96.2 mn€).